Practice Management

Marketing & Client Acquisition

In a business powered by referrals, why bother with marketing? A decade or two ago, this may have been a fair question. Traditional marketing was primarily outbound – pushing sales messages towards prospects or clients, trying to gain awareness or consideration with a catchy or exciting pitch. In the digital age, much of marketing is inbound – pulling consumers in with information, validation or solutions at every step on their path to purchase. Even referrals are likely to use an internet search to investigate and validate the decision to work with you.

Digital marketing is so essential today, consumers engage without thinking about it as marketing. Indeed, many businesses participate without thinking about it as marketing. But advisors who take it seriously and invest time and resources into digital marketing have an edge. According to the research conducted for Capital Group’s Pathways to Growth: Advisor Benchmark Study, the highest growth advisors claimed two times greater confidence in their marketing skills than the average advisor and were more than twice as likely to use digital marketing strategies. (Of course, not all firms allow their financial professionals to make these types of digital connections. It’s important to review your firm’s policies and regulations before planning your strategy.)

But where to start? Or, if you are doing digital marketing already, where do you focus or refine your efforts? The answer may depend on what you want clients or prospective clients to do. You can get different results depending on the point of access. Your website can help prospective clients determine whether your practice is a fit. Search engine optimization (SEO) can help them find you. Social media lets them see who you are, your motivations and what you care about personally and professionally. Content shows off your authority. And email can deepen engagement.

So why wait? Here are five digital marketing essentials to help you increase brand awareness, gain authority, deepen engagement and convert more prospects into clients.

1. Build a website that defines who you are and whom you serve

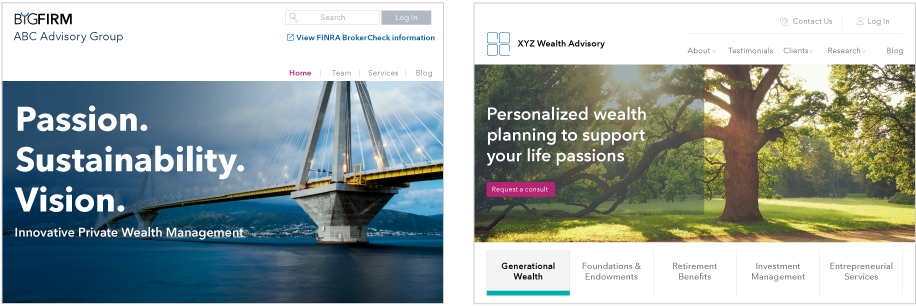

You can think of your website as a billboard, a digital storefront, an online prospecting seminar – it can be all of these and more, depending on what you do with it. But your website doesn’t need to be flashy to be effective; it just needs to speak directly to your target audience.

A strong brand identity and mission statement on your homepage can work to quickly capture the attention of prospective clients. Think of a successful website for any brand: it clearly states what the business does, the customers they serve and what differentiates them. The messages are typically written in the simplest terms, to be easily understood by anyone but also to resonate with people’s needs.

Of particular importance to financial advisors: a robust About Us section and team biographies. This helps consumers validate you and your practice from an experience standpoint. It also allows you to explain why you do the work you do in service of your clients.

A site that speaks to your ideal client

Whether you work under a big firm or have your independent practice, there are ways to add a targeted touch to your messaging.

Learn more about website optimization:

