Markets & Economy

Will M&A play a significant role in the post-pandemic world? Companies often rely on mergers & acquisitions to transform their businesses by buying, selling or divesting assets, and 2021 is shaping up to be a big year for deal making.

M&A activity hit US$484.5 billion for January and February 2021, up 33% compared to last year.

“Watching companies get acquired or become acquirers is one of my favourite aspects of small-cap investing,” says portfolio manager Greg Wendt. “It’s fascinating to track small companies and see which ones make it to a much bigger scale.”

M&A is not just a big deal in small cap. It can impact companies across equity and bond markets. With that in mind, Wendt and a few other Capital Group portfolio managers shared their views on 5 key questions about the M&A boom:

1. What’s fueling the rise of M&A?

“Companies have come out of the shell shock of the first half of 2020 and are now more confident about the future,” Wendt says. Many have strong balance sheets and consider M&A as a growth strategy.

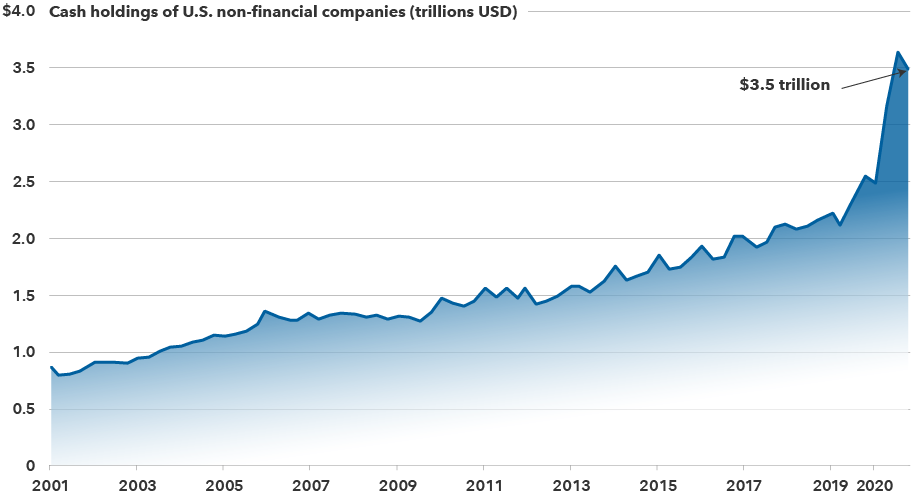

Companies are also sitting on record amounts of cash, says Scott Sykes, a fixed income portfolio manager. Some industries such as cruise lines and hotel chains raised money to stay afloat through the pandemic. Others — after an initial dash for cash in case of a prolonged downturn — raised additional funds to take advantage of low interest rates.

Many investors expect companies to buy back stock and debt, put funds toward acquisitions, or do a combination of all three, Sykes notes.

Companies have amassed a record amount of cash

Sources: Federal Reserve, Refinitiv Datastream. As of 9/30/2020.

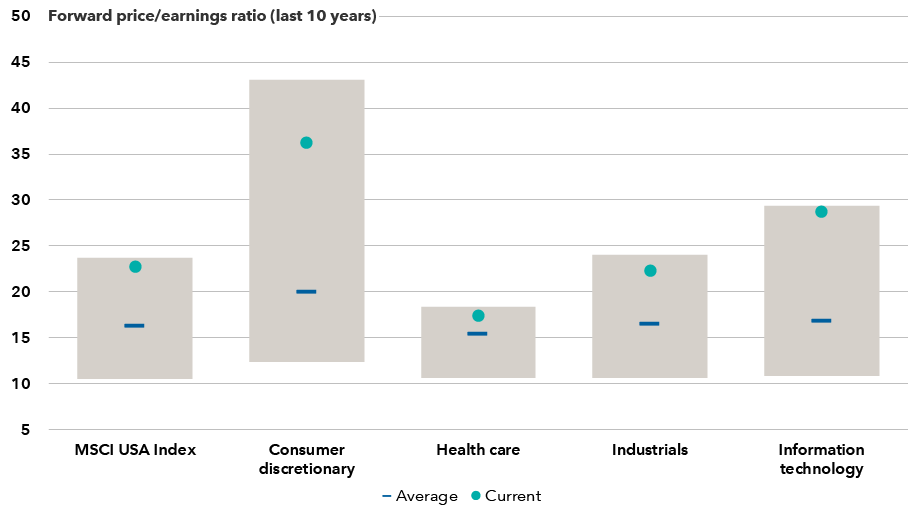

2. Are sky-high equity valuations influencing deals?

“CEOs are a little amazed at their stock prices. They want to use that advantage strategically, and many want to make acquisitions,” Wendt says. “We are in a buoyant market with high stock prices that companies can use as currency.”

