Client Conversations

- An investment policy statement (IPS) outlines the client’s expectations, objectives and strategic asset allocation.

- An IPS can help reduce ambiguity, foster accountability and build trust between advisors and clients.

- An IPS provides advisors an opportunity to demonstrate their value to clients.

Investment management has become more complex. Today, with the constant flow of information and diversity of investment options, it is essential for financial advisors and their clients to have a clear shared understanding of the objectives and policies that govern their relationship. We find that one of the oldest tools in the investment management toolbox — an investment policy statement (IPS) — remains one of the most effective ways to accomplish this task.

What is an IPS and why does it matter?

An IPS isn’t just a document; it’s a foundation for building an investment portfolio and a productive client relationship. It sets expectations and provides a framework for decision-making. In the face of uncertainty or emotion, it’s the compass that can keep portfolios aligned with long-term goals. By outlining return objectives, acceptable risks, time horizons and unique circumstances, an IPS provides a disciplined framework for portfolio construction and monitoring. Investors and advisors can use it as a reference to evaluate performance, decide when adjustments are needed, and help ensure alignment with objectives.

An IPS can help reduce ambiguity, foster accountability and build trust between advisors and clients by making expectations explicit. Although an IPS can take many forms, the more details it includes, the clearer the expectations are for all parties involved. Some institutional policy statements are meticulously detailed. For example, the California Public Employees’ Retirement System's IPS is 120 pages long. However, not every IPS requires such granular specificity. An IPS is not meant to be a clinical information gathering process. What is most important is that clients see themselves in the IPS. It needs to be personal and tell the client's story.