Prospect and grow using digital strategies

Webinar on demand: Turbocharge your brand

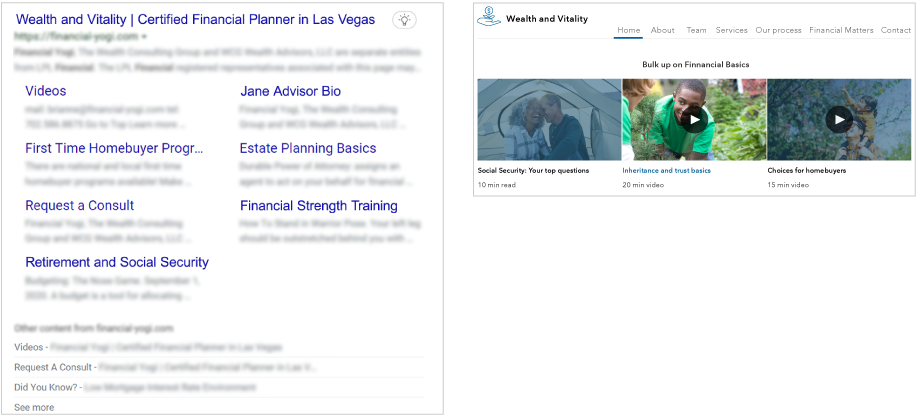

2. Gain a basic understanding of SEO and SEM

Search engine optimization (SEO) is a way of organizing your web pages to appeal to search engines like Google and Bing, in an attempt to get your site listed among the top results for any conceivable consumer search. It’s been described as a combination of art and science, but it’s really all about giving prospects what they are looking for and doing it in a way that search algorithms can clearly comprehend. Search engines favor a combination of content quality, an authoritative source and validation from users. Search engine marketing (SEM) is similar, paid option to improve search ranking. Having an understanding of SEO can help you with both strategies.

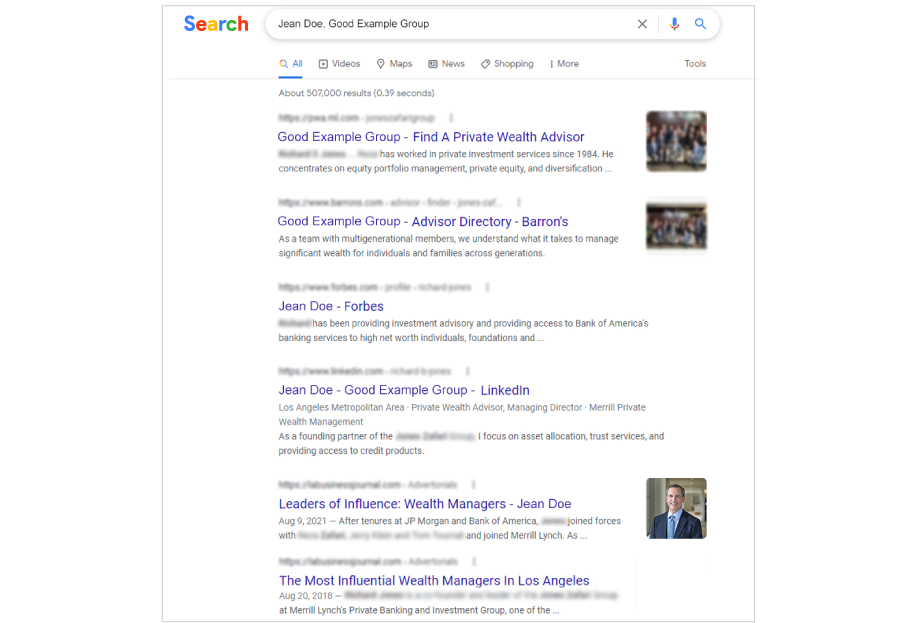

Become more visible in search

Search your name and firm name to see what comes up. Along with a website and professional bio, search engines will look for third-party validation or reviews. Articles or mentions that build your authority as a financial professional are typically favored by the search algorithm.

To help search engines find you, a great first step is to register your business with Google. Businesses that are not currently found on Google can add or claim a spot through https://www.google.com/business/. At https://www.bingplaces.com/, you can do the same on Bing, where there is far less search volume but also less competition. It also helps to have a Google My Business profile and page. If you have those, you can import the same information into Bing automatically.

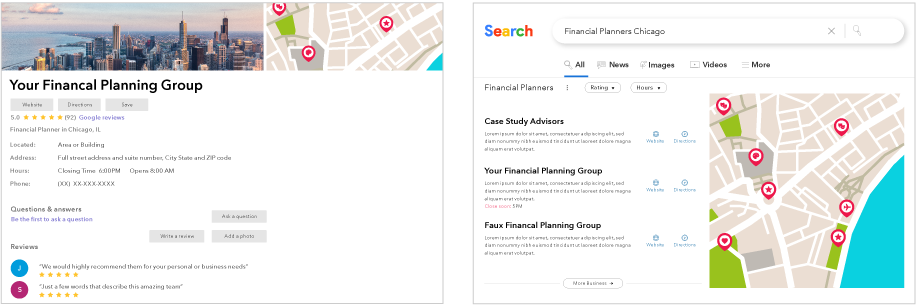

Put your firm on the map

Targeted local search keywords may help you get placement in a search engine’s “map pack.”

