Long-Term Investing

Market Volatility

When is the next recession?

That's one of the questions we hear most often. Although a recession has seemed imminent for a while, the economic picture has become muddied as industries have weakened and recovered at different times. If we do see a broad contraction, our expectation is that it will be less severe than the 2008 global financial crisis and other more typical recessions, followed by a strong recovery.

To help you prepare for these uncertain times, we researched more than 70 years of data including the last 11 economic downturns to distill our top insights and answer key questions about recessions:

1. What is a recession?

2. What causes recessions?

3. How long do recessions last?

4. What happens to the stock market during a recession?

5. What economic indicators can warn of a recession?

6. Are we in a recession?

7. How can you position a stock portfolio for a recession?

8. How can you position a bond portfolio for a recession?

9. What are ways to prepare for a recession?

1. What is a recession?

A recession is commonly defined as at least two consecutive quarters of declining GDP (gross domestic product) after a period of growth, although that isn’t enough on its own. The National Bureau of Economic Research (NBER), which is responsible for business cycle dating, defines recessions as a “significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production and wholesale-retail sales.” In this guide, we will use NBER’s official dates.

2. What causes recessions?

Past recessions have occurred for many reasons, but typically are the result of economic imbalances that ultimately need to be corrected. For example, the 2008 recession was caused by excess debt in the housing market, while the 2001 contraction was caused by an asset bubble in technology stocks. An unexpected shock such as the COVID-19 pandemic, widespread enough to damage corporate profits and trigger job cuts, also can be responsible.

When unemployment rises, consumers typically reduce spending, which further pressures economic growth, company earnings and stock prices. These factors can fuel a vicious cycle that topples an economy. Although they can be painful to live through, recessions are a natural and necessary means of clearing out excesses before the next economic expansion. As Capital Group equity portfolio manager Rob Lovelace has noted, “You can’t have such a sustained period of growth without an occasional downturn to balance things out. It’s normal. It’s expected. It’s healthy.”

Go deeper:

- As the Fed pauses, what's next for inflation and rates?

