Artificial Intelligence

Global Equities

As an investor with more than three decades of experience, the past 16 months stand out in my career as both intensely painful and incredibly instructive. On or about March 23, 2020, the Standard & Poor’s 500 Composite Index and MSCI All Country World Index hit bottom, establishing the fastest bear market in U.S. history as the COVID-19 pandemic spread across the globe.

Last week, in stark contrast, U.S. equity markets hit new record highs, bringing us full circle from the depths of 2020 to the heights of 2021. Given these remarkable milestones, I thought this would be an opportune moment to share some of my learnings from this most unusual time in U.S. history.

I’ll start with a brief summary of my mindset as we entered the plague year. In late 2019, I felt confident that the markets were well positioned for a period of strong returns. Inflation and interest rates were low and looked likely to remain so. Banks were eager to lend, and companies seemed willing to invest in productive capacity again — as opposed to share buybacks and questionable acquisitions.

True to my beliefs, I entered 2020 invested as suggested above, with little cash and plenty of cyclicality reflected in my largest holdings. In less than three months, as the global economy came to a virtual standstill and fear gripped the markets, my pro-cyclical positioning looked problematic to say the least. But context is important. And to understand that, it helps to understand my investment style.

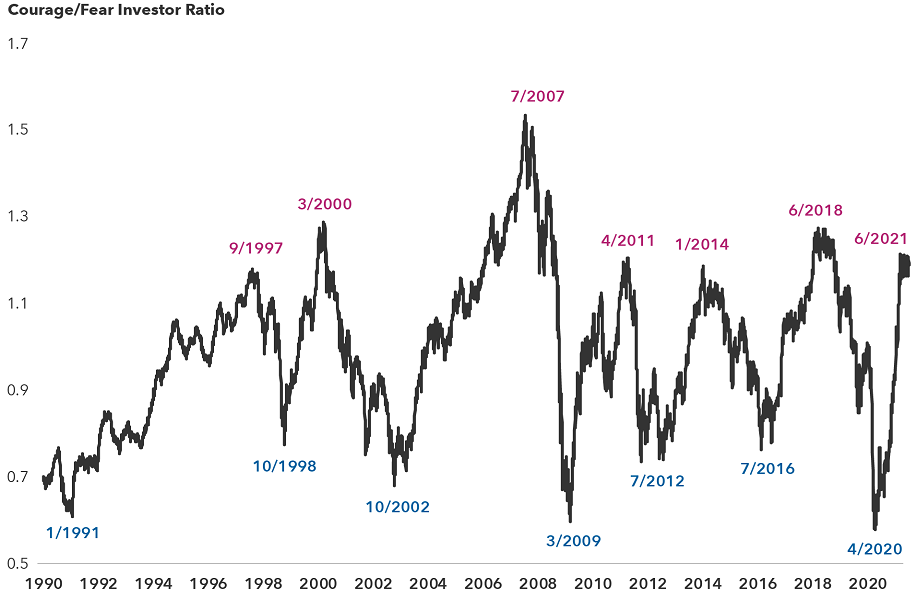

U.S. investors move from courage to fear

Source: The Leuthold Group. As of 6/30/21. The Courage/Fear Investor Ratio is developed by The Leuthold Group and shows the relative return of a "Courage Portfolio" over a "Fear Portfolio." The Courage Portfolio averages returns of the Russell 2000 Small Cap Index, MSCI Emerging Markets Index, CRB Raw Industrials Index and S&P 500 cyclical sectors. The Fear Portfolio averages returns for the U.S. Dollar Index, gold prices, S&P 500 Low Volatility Index and 10-year Treasury.

Friends and colleagues sometimes say, “Steve is the kind of guy who runs into burning buildings.” I find that a bit extreme, but it’s true that I am a contrarian investor at heart. As long as I’ve been in this business, I have believed that the market swings from excessive enthusiasm to extreme pessimism. An investor with a reasonable degree of objectivity can benefit from selling the former and buying the latter.