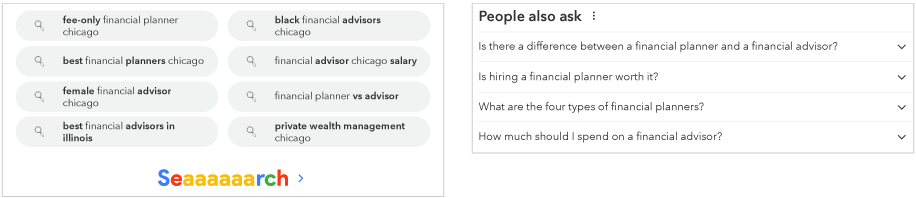

Next, find the most relevant, highly searched keywords or key phrases that prospects might use to find your business. Some businesses use software to find and target these terms, but you can get a lot of ideas from Google itself. Do a few searches of your own and pay attention to the related searches that Google recommends. See which competitors rank highly in your area and which terms they are using. These same keywords can be repeated strategically throughout your site and in your content.

Look for search clues

Google’s “People also ask” suggestions – typically found near the middle and at the bottom of your search results page – can help you identify terms to target next. In this example, the search term is “financial advisor in Chicago.”

Source: Google

Google estimates that 46% of searches are for local content, so consider all of the different ways potential clients in your region and beyond might search for a firm like yours and experiment with keyword variations. For example, if you rank highly for the term “Austin financial planner,” you may also want to rank for terms such as “advisors in Austin,” “Austin wealth manager,” “best financial planners in Texas” or “financial advisor near me.” Depending on your niche, you could also target affinity terms, such as “tech employees,” “millennials,” “entrepreneurs” and so on.

Local search checklist

Here are six quick and easy additions to help your local search strategy:

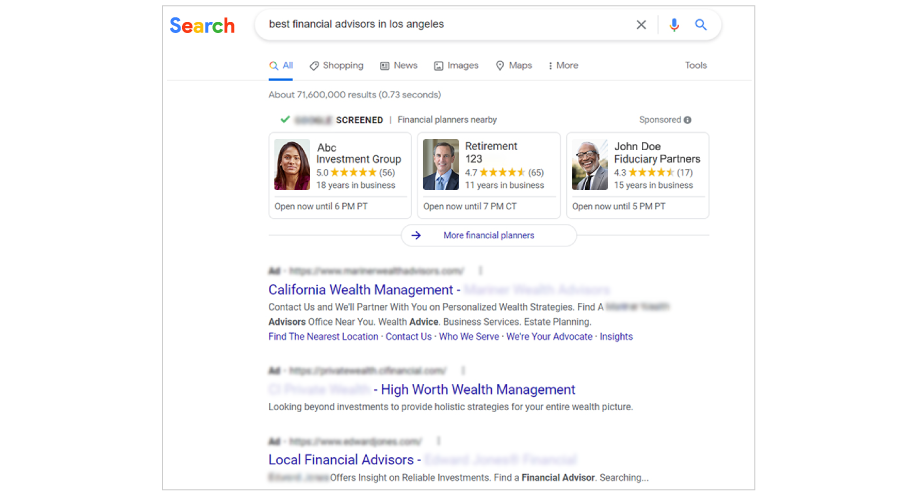

Businesses that have maximized SEO and are ready for more digital leads may also consider SEM, which is a similar but completely separate strategy in which you not only optimize your content for certain search keywords but also pay for a top spot in the rankings. It is also known as pay per click, because businesses typically pay only for direct traffic to their sites. For example, Google’s local services ads will place your firm among the top results for relevant local search terms. These ads can also come with a “screened” or “verified” symbol that may instill trust in some search users.