Companies that engage in M&A are often those with a history and pattern of deal making. “There are companies you know that make sense as part of bigger companies. And every now and then you’re surprised when the acquirer gets acquired,” Wendt adds.

Meanwhile, companies with more leverage, such as those in the high-yield sector, could use this opportunity to go public, according to portfolio manager David Daigle. “Private equity firms will be minor players when it comes to buying public assets at these valuations,” Daigle adds. “They will, however, bid aggressively for carve out assets that come up for sale as companies seek to reposition their businesses. But paying a 30% premium on top of already high public valuations is not something you’ll see very often.”

Valuations across most industries are high

Sources: RIMES, MSCI. As of 1/31/21.

3. Is M&A good for investors?

While companies often tout value creation as a result of M&A, many end up destroying value, Wendt says. The Harvard Business Review recently warned management that the “once-in-a-generation opportunity to make acquisitions” could lead to deals that ultimately hurt companies.

“I’m not a huge fan of transformative acquisitions — I’ve seen too many that didn’t work,” Wendt says. “Often M&A is a product of a company running out of gas. They fail as often as they succeed.”

“I think big picture, M&A is a key risk to credit,” Sykes adds. “Large deals tend to add leverage and increase risks. M&A is something I am tracking, and I actively avoid or reduce investments in companies I think could lever up dramatically.”

But the right management team can make all the difference. “Many executives love their companies, and it says a lot about their commitment to maximizing shareholder value when they are willing to sell,” says Wendt. “One of my favourite examples is an airline that sold itself at a time when it was doing very well. The CEO said he just did not see a path to becoming a long-term winner in a consolidating industry.”

On the flip side, there have been companies that turned down incredible offers only to languish for decades trying to get back to that higher price.

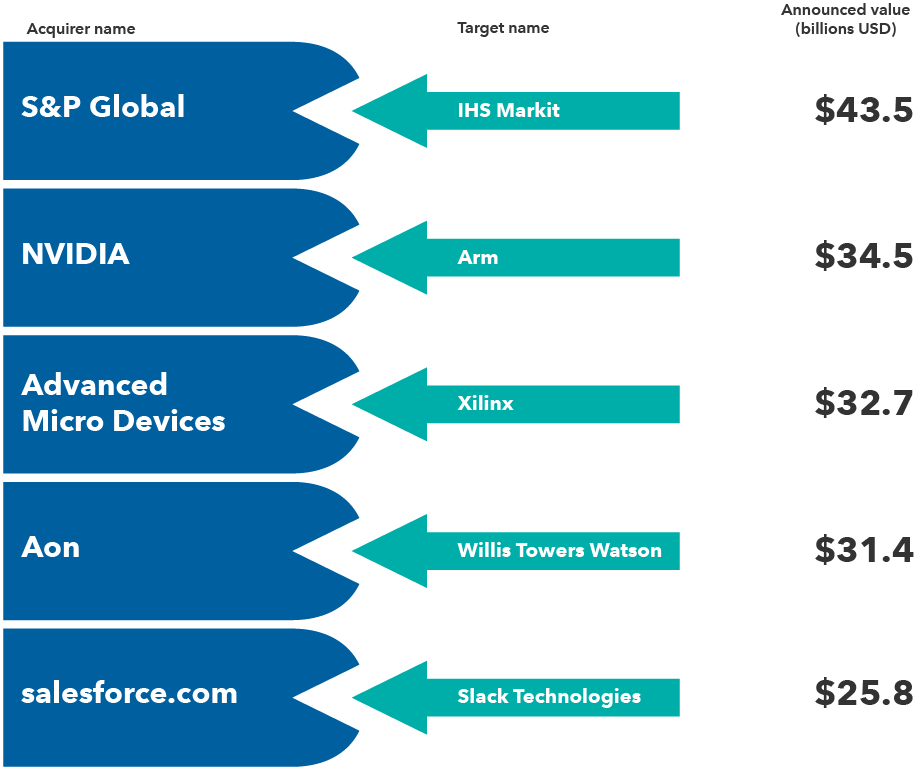

Largest U.S. M&A deals of 2020

Source: Bloomberg. Includes five largest announced deals in 2020 completed or still pending as of 2/28/21.