It’s an approach that has served me well for the past 30-plus years, but it also frequently causes pain and tends to pay off mostly during the early stages of market upturns, as pessimism gives way to optimism. Warren Buffett said it best: Be fearful when others are greedy and greedy when others are fearful.

That’s me in a nutshell. Now, here are five lessons I learned or relearned in the pandemic that I’m using in my portfolios today:

1. Market crises are inevitable

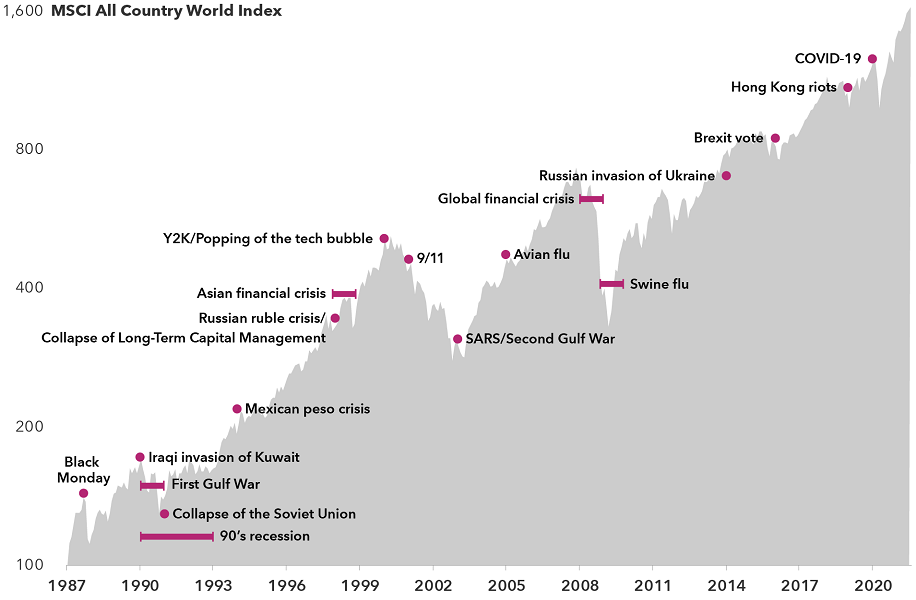

The advent of the pandemic-driven stock market crisis led me to think of past market traumas I have experienced. I counted 21, including the collapse of the Soviet Union, the bursting of the technology bubble, the global financial crisis and now COVID-19.

I offer this list of events only to highlight the fact that market disruptions are a fact of life for investors. It’s just a matter of time before the train runs off the rails. My list suggests we get one of these events every 18 months or so.

Market disturbances are a fact of life for investors

Sources: MSCI, RIMES. As of 6/30/21. Data is indexed to 100 on 1/1/87, based on MSCI World Index from 1/1/87-12/31/87, MSCI ACWI gross returns from 1/1/88-12/31/00, and MSCI ACWI net returns thereafter. Shown on a logarithmic scale. Returns are in USD.

No one could have predicted the pandemic but, in hindsight, it would have been wise to consider the chance that something would come along and disrupt the incredible bull market of the previous decade. If history is any indication, it would also be wise to believe that we’d get through it and emerge stronger on the other side. And, indeed, we have so far.

2. Interpreting history isn’t an exact science

This relatively short list of events offers other important lessons, as well, including the fact that history does not necessarily repeat itself in ways you might expect. It’s easy to draw false parallels, and I did exactly that during the early months of the COVID crisis.

For instance, I lived in Hong Kong through the dark days of the SARS (Severe Acute Respiratory Syndrome) epidemic in 2003. I was quick to make overly simplistic comparisons between SARS and COVID. But while SARS was terribly frightening to live through, relatively speaking, it was a fairly minor event. Drawing conclusions about COVID from the SARS experience proved to be a mistake, leaving investors unprepared for the extent and duration of this pandemic.