- 10 investing lessons from 2008 that apply today

Get the Guide to recessions

3. How long do recessions last?

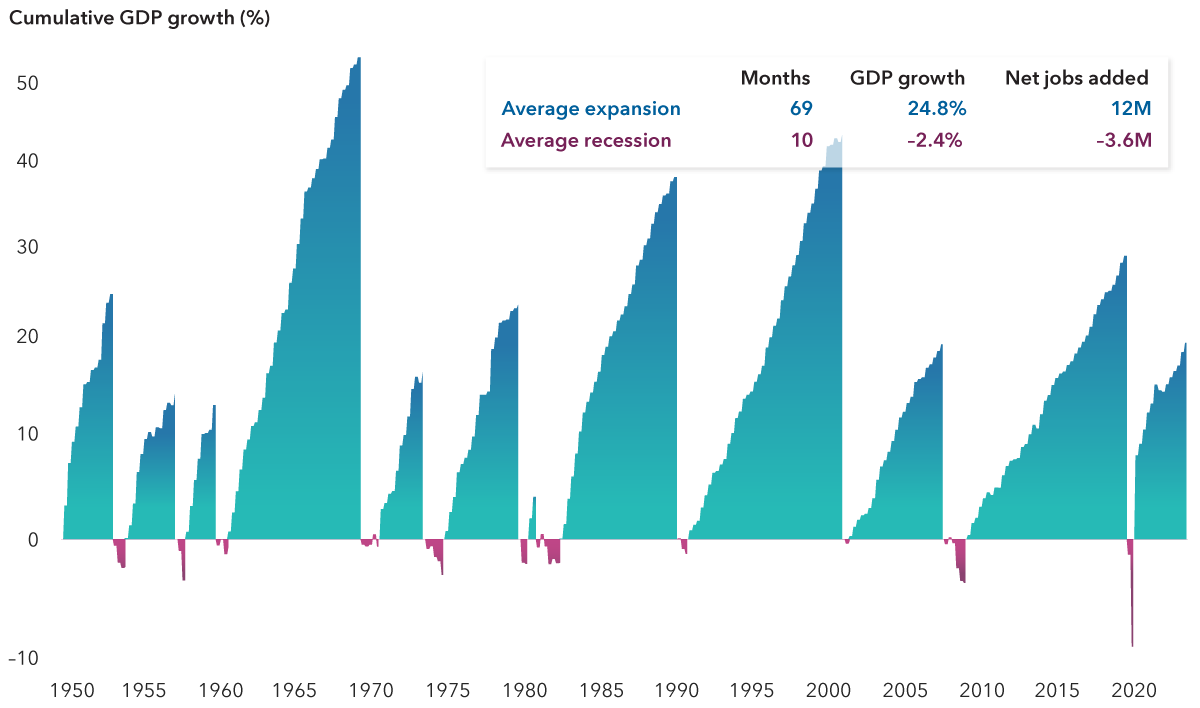

The good news is that recessions generally haven’t lasted very long. Our analysis of 11 cycles since 1950 shows that recessions have persisted between two and 18 months, with the average spanning about 10 months. For those directly affected by job loss or business closures, that can feel like an eternity. But investors with a long-term investment horizon would be better served looking at the full picture.

Recessions are painful, but expansions have been powerful

Sources: Capital Group, National Bureau of Economic Research (NBER), Refinitiv Datastream. Chart data is latest available as of 6/30/24 and shown on a logarithmic scale. The expansion that began in 2020 is still considered current as of 6/30/24 and is not included in the average expansion summary statistics. Since NBER announces recession start and end months, rather than exact dates, we have used month-end dates as a proxy for calculations of jobs added. Nearest quarter-end values used for GDP growth rates. Past results are not predictive of results in future periods.

Recessions have been relatively small blips in economic history. Over the last 70 years, the U.S. has been in an official recession less than 15% of all months. Moreover, their net economic impact has been relatively small. The average expansion increased economic output by almost 25%, whereas the average recession reduced GDP by 2.4%. Equity returns can even be positive over the full length of a contraction since some of the strongest stock rallies have occurred during the late stages of a recession.

Go deeper:

- Can this stock market rally continue?