4. What industries could be most transformed by M&A?

Digitization across all industries will drive many M&A deals. The pandemic accelerated the growth of many tech companies, particularly Big Tech. Although Facebook, Amazon and Alphabet may refrain from acquisitions in the face of intense regulatory scrutiny there are several smaller tech companies that could become targets or buyers, according to Wendt.

For example, banks have always wanted a slice of the digital payment space, but the pandemic accelerated the move toward contactless payments. Large players such as PayPal continue to make acquisitions but may eventually find themselves a target.

Gaming companies such as casino operators are also on the hunt for digital offerings in the areas of fantasy sports and online betting. “This industry is maturing quickly, and it is much easier to get a known customer to bet more than to identify new customers,” Wendt adds.

Media is also another sector undergoing massive shifts, with cord cutting continuing to drive some of the changes. “There’s a lot more competition creating content, and it’s unclear if some of the programming translates well to streaming,” Sykes notes. “Will Amazon, Netflix, or Disney+ buy content the same way that CBS and ABC once did?”

Meanwhile, Big Pharma’s penchant for acquiring smaller companies with drugs nearing regulatory approval is well-known. This year will be no exception, he adds.

Innovation is particularly fragmented in drug development with many small players working to find solutions to big health care problems. Regulatory pressure to keep costs low and preserve patent expirations on key drugs tend to support M&A activity no matter the economic environment.

In energy, companies may engage in M&A to create a better industry structure that allows them to be profitable, Daigle says. Many are investing in renewables as governments worldwide call for lower emissions, and legacy energy companies are seeking to consolidate amid persistently low energy prices.

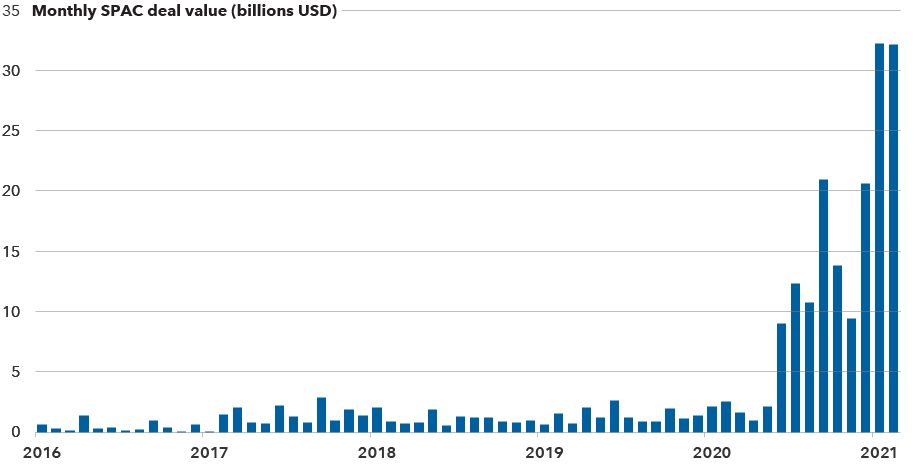

5. How are SPACs changing the game?

The frenzy around special purpose acquisition companies (SPAC) has achieved star status. Shaquille O’Neal and Alex Rodriguez are among the names providing the funding. Even major corporations such as consumer food company Post Holdings and device maker Medtronic are in on the act.

A SPAC allows a private company to become public without going through the lengthy process of filing an initial public offering, or IPO. Here’s how it works: The publicly traded SPAC raises cash via the market and uses the funds to acquire a private company. By comparison, an IPO is when a company files paperwork to raise funds as part of its effort to go public.

More than 380 SPACs raised US$106 billion last year. And in January 2021 alone, SPACs raised roughly US$32 billion.

SPACs are on the rise

Source: Bloomberg. Includes all announced deals as of 2/18/21.

The sheer number of active SPACs created in 2020 indicates the pipeline for acquisitions is exceptionally high.

“M&A is going to be really interesting this year because of the rise of SPACs, which generally have two years to find a deal or the money gets returned,” says Wendt, who has already invested in several SPACs. “There are going to be lots of new companies introduced to the market, which is great for an organization with deep research capabilities.”

Our latest insights

-

-

Currencies

-

Market Volatility

-

Market Volatility

-

Markets & Economy

RELATED INSIGHTS

-

Chart in Focus

-

-

Economic Indicators

The MSCI USA Index is a free float-adjusted, market capitalization-weighted index that is designed to measure the U.S. portion of the world market. The index is unmanaged and, therefore, has no expenses. Investors may not invest directly in an index.

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

David Daigle

David Daigle

Scott Sykes

Scott Sykes

Greg Wendt

Greg Wendt