This strategy offers more control over the outcomes than SEO, and you will likely see results much more quickly. But an SEM link will appear as an ad in search results, while SEO links do not. When determining which strategy to use for a given campaign, you can use cost-per-click analysis to see what a certain keyword would cost and to examine your return on investment.

Different types of search ads to help generate leads

Paying for placement at the top of local search results may help with new client acquisition.

Learn more about SEO:

DIY SEO: 6 steps that anyone can follow to get results

The 17 most important SEO tips for higher rankings

The benefits of search engine marketing

3. Prioritize and personalize your social media presence

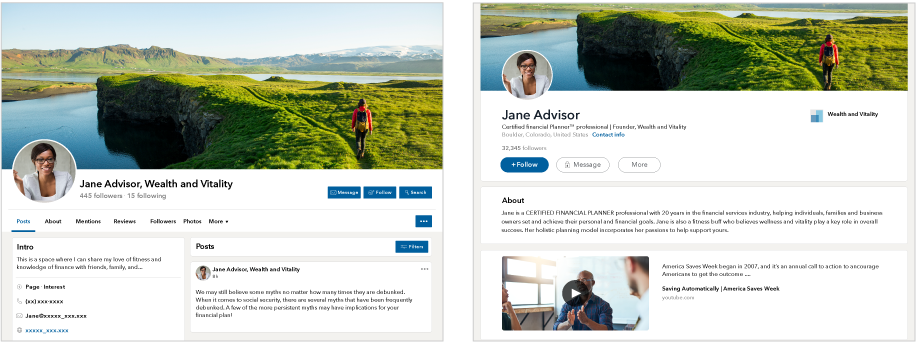

With so many social media platforms to consider, it’s tempting to either engage minimally with each one or avoid them altogether. A better strategy may be to choose one platform and focus on ways to optimize it for your audience. What separates these platforms from other types of marketing is the social aspect: they encourage authentic, personal connections. Those who find success on these platforms open up and share aspects of the business and the lives of the employees.

According to a 2022 Content Study from digital client engagement firm Hearsay,* financial services professionals began to see higher returns by focusing on the quality of their social media posts and through greater personalization. It also found that many financial professionals have yet to take a crucial first step in creating a memorable brand on social: completing their profile.

On LinkedIn, arguably the most important network for professional connections and referrals, fewer than 45% of financial professionals had a background photo in their profiles and nearly 25% were missing a summary. On Facebook, another surprisingly effective channel for consumer interaction, 52% of financial professional profiles lacked a description, according to the Hearsay study. These images and descriptions are easy to add and can go a long way in boosting your profile. The study also recommended that financial professionals take Instagram more seriously, suggesting graphics and images with text as a different way to connect with your target audience. If you have considered video content, YouTube may be a great channel for you.

Regardless of which social network you focus on, be sure that your presence on these platforms has a personal feel. This does not mean you have to use your personal profile to make these connections. Your business profiles should feel as branded as your website and other client touchpoints. But you can also include those things that are meaningful to you personally, such as affinity groups, favorite teams or authors, charities and community projects. You can engage with connections in a way that feels organic to the platform, sharing special moments and milestones for you, your team and your practice. If you have a blog or video content, social offers an easy way to distribute it and get it noticed.

If you feel you have the basics covered on social, the next step may be paid social media advertising. On Facebook and other platforms, you can boost certain posts to get more visibility or target your ads to reach specific audiences a certain number of times per week. There are different strategies to consider depending on your desired goals – brand awareness, leads, newsletter signups, traffic to your site, requests for consults, etc.

Learn more about social media:

6 social media myths preventing your practice from growing

Video: How to reach high net worth prospects on LinkedIn

How to advertise on Facebook

4. Create content marketing that shows off your expertise

Content marketing is all about using education, entertainment or valuable information to attract the types of prospects you want to your site. The content is not necessarily promoting your brand or services. Instead, it’s there to engage the types of clients you want to reach – your brand is simply adjacent. Content can be used across digital platforms to draw potential clients to your website. Content can also help build your authority as an expert on a given topic or on personal finance in general. As an added benefit, it might inform and impress existing clients who are looking to you for insights into pressing topics.