4. What happens to the stock market during a recession?

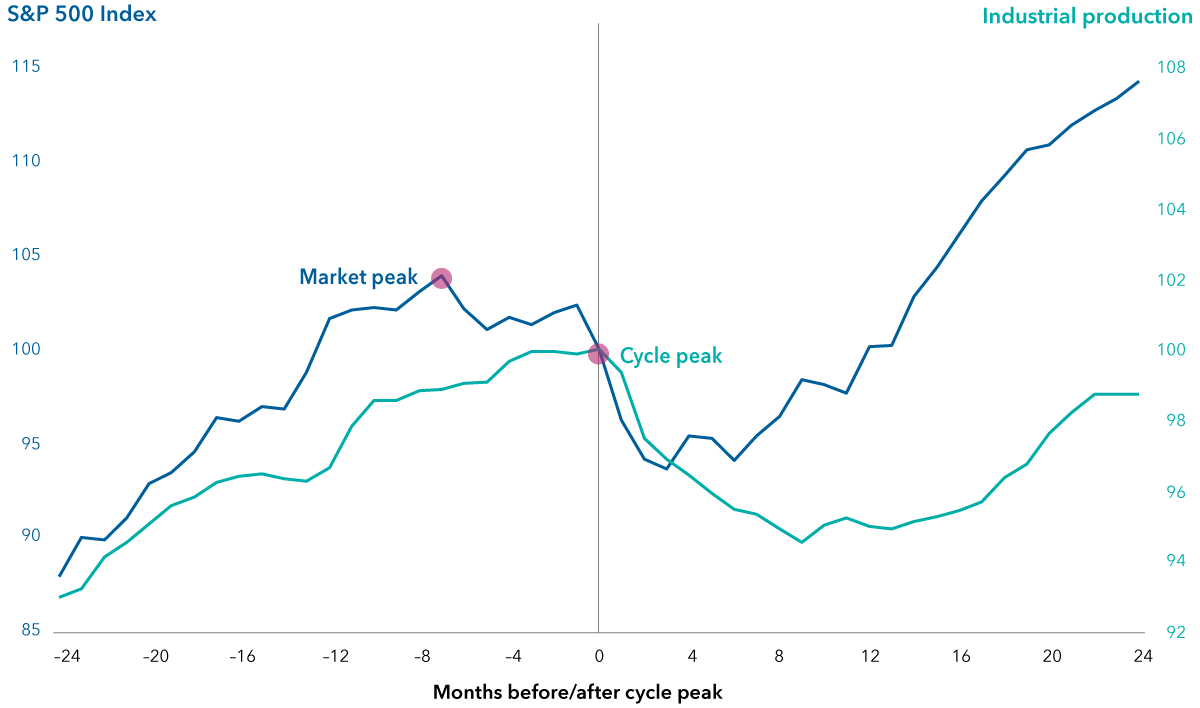

The exact timing of a recession is hard to predict, but it’s still wise to think about how one could affect your portfolio. Bear markets (market declines of 20% or more) and recessions have often overlapped — with equities leading the economic cycle by six to seven months on the way down and again on the way up.

Equities have typically peaked months before a recession, but can bounce back quickly

Sources: Capital Group, Federal Reserve Board, Haver Analytics, National Bureau of Economic Research, Standard & Poor's. Data reflects the average change in the S&P 500 Index and economic activity (using industrial production as a proxy) of all completed economic cycles from 1950 to 2023. The “cycle peak” refers to the highest level of economic activity in each cycle before the economy begins to contract. Both lines are indexed to 100 at each economic cycle peak and indexed to 0 “months before/after cycle peak” on the x-axis. A negative number (left of the cycle peak) reflects the average change in each line in the months leading up to the cycle peak. The positive numbers (right of the cycle peak) indicate the average changes after the cycle peak. Past results are not predictive of results in future periods.

Still, aggressive market-timing moves, such as shifting an entire portfolio into cash, can backfire. Some of the strongest returns may occur during the late stages of an economic cycle or immediately after a market bottom. A dollar cost averaging strategy, in which investors systematically invest equal amounts at regular intervals, may be beneficial in down markets. This approach allows investors to purchase more shares at lower prices while remaining positioned for when the market eventually rebounds.

Go deeper:

5. What economic indicators can warn of a recession?

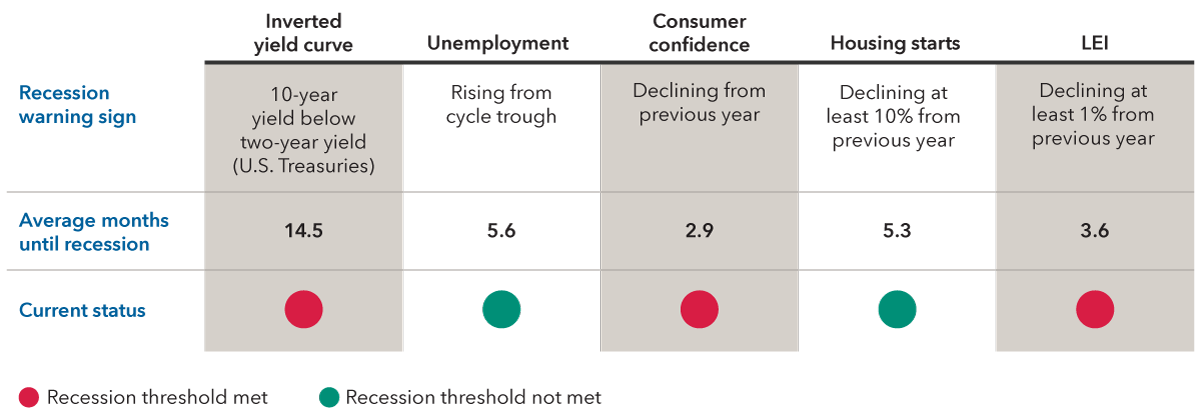

Wouldn’t it be great to know ahead of time when a recession is coming? Despite the impossibility of pinpointing the exact start, there are some generally reliable signals worth watching closely in a late-cycle economy.

Sources: Capital Group, Refinitiv Datastream. Reflects latest data available as of 6/30/24.

Many factors can contribute to a recession, and the main causes often change. Therefore, it’s helpful to look at different aspects of the economy to assess where imbalances may be building. Keep in mind that any indicator should be viewed more as a mile marker than a distance-to-destination sign.

Four examples of economic indicators that can warn of a recession include the yield curve, unemployment rate, consumer confidence and housing starts. Aggregated metrics, such as The Conference Board Leading Economic Index® (LEI), which combines 10 different economic and financial signals into a single analytic system to predict peaks and troughs, have also been consistently reliable over time.