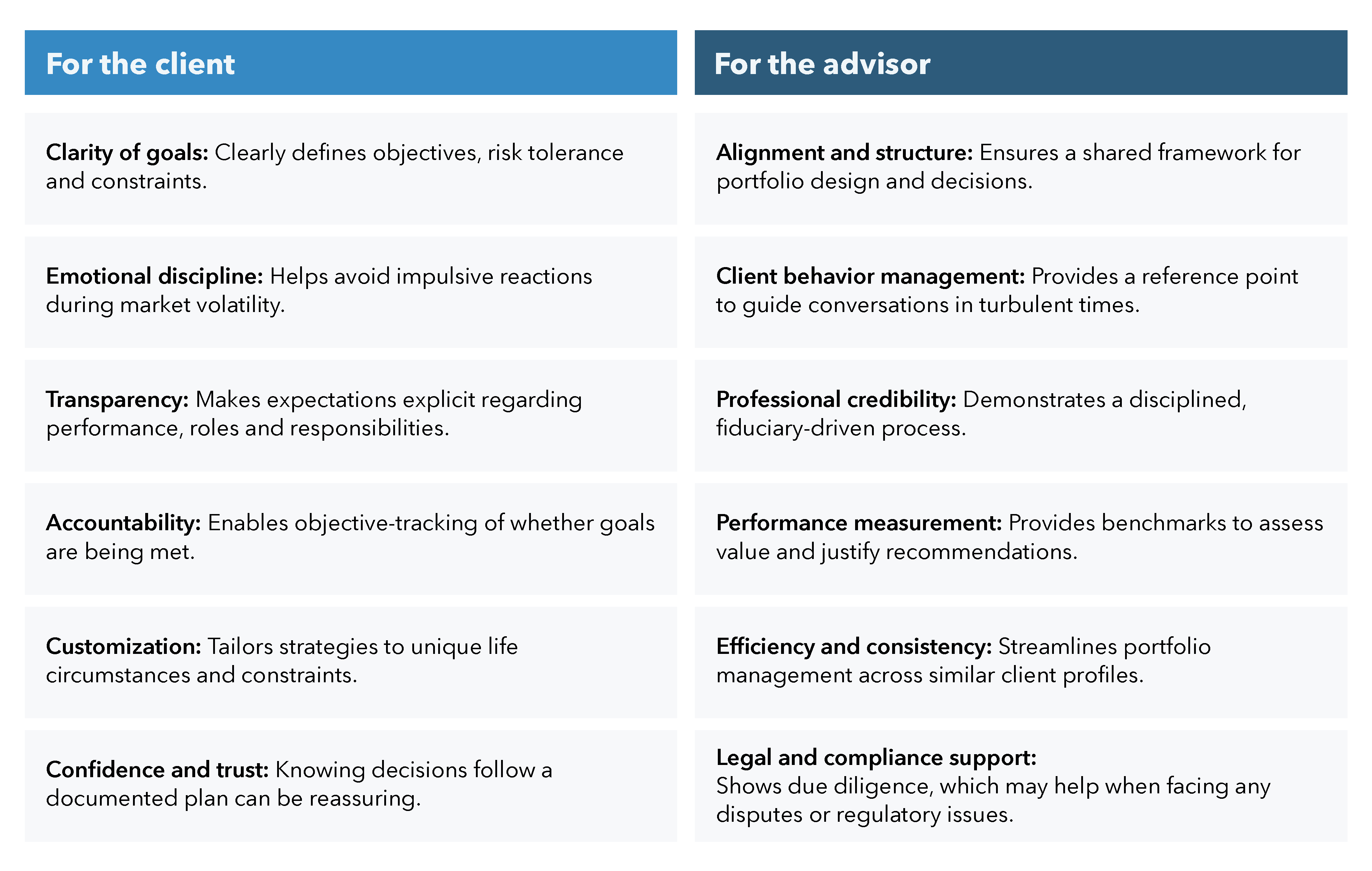

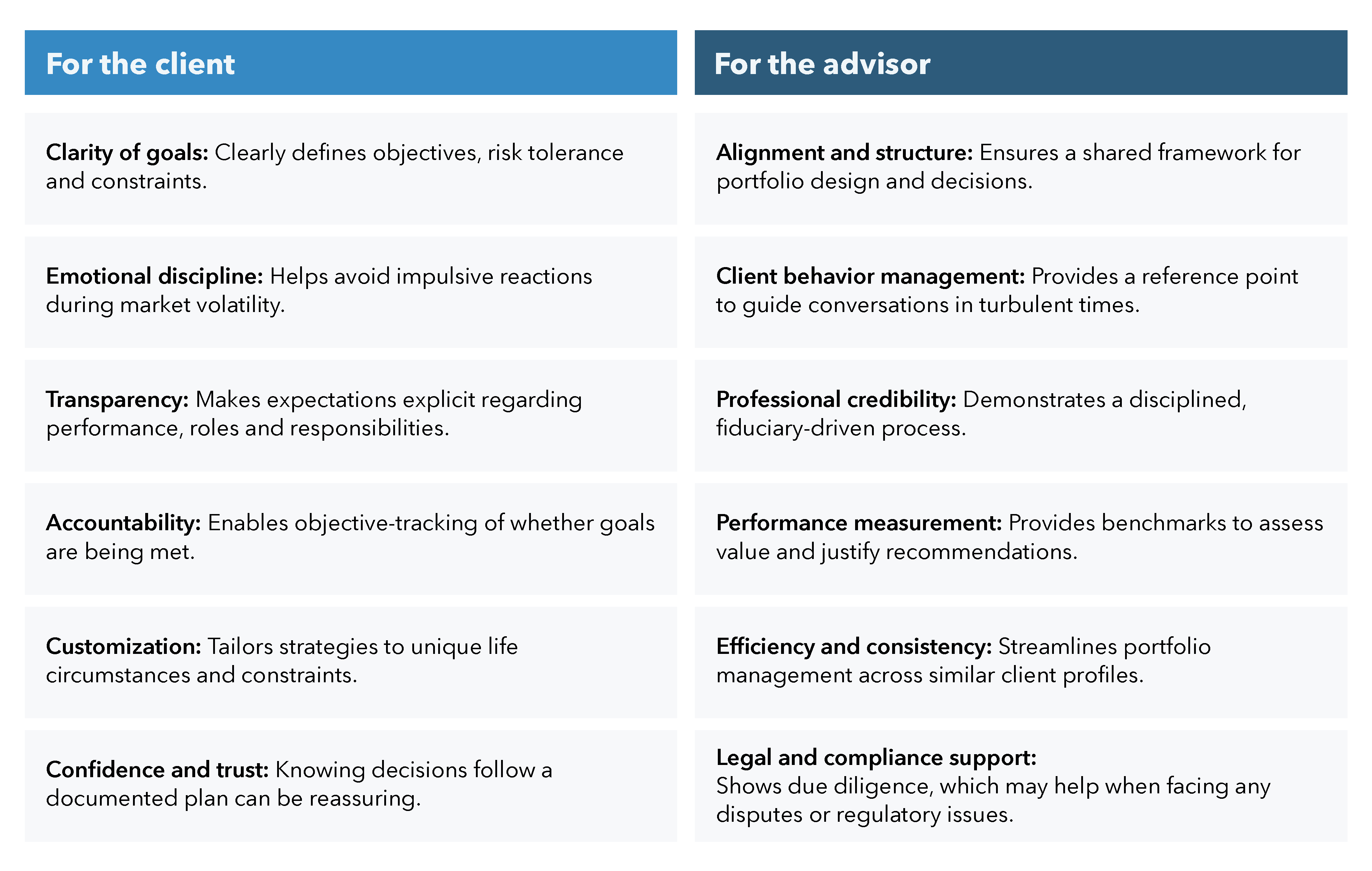

Benefits of an investment policy statement

Source: Capital Group.

Here are six foundational elements that help make an IPS effective:

1. Statement of purpose: Start with why

A good IPS begins with a clear and simple question: “Why are we creating an IPS?” This section identifies the investor and advisor and clearly states what the document represents.

How this impacts your practice: A statement of purpose clarifies what an IPS document is and what accounts it covers.

A few things to keep in mind:

- Make it clear.

- Keep it simple.

- There's room for more details later in the document.

Example: “This investment policy statement outlines the investment objectives, constraints and guidelines for the Johnson Family Portfolio and serves as a strategic framework for managing the assets in line with their long-term financial goals and risk tolerance.”