I will add that I was also similarly surprised by the swiftness and power of the U.S. governmental response — both fiscal and monetary — to the COVID crisis. That response arguably helped minimize some of the damage to my pro-cyclical positions during the early months of 2020.

3. Growth or value? Both, at the right entry point

While I acknowledge some discomfort with the overly broad and vague labels “growth” and “value,” I’m going to use them here even as I agree that they lack nuance. The fact is, my fairly limited selection of growth-oriented stocks saved my skin during the worst days of 2020. These included some technology shares, particularly in the semiconductor industry, as well as some consumer-oriented internet and e-commerce companies.

Despite my value bent, I remain a strong believer in the resilience of the tech sector. Entry point is important to me; therefore, many of my tech-related investments are long-term holdings initially added before the market recognized their potential. I like to purchase shares when they are down and out, but I also like to hang on long enough to let the market catch up with what I think is the true value of the company in question. As a result, some of my holdings today don’t look contrarian, but they likely did at one time.

As these stocks rallied amid the pandemic, I gradually trimmed some of them to make room for more unloved areas of the market, including energy, financials and travel.

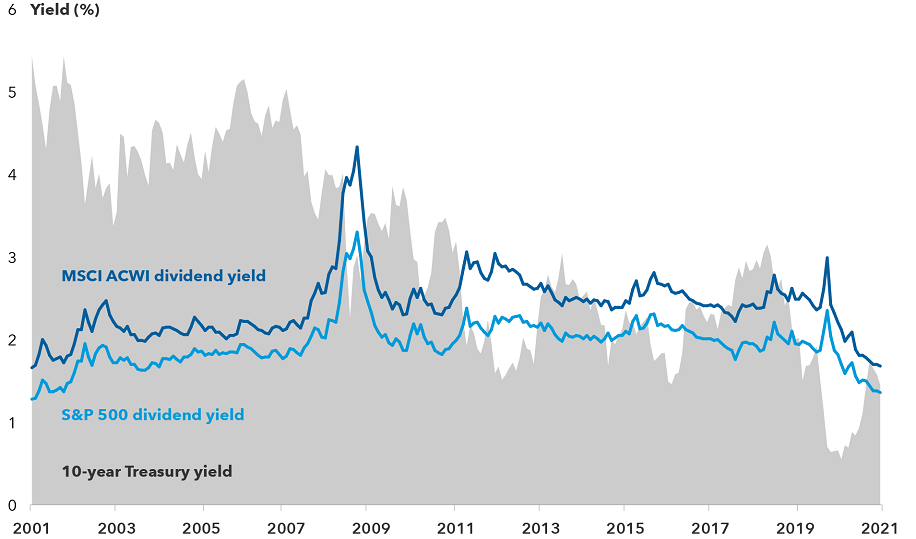

4. Dividends help pay the rent

Speaking of unloved areas, I have long placed an emphasis on dividends as the principal mechanism for the transfer of value from a company to its investors. I’ve also maintained the expectation that dividends will continue to serve as a stabilizing factor during times of market turbulence.

Sadly, the latter characteristic has been weakened over the last decade and seemed to fall away completely at times in 2020. But I’m not willing to say that yield is useless. Our current unprecedented monetary conditions, coupled with the market’s devotion to fast-growing, society-changing companies, have tossed aside lots of historical norms.

That said, I do not think the value of the dividend as a wealth-transfer mechanism linking companies and investors has ended. In my view, it is more important than ever. And I continue to hold a number of high dividend payers, as well as dividend growers, in my portfolios.

Simply put, I loved dividends before the pandemic and continue to love them now. The shares in my portfolios, like my own children, should pay rent to live with me.

Dividend-paying companies are an important source of income

Sources: MSCI, Refinitiv Datastream, Standard & Poor's. As of 6/30/21.