These factors paint a mixed picture. The yield curve and LEI have flashed recessionary warnings since 2022, but a strong labor market has helped support the economy. However, consumer confidence and employment data have started to trend in the wrong direction, even as they remain above historical averages. The housing industry has essentially already fallen into recession but has since stabilized. However, these are just a few indicators and new economic data can quickly change the narrative

Go deeper:

6. Are we in a recession?

While at times the market has become increasingly concerned about the possibility of a recession, the economy has kept one at bay so far. Despite the impact that high inflation and rates have had on consumer spending and corporate earnings, the economy has been relatively resilient, and now those forces are moderating.

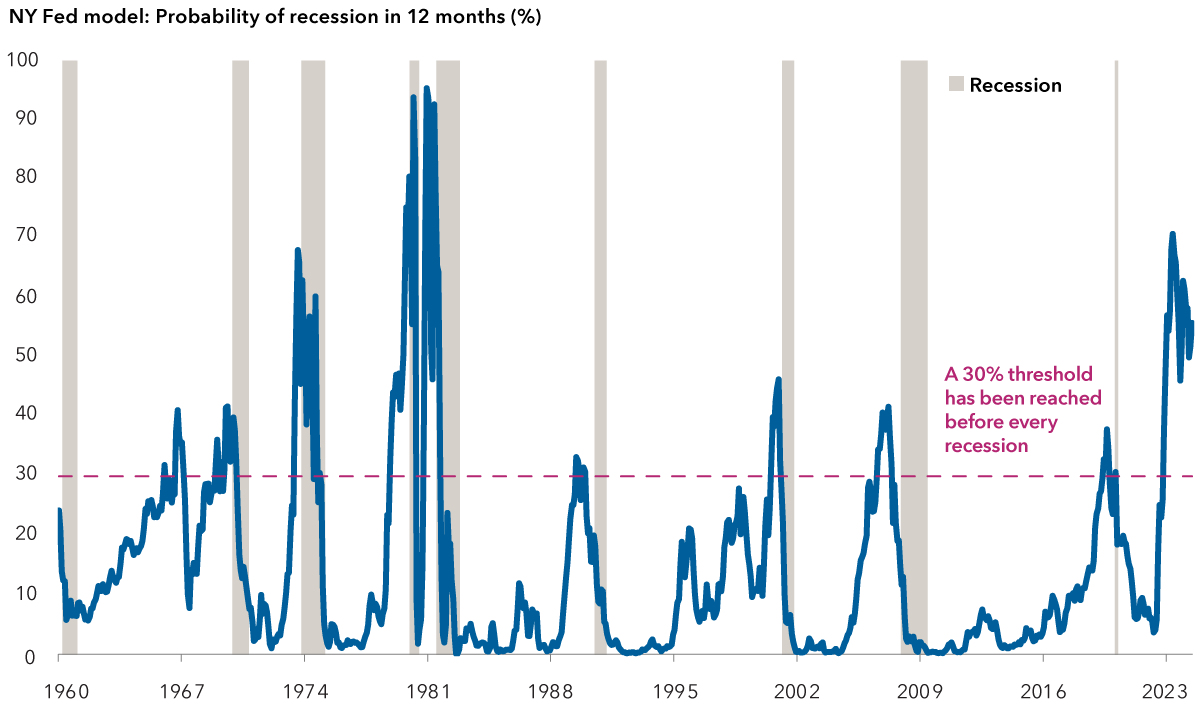

The likelihood of a recession has declined since its peak in 2023

Sources: Federal Reserve Bank of New York, Refinitiv Datastream. As of 6/30/24. Shaded bars represent U.S. recessions as defined by the National Bureau of Economic Research.

Currently, we’re not seeing anything that would suggest a sharp drop-off or a change in the fundamentals of the U.S. economy. Most of the data suggests a slowing in the pace of economic activity, but not necessarily a contraction.

Instead of an official recession, what we may see is a continuation of a rolling recession, where parts of the economy contract and recover at different times. Housing had a slowdown deeper than many past recessions but has started to stabilize. Goods production, however, remains sluggish as spending continues to shift away from goods back toward services. Most countries can’t withstand declines in multiple sectors and still avoid a broad recession, but the U.S. economy has shown remarkable resiliency and flexibility, so avoidance remains a real possibility.

