Planning & Productivity

Team Management

Have you ever experienced a business where the service is stellar? Each associate you encounter seems as bright and committed as the next, and the operation runs so smoothly you hardly even notice it. This type of experience doesn’t just happen. It takes a well-run team.

Workplace analytics firm Gallup defines it as employee engagement: the involvement and enthusiasm of employees in their work and workplace. Backed by more than 50 years of employee engagement research, the firm finds engaged employees “produce better business outcomes than other employees — across industry, company size and nationality, and in good economic times and bad.” According to 2021 data, Gallup found that the manager determines 70% of the variance in team engagement.

This bears out in our own industry research. According to Capital’s Group’s Pathways to Growth: 2023 Advisor Benchmark Study, high-growth financial advisors spend 35% more time focused on team management than their peers and are 75% more likely to claim expertise at it.

At a time when customer service is at a premium, and good employees are harder than ever to find, a focus on leading an engaged team may help position your business for success.

What is employee engagement?

An engaged employee is easy to recognize: someone leaning into work rather than just putting in time. But Gallup data goes even deeper, finding key elements of employee engagement range from expectations and equipment, to purpose and fulfillment. Today’s employees care less about job satisfaction than about personal growth.

Gallup’s data also shows that only about a third of U.S. employees are currently engaged. This creates an opportunity to provide the working conditions employees are seeking, but engaging employees requires leadership and development skills that don’t always come naturally.

The manager’s pivotal role

Source: Gallup, June 2021.

A framework for successful teamwork

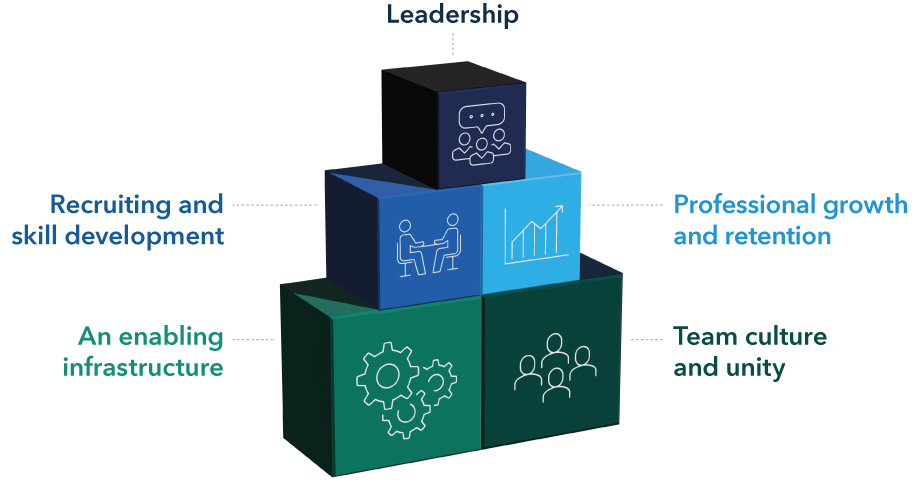

To help build these skills, consider the “total employee experience” framework summarized in the chart below. Assessing your practice in terms of these building blocks can help you attract and select the right people, and take steps to make sure they are enabled to do their best work and grow in your organization.

You can see that the left side is focused more on hard skills, such as operational processes and technology, while the right side is centered around the employee and the human side of things. As the Gallup research illustrated below, the combination of these elements leads to employees who are fulfilled in their jobs and who feel they are part of the firm’s overall mission.

If you think of leadership as a set of building blocks, it may be easier to take on one by one – with your leadership style and tactics at the top. Beneath that are two building blocks of equal importance: recruiting and skill development, and professional growth and retention. Supporting these blocks are an enabling infrastructure and team culture and unity.

The building blocks of employee engagement

Source: Capital Group research

1. Lead with purpose

There are many effective leadership styles. You might be a more laissez-faire leader, largely relying on your team to work well on their own. Or you might have a more democratic style, through which you rely on employee feedback to make decisions.

No matter your style, the crucial element is leading with purpose that goes beyond just a paycheck. Purpose pulls employees in, encourages them to find meaning in the work, empowers them to make better decisions, and reminds them of their ability to make a difference. That motivation can lead to better outcomes for clients.

“Your team is your biggest asset,” says Eric Grey, Capital Group’s RIA National Sales Director. “In addition to traditional development, we work to create learning and engagement in real-time by thoughtfully involving associates in initiative development, decision-making and execution so that it can broaden their perspective, skills and network.”