These days, content is a buzzword that can mean many things. Typically, content marketing involves topic-focused articles or blogs, but it can also include infographics, videos, podcasts or even tweets. The medium you choose may be driven by the preferences of your target audience – research may help you discover that certain client segments prefer video over PDF white papers, blog posts over podcasts – or you may dabble a bit in each until you find what works for you as well as the audience.

When deciding what to cover in your content, you can provide educational materials for all or tailor the subject matter to address the needs and common questions of your ideal client. You might also create thought leadership pieces to build authority in your industry and/or just show off your unique personality.

Learn more about content marketing:

The power of storytelling

6 tips for writing content that drives an immediate response

5. Experiment with more engaging email

You are likely already using email for client communications and firm announcements. But a regular email newsletter to clients and prospects – or even segmented versions of each audience – can be a great way to highlight your content and your unique value.

As with social media, a client newsletter written in a personal voice can be a powerful way to reach readers. You can use it to calm client fears during volatile markets, explain changes in tax law or discuss the benefits or drawbacks of certain financial moves in the current environment. An email newsletter offers you a way to check in regularly with all clients, and with personalized topics, it can really feel like you care and are looking out for them – potentially reducing the need for many one-on-one discussions.

A successful email strategy can depend on whether readers open it, so a compelling subject line is key. Personalized emails addressing the recipient by their first name can also be effective attention grabbers. Some advisors use email service providers, which can offer modern template designs that will provide a quality look and feel to your newsletter. Service providers also make it easier to personalize emails and subject lines, track open rates and click-throughs to content and manage and segment subscriber lists and get more efficient about what works over the long term. Some providers can also help you find leads and build prospecting lists.

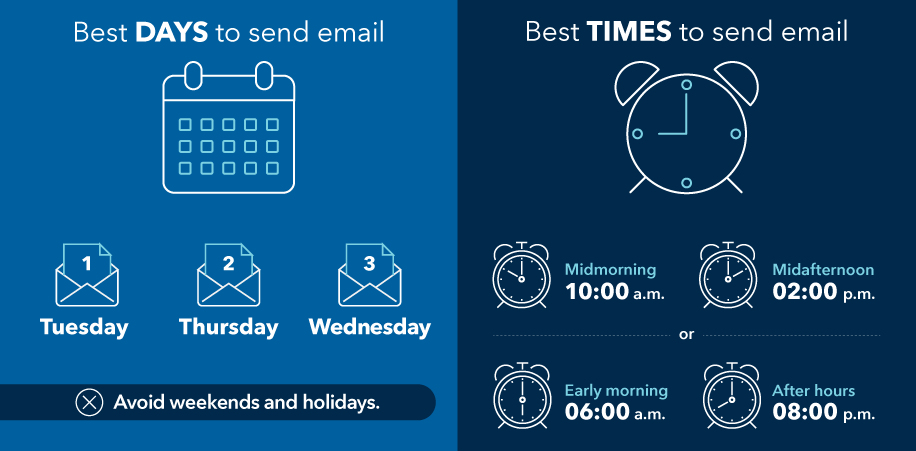

Another way to encourage engagement is to optimize when your emails are sent. In general, the best days to send email are weekdays, with Tuesday being the day people are most likely to open it, followed by Thursday and Wednesday (Tuesdays and Thursdays are best if sending multiple emails in a single week), according to CoSchedule, a marketing software company. The best times are generally midmorning or midafternoon, although those sent very early or late in the day have the potential to attract clicks as well. Many email service providers will let you schedule send times and can provide metrics to arrive at the send times that work best for your business.

Email marketing: When to hit “Send”

While it’s important to experiment to find what works with your audience, research shows that people are more likely to open emails at certain times.

Learn more about email marketing:

Beginner’s guide to email marketing

The ultimate guide to email marketing

To be sure, the timing and results of your strategies may vary. But another great thing about digital marketing is it allows you to experiment. You don’t have to do everything at once or hit your stride immediately. Even trial and error may lead you to some surprising discoveries along the way.