If economic data continues to weaken across the board, such as unemployment rising toward 5%, that could lay the groundwork for steeper interest rate cuts from the Federal Reserve. Other unexpected events — such as a geopolitical shock — could also arise to darken the near-term outlook.

Go deeper:

- U.S. economy hit by rolling recession

- Economic outlook: Mild recession, strong recovery

7. How can you position a stock portfolio for a recession?

We’ve already established that equities often do poorly during recessions but trying to time the market by selling stocks is not suggested. So should investors do nothing? Certainly not.

To prepare, investors should take the opportunity to review their overall asset allocations, which may have changed significantly during the bull market, to ensure their portfolios are balanced and diversified. Consulting a financial advisor can help immensely since these are often emotional decisions for investors.

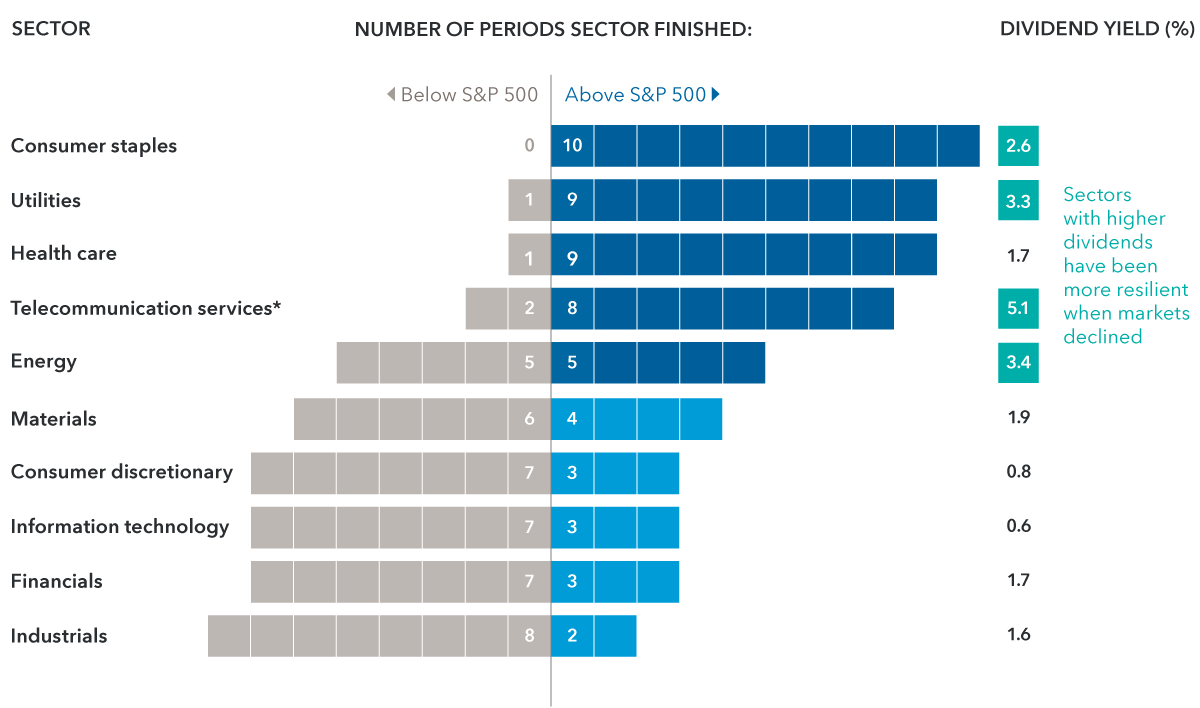

Through 10 declines, some sectors have finished above the overall market

*In September 2018, the telecommunication services sector was renamed communication services, and its company composition was materially changed. The dividend yield shown is for the telecommunication services industry group, a subset of the newly constructed communication services sector. The communication services sector’s dividend yield was 0.9% as of 6/30/24.

Sources: Capital Group, FactSet. Includes the last 10 periods that the S&P 500 Index declined by more than 15% on a total return basis. Sector returns for 1987 are equally weighted, using index constituents from 1989, the earliest available data set. Dividend yields are as of 6/30/24.

Not all stocks respond the same during periods of economic stress. In the eight largest equity declines between 1987 and 2023, some sectors held up more consistently than others — usually those with higher dividends such as consumer staples and utilities. Dividends can offer steady return potential when stock prices are broadly declining.