Gallup recommends that leaders seek to create workplaces that meet employees’ fundamental psychological needs. Engaged employees need the right materials and equipment to do their jobs and they also want someone at work who cares about them as a person and seeks out their opinion.

2. Be intentional about recruiting and skill development

Pause and consider what, if any, process you use to recruit, hire and train employees. Are you reacting, triggered by a one-off need sparked by an employee departure or a new business opportunity? Or do you have a playbook for recruitment and development that considers your resources — one that defines not only the capabilities of the role, but also the characteristics of the employees you seek? Here are a few things to consider when developing a recruitment and hiring model.

Expand your candidate pool

First, consider your sources for finding potential employees. Study after study has shown that nonhomogeneous teams are smarter: They challenge each other’s thinking, which leads to new ideas and creativity.1 Additionally, adding diversity to your staff (in terms of gender, ethnicity, age or background) can also help expand your thinking about the clients you serve and how you serve them.

But in today’s climate, hiring managers are realizing it’s difficult to just find qualified candidates, let alone candidates from diverse backgrounds. To increase your pipeline of diverse, qualified individuals, consider looking to networks, such as the Association of African American Financial Advisors, or the Accounting & Financial Women’s Alliance. The idea here is to proactively seek connections to groups of individuals you don’t already come across through your daily work routines.

You might also look to younger candidates to invest in. Recruitment offices at local colleges and universities can be a fertile place to forge relationships with young talent. For example, when Scott Rister led the firm Budros, Ruhlin & Roe in Columbus, Ohio, the firm had a program aimed at bringing more women into wealth management. A paid summer internship came with a $1,500 stipend that could be used to pay tuition. “When we first started that, we’d interview 10 people, and only one person would be head-and-shoulders above,” says Rister, who now leads his own firm, Transcend Partner Group. That work forming relationships with university professors in seeking scholarship candidates has yielded a larger group of great candidates.

Similarly, advisor Rita Lee at San Francisco’s Brouwer & Janachowski seeks young talent from diverse backgrounds looking for the right opportunity to develop and grow. She has worked with nonprofits, such as 10,000 Degrees, which helps students from low-income backgrounds obtain college degrees.

Hire for capabilities and characteristics

Some hiring managers only pay attention to a candidate’s skills and experience; others favor personality and relatability. These factors can help you get to know what someone says about themselves. But to predict how they might perform as an employee, consider capabilities and characteristics:

Capabilities: A candidate might be able to list the skills needed to do a particular job, but someone with strong capabilities can talk about using those skills in different scenarios. For positions that require a high level of skill, you should not be afraid to ask questions required of an expert — whether they are a sharp-eyed numbers whiz, or an empathetic relationship expert who knows how to shepherd a distraught client through the estate process or engage with next-generation members in a client’s family.

Characteristics: Then there are the qualities you can’t instill in others — the more intrinsic aspects of an engaged employee — such as intellectual curiosity, passion, resourcefulness and resilience. Someone with these characteristics can be trained or taught to do anything. To assess these characteristics, ask them about how they handled situations involving the skills or processes you are looking for. Do they seem capable of leadership, autonomy, time management, problem solving, etc.?

“Hire for characteristics first — those qualities that are fundamental to your culture, like learning, drive and self-awareness,” Grey says. “For example, I like to consider the qualities of first-generation success, like taking responsibility for outcomes, not taking success for granted, and maintaining humility and awareness of others’ contribution to their success. Those things will be durable superpowers over time.”

3. Consider your value proposition to current employees

Hiring is one hurdle, but developing and retaining engaged employees can bring additional challenges. As a leader, it helps to create an employee experience that is just as strong as your client experience. In fact, you can develop a clear value proposition for employees, just as you do for clients.

Think creatively about compensation

Compensation in terms of salary, retirement and health benefits is table stakes, so it helps to know where your offering sits in the marketplace. (Candidates likely will.) But employees may also be attracted to nonfinancial incentives, such as remote work, flextime or other work-life balance benefits. Even simple recognition and department-level awards (think: Superstar Service; Terrific Teamwork) can make an impact.

If your firm is structured in a way that only the top person “wins,” it is not always easy to incentivize the rest of the team. Your value proposition for key staff could be offering “phantom equity,” or shadow stock, where individuals don’t actually own a percentage of the business but receive bonus pay as if they did. “Advisors can structure that compensation on areas of the business they want to grow,” such as fee-based offerings, says Chris Gies, director of advisor practice management at Capital Group. “And it can be well-defined, so that each employee knows exactly what they need to do to earn that bonus.”