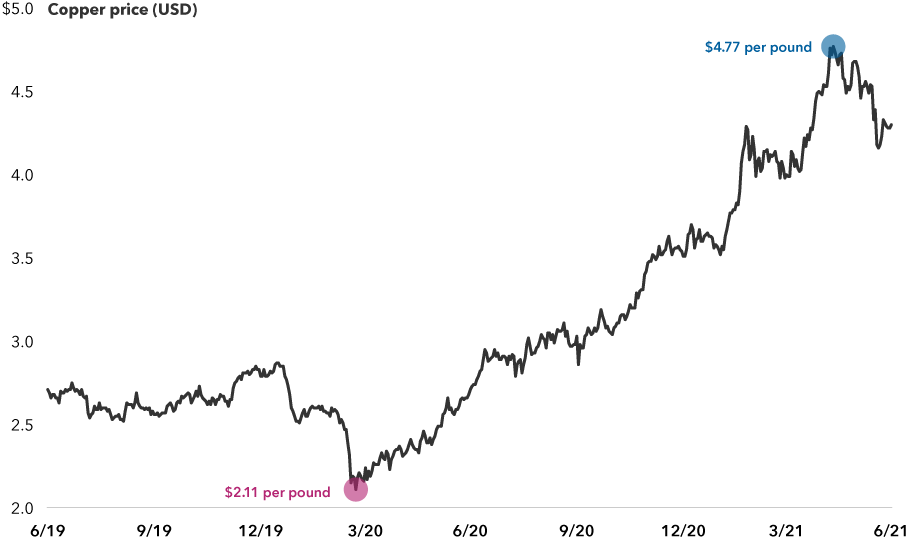

5. Dr. Copper delivers a healthy diagnosis

My outlook, as wrong as it was in the first quarter of 2020, hasn’t changed much today.

Just as the markets have come full circle, I find myself feeling much like I did in late 2019: I am still fully invested and I expect global markets to be higher a year from now. My portfolios are still characterized by a pro-cyclical tint, meaning I favour companies that I believe will benefit from a reacceleration of global economic growth.

I could be wrong, of course, but I feel heartened by the diagnosis of Dr. Copper. Copper, as you may have heard, is the commodity with a PhD in economics, given its keen ability to help predict the path of the global economy. Copper prices bottomed in late March. They are suggesting now that the economy is mounting a strong recovery and will likely continue to do so. Copper may also be warning about mounting inflationary pressures, but for the time being, I do not see inflation, or higher interest rates, as a threat to global equity markets.

Copper prices indicate the economy is in good shape

Source: Refinitiv Datastream. As of 6/30/21.

I am also finding more attractive opportunities outside the U.S. In my view, the rest of the world, particularly emerging markets, are currently far more attractive from a valuation perspective than the U.S., and my portfolios generally reflect that view.

In short, we now have all the elements, once again, that I was so confidently wrong about in late 2019 and early 2020. A critic might say that I have trouble learning my own lessons. But I would respond that perhaps the plague year was an anomaly. And perhaps we can now live again with investment styles influenced by market history, and place a greater emphasis on the expectation of a return to historical norms.

It’s possible even — dare I say it — that growth is ready to pass the baton back to value and non-U.S. markets are poised to outpace the U.S. in the years ahead.

We shall see.

Our latest insights

RELATED INSIGHTS

-

Artificial Intelligence

-

Artificial Intelligence

-

MSCI All Country World Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

MSCI Emerging Markets Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global emerging markets, consisting of more than 20 emerging market country indexes.

MSCI World Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results of developed markets. The index consists of more than 20 developed market country indexes, including the United States.

Russell 2000 Small Cap Index measures the performance of 2,000 small cap stocks.

CRB Raw Industrials Index is a price index constructed from a basket of various industrial commodities.

S&P 500 Low Volatility Index measures the performance of the 100 least volatile stocks in the S&P 500.

U.S. Dollar Index is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners.

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Steve Watson

Steve Watson