Growth-oriented stocks can still have a place in portfolios, but investors may want to consider companies with strong balance sheets, consistent cash flows and long growth runways that can better withstand short-term volatility.

Even in a recession, many companies may remain profitable. Focus on companies with products and services that people will continue to use every day such as telecom, utilities and food manufacturers with pricing power.

Go deeper:

8. How can you position a bond portfolio for a recession?

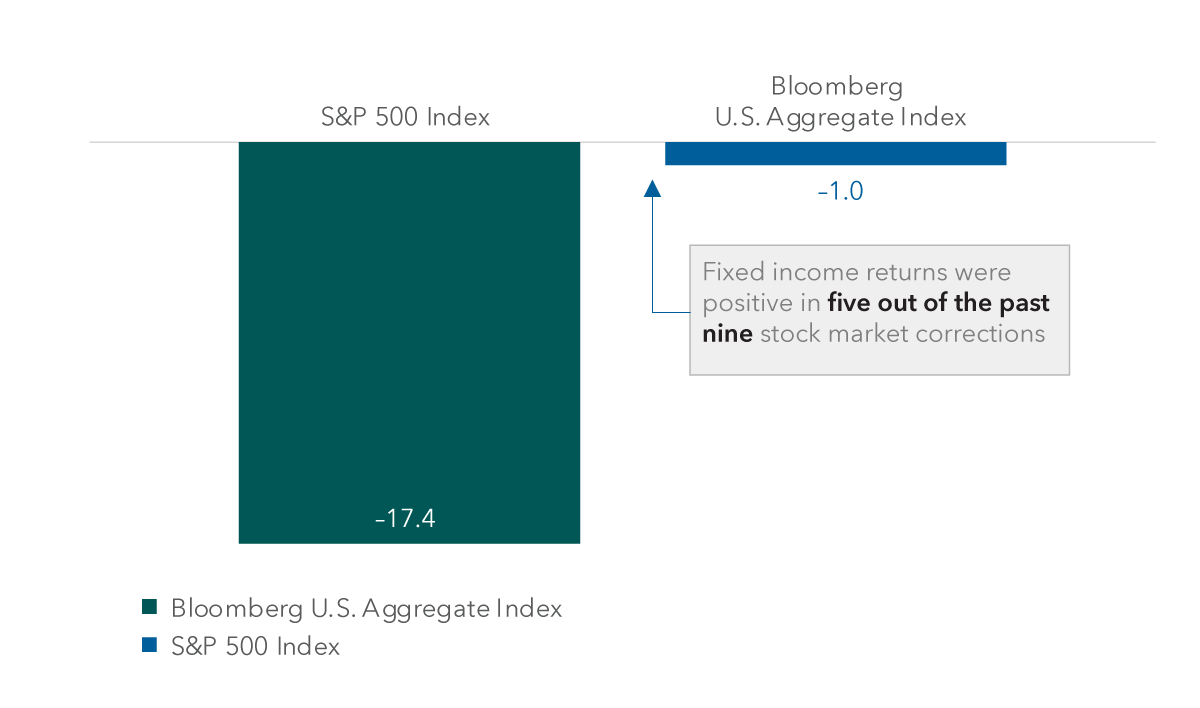

Fixed income is often key to successful investing during a recession or bear market. That’s because bonds can provide a measure of stability and capital preservation, especially when equity markets are volatile.

The market selloff in 2022 was unique in that many bonds did not play their typical safe-haven role. But in the nine previous market corrections, bonds — as measured by the Bloomberg U.S. Aggregate Index — rose five times and never declined more than 1%.

Average returns during prior equity corrections (%)

Sources: Capital Group, Morningstar. As of 6/30/24. Averages were calculated by using the cumulative total returns of the S&P 500 Index and the Bloomberg U.S. Aggregate Index during the nine equity market correction periods since 2010. Corrections are based on price declines of 10% or more (without dividends reinvested) in the unmanaged S&P 500 Index with at least 75% recovery.

