Founding and early years

When Jonathan Bell Lovelace founded Capital Group, he prioritised honesty and integrity. By researching and investing in valuable companies, he achieved success.

His plan paid off in 1933 when he assumed the management of The Investment Company of America®, which would go on to become one of the largest U.S. mutual funds.*

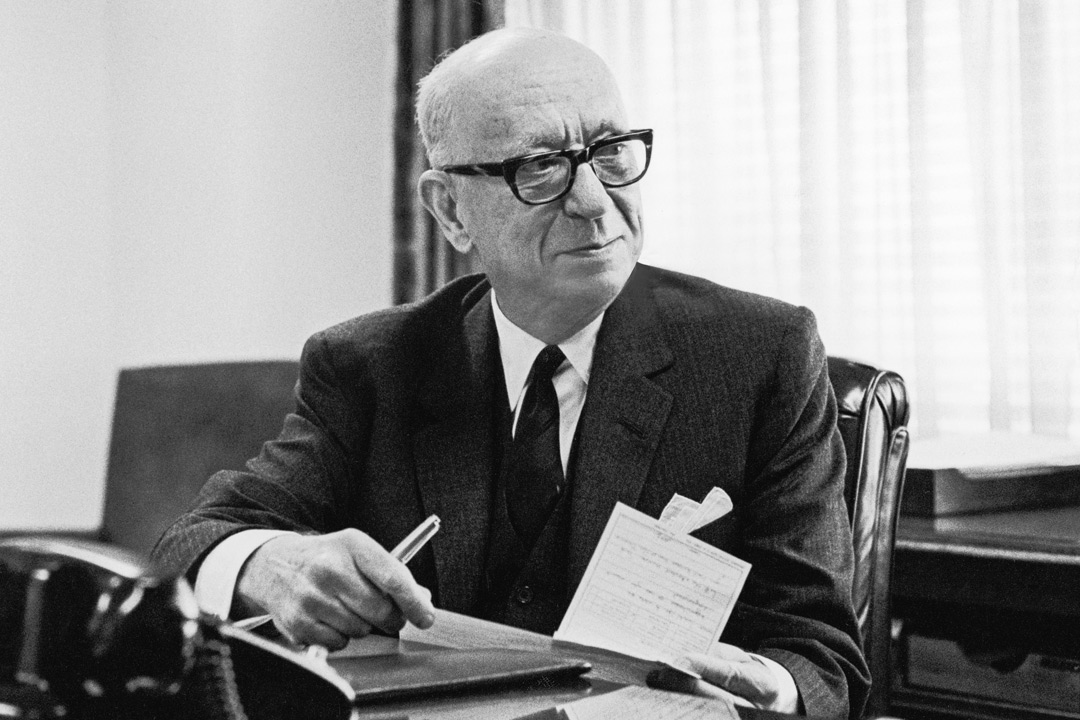

Photo: Jonathan Bell Lovelace, 1968

* By AUM for open-end U.S. funds. Data from Morningstar as of 31 December 2023.

Giving Hollywood a hand

In the 1930s, Jonathan Bell Lovelace helped Roy and Walt Disney finance “Snow White and the Seven Dwarfs” and “Fantasia.”

Making an impact

Lovelace provided testimony during the U.S. government hearings that helped lead to the passage of the Investment Company Act of 1940.

Marketing to broker-dealers

In the late 1940s, we made a conscious decision to market through the broker-dealer community rather than sell the funds directly to the public.

The Capital System™

Early on, Lovelace recognised the benefits of collaborative research, diverse perspectives and a long-term view. His thoughtful process grew into The Capital System.

This distinct investment approach has given us the flexibility to evolve with markets and client needs, delivering new strategies in the investment vehicles clients seek.

Over the years, The Capital System has proven to be one of our greatest competitive advantages.

Photo: Investment Group meeting, 1973

1937

18 associates

US$13.7M AUM

1962

75 associates

US$481.7M AUM

1990

1,529 associates

US$60.3B AUM

2023

8,873 associates

US$2.5T AUM

† AUM = assets under management. Data as of 31 December 1937, 1962, 1990 and 2023, respectively. Reflects the Capital Group global organisation.

Our global footprint

In the early 1960s, we noticed a trend of global economic integration and sought to understand worldwide activities.

In 1962, our first European office opened in Geneva, Switzerland. Although few American investment companies had foreign investments at the time, one of our largest funds invested over 10% of its portfolio internationally.

Photo: David Fisher and fund director, 1979

Broadening asset choices

We began managing non-U.S. assets for U.S.-based institutional clients in 1978.

Seeking long-term opportunities

In 1979, we opened a London office amidst a downturn in the U.K. economy. Though perceived as a risk, our long-term perspective enabled us to view it as an opportunity.

Moving into Asia

In 1982, we established our first office in Asia in Tokyo, then expanded to Hong Kong and Singapore. These additions provided us with enhanced access to Asian industries.

Pioneering international investing

In the late 1960s, Capital Group became a global investing trailblazer.

When we found scarce statistical information and investment data for non-U.S. markets, we created what would become the global standard for measuring international investment results: the Europe, Australasia, Far East (EAFE) Index.

This eventually morphed into the Morgan Stanley Capital International (MSCI) indices, which are still used to this day.

Photo: Capital Group associates in Hong Kong, 1985

Investing internationally

In 1953, we invested in Royal Dutch Petroleum and later were early institutional investors in Japanese stocks.

Going global

In 1969, Capital Group introduced our first European fund. In preparation, our research analyst took a crash course in Italian.

Keeping a long-term perspective

In 1970, we founded a Luxembourg-based fund, followed by the New Perspective strategy in 1973 in the U.S.

Expanding services and offerings

In 1968, we launched our institutional business, beginning the expansion of our offerings, and later continued to grow by establishing ourselves as providers of fixed income and 529 college savings plans.

We’re constantly evolving as our clients seek new ways to invest and appreciate insights from industry experts.

Photo: Jon Lovelace with shareholder, 1968

Launching fixed income

Our first fixed income fund debuted in 1974. In 50 years, we grew our fixed income AUM to nearly US$500B.‡

Helping families fund educations

In 2002, we debuted our 529 savings plan, which has grown into the largest 529 savings plan in the U.S.§

Making planning easier

In 2007, we launched our first target date series, which has helped millions pursue their retirement goals.

‡ As of 31 December 2023. Assets managed by Capital Fixed Income Investors.

§ Largest by assets, according to the 529 Quarterly Data Update, Fourth Quarter 2023 from ISS Market Intelligence. As of 31 December 2023.

We’re turning 100!

As Capital Group approaches its 100th anniversary in 2031, our long-term strategy remains firmly rooted in our mission to improve people’s lives through successful investing. For more than nine decades, we have continually evolved to achieve that goal.

As we progress, our entire organisation remains focused on fulfilling that mission through our strategic priorities.

Deliver superior investment results

We will continue to innovate our research, portfolio construction and risk management processes.

Evolve with our clients

We will continue to put our investors first and work to be the business partner of choice by helping our clients achieve their business priorities.

Simplify and scale

We will deliver world-class service and maintain the financial strength to continually reinvest in our business, clients and associates.

Invest in our culture and the associate experience

We will invest to continually improve the experience of working at Capital Group.