2. Governance: Define the roles

Clear governance is critical. Who makes decisions? Who monitors performance? Who’s accountable? Defining roles and responsibilities, and how decisions get made and communicated, helps ensure alignment and avoid confusion.

How this impacts your practice: Defining roles establishes clear accountability and expectations, and reduces confusion. It empowers you to act within your mandate and know when client input or re-engagement is necessary.

A few things to keep in mind:

- It's a two-way relationship.

- The advisor and client have unique responsibilities.

- The clients' responsibilities are just as important as the advisor's.

Example: “The financial advisor is responsible for recommending and implementing investment decisions, monitoring the investments, facilitating financial plan reviews and recommending changes as the need arises, while the client agrees to communicate to the advisor any changes in financial circumstances or objectives.”

3. Investment objectives: Risk vs. return

An IPS helps translate a client’s investment objectives into specific risk and return parameters. To build the optimal investment portfolio, be clear on what the return requirements are and how much risk an investor is willing to accept to pursue those returns.

How this impacts your practice: Risk and return objectives give you a foundation for defining success. It aligns planning and investment actions with the client's specific objectives rather than using a one-size-fits-all approach.

A few things to keep in mind:

- It may be helpful to distinguish between return requirements (essential goals like retirement income) and return desires (aspirational goals like legacy planning).

- The IPS reconciles these goals with the investor’s ability and willingness to take on risk.

- Ability is quantitative: What are the investor’s resources, time horizon and risk tolerance?

- Willingness is qualitative: How comfortable is the investor with volatility and uncertainty?

Example: “The portfolio seeks a 6% annual return to fund retirement while accepting moderate risk and occasional market fluctuations to achieve this goal.”

4. Constraints: Know the boundaries

Constraints aren’t limitations, they’re design parameters. Every investor faces constraints — some obvious, others hidden.

How this impacts your practice: This ensures the client-specific constraints are understood and documented. It gives the advisor clear boundaries when designing the investment portfolio and reduces the risk that the suggested investment portfolio violates a client constraint.

A few things to keep in mind: There are five common categories of constraints.

- Liquidity needs: From daily expenses to emergency reserves.

- Time horizon: Short-term goals vs. long-term growth.

- Tax considerations: After-tax returns matter more than pre-tax projections.

- Legal/regulatory: Compliance isn’t optional.

- Unique circumstances: From concentrated stock positions to environmental, social and governance preferences.

Example: “John requires $20,000 in annual withdrawals starting at age 65, prefers tax-efficient investments, and has large holdings in XYZ stock due to employee grants that cannot be sold."

5. Strategic asset allocation: Build the blueprint

The preceding sections focus on taking in client information. This section develops the output. It outlines the long-term mix of asset classes that reflects the optimal portfolio aligned to the client's goals, risk preferences and constraints. It sets target allocations, acceptable ranges and rebalancing thresholds. It also enforces discipline, which is essential when pursuing investment objectives.

How this impacts your practice: Strategic allocation acts as your investment blueprint. It ensures that portfolio discipline supports rebalancing, and it keeps you focused on long-term strategy instead of reacting emotionally to market events.

A few things to keep in mind:

- This is meant to be constant over time and aligned to objectives.

- Usually designed with passive market indexes as asset class allocations.

- This should align to the stated benchmarks under performance evaluation.

Example: “The target portfolio allocations will be 60% equities, 30% bonds and 10% cash, with rebalancing whenever any asset class deviates by more than 5%.”

6. Performance evaluation: Measure what matters

This section defines how performance will be measured, how often it will be reviewed, and under what conditions it will be revised. This section isn't just about returns; it’s about ensuring continual alignment with objectives, identifying obstacles and making adjustments when needed.

How this impacts your practice: It provides a structured evaluation process, helps to manage expectations and demonstrates your value over time, and it sets a routine for proactive client check-ins and discussions.

A few things to keep in mind:

- Benchmarks need to be aligned to objectives.

- Don’t over-engineer benchmarks, use simple blended benchmarks when appropriate.

- Don’t let short-term investment outcomes drive long-term strategy changes.

Example: “Portfolio performance will be formally reviewed with the client semi-annually and compared to a blended benchmark of 60% S&P 500 Index and 40% Bloomberg U.S. Aggregate Index. Adjustments will be made if certain investments fall short of expectations or the client’s circumstances change.”

Sign and date the document

An IPS isn’t complete until both advisor and client sign it with a stated date. That signature is more than a formality, it’s a commitment to shared goals, mutual accountability and long-term partnership.

An IPS can help strengthen your practice

An IPS provides an opportunity to demonstrate your value to the client. By formalizing the client’s expectations, objectives, desired outcomes and strategic asset allocation, an IPS shows clients that you truly understand them — and that you are taking a thoughtful, rigorous approach in pursuing their financial goals. It can also help clients feel more confident that you are giving them a personalized portfolio tailored to their objectives — not a cookie-cutter solution.

For financial professionals only. Not for use with the public.

Jan Gundersen

Jan Gundersen

Andrew Bates

Andrew Bates