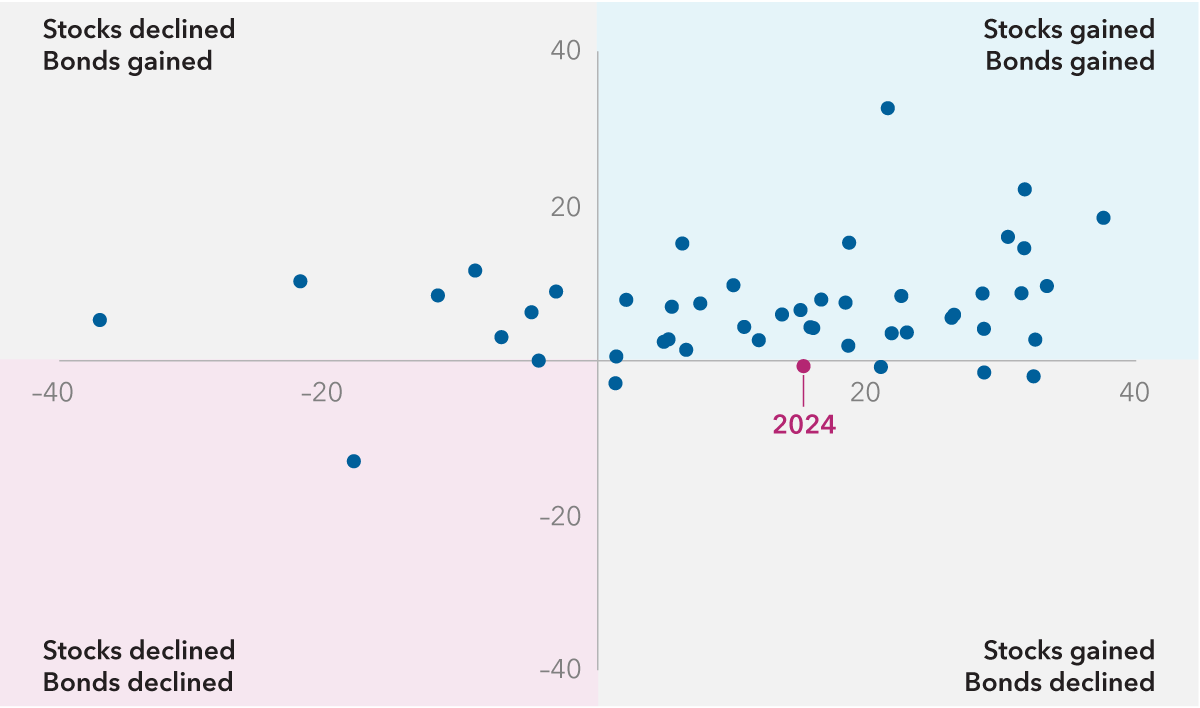

Annual returns for stock and bonds since 1977 (%)

Sources: Capital Group, Bloomberg Index Services Ltd., RIMES, Standard & Poor's. Returns above reflect annual total returns for the S&P 500 ("stock returns", depicted on the x-axis) and the Bloomberg U.S. Aggregate index ("bond returns", depicted on the y-axis) for each year between 1977 - 2024. Year-to-date (YTD) figures as of June 30, 2024.

Achieving the right fixed income allocation is always important. But with the U.S. economy entering a period of uncertainty, it’s especially critical for investors to focus on core bond holdings that can help provide balance to their portfolios. Investors don’t necessarily need to increase their bond allocation ahead of a recession, but they should review their fixed income exposure with a financial professional to ensure it is positioned to provide diversification from equities, income, capital preservation and inflation protection — what we consider the four key roles fixed income can play in a well-diversified portfolio.

Go deeper:

- Bond outlook: Fed pause leaves many paths to income potential

- 4 lessons from 50 years of bond investing

9. What are ways to prepare for a recession?

Above all else, investors should stay calm when investing ahead of and during a recession. Emotions can be one of the biggest roadblocks to strong investment returns, and this is particularly true during periods of economic and market stress.

If you’ve picked up anything from reading this guide, it’s probably that determining the exact start or end date of a recession is not only difficult, but also not that critical. What is more important is to maintain a long-term perspective and make sure portfolios are appropriately balanced to benefit from periods of potential growth, while being resilient enough to minimize losses during periods of volatility.

Go deeper:

- 5 investing mistakes to avoid

- 3 ways to prepare for down markets

Regular investing does not ensure a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade (BBB/Baa and above) fixed-rate bond market.

Jared Franz

Jared Franz

Darrell Spence

Darrell Spence