As an example, he cites rockstar Jon Bon Jovi and his backing band. “The equity of the franchise, the band Bon Jovi, is all with Jon Bon Jovi, and he paid people to play with him,” Gies says. “While the band never owned any part of the franchise per se, he made them very wealthy as a result of the success of the business.”

Build professional growth paths

Employees are hungry for opportunity, but 80% of workers find they have to change employers to get the career development they seek, according to a 2018 survey by the Society for Human Resource Management. Your value proposition to employees can also be shown through your commitment to their professional growth.

One way to do this is to create a unique plan for each employee’s career development. Using your skills as a professional advisor, ask each individual what career progression looks like for them, and create a plan they can work toward. Not everyone will have the same goals. Some may be hierarchical (i.e., “moving up”), while others may involve acquiring different skills or taking on new challenges.

Employee needs have changed

Source: “Building a high-development culture through your employee engagement strategy,” Gallup, 2020.

Are there ways to support those aspirations in their current roles? Are there tasks they can work on to gain expertise or skills needed for the next step? Think about how you or other senior associates can mentor employees as they expand their responsibilities. “We are involving our associates in more of the decision-making at Capital Group,” says Grey.

“Some advisors think too zero-sum: Investing in employees might mean they could be more likely attractive to other firms and leave, but actually the opposite happens,” Grey says. “Consider that your team is the greatest force-multiplier that you have. And investing your time in their effectiveness, engagement and productivity will return more to the business than almost any other focus of your attention.”

4. Set clear parameters, processes and tools

Perhaps the most important aspect of employee development is creating a clear runway for them to succeed at their jobs. Many high-performing advisory teams are doing this through processes and workflow management, creating operational efficiencies that save time and make it clear how everyone works together to support clients.

Build clear roles and consistent processes

For example, standard operating procedures (SOPs) provide clear sets of directions for how important business tasks are handled, so that anyone can onboard a client or answer a relationship management question with the same level of surety. This helps to provide a seamless service experience, regardless of who the client is interacting with. It also creates efficiency to help the business scale, by building models that can be repeated by future employees and teams. Indeed, more than 62% of the highest growth practices in our benchmark study have SOPs in place for things like client onboarding, for example.

Optimize technology

Technology can help standardize processes and make it easier for employees to work as a team to provide outstanding service. High-growth advisors in our study were more likely to rely on technologies to help optimize workflow processes such as portfolio rebalancing, document management and customer relationship management. High-growth advisors were also more likely to drive efficiency by using models for portfolio management. And there was a leap in overall adoption of tech tools by advisory firms during the pandemic: More than half of firms surveyed by Charles Schwab in its 2022 benchmarking survey increased their use of digital workflows, boosting gains in assets under management per professional by 11% from 2020 to 2021.2

Promote a growth mindset

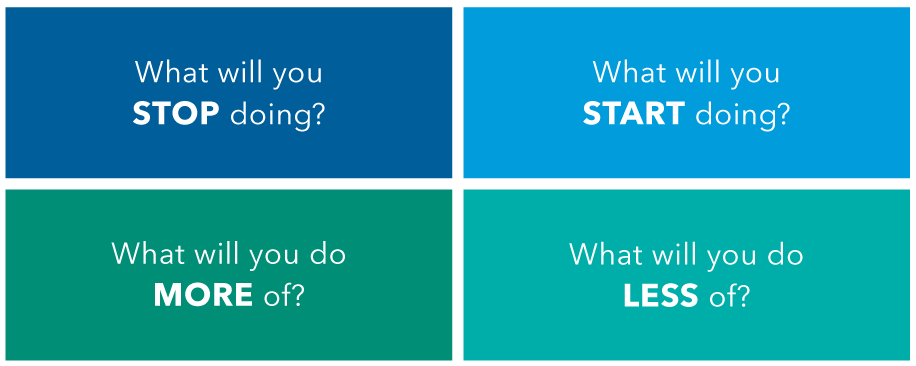

Encourage staff to consider continuous improvement as not things to achieve, but a way of thinking and working that can result in growth. Use a “More. Better. Less. Stop.” framework in regularly scheduled meetings to encourage feedback and discussion about what does and doesn’t work in the service of clients, and how to make what is working better.

Conduct a retrospective in four steps

Follow up on changes you’ve implemented. Share success stories, mistakes and overall learnings without judgement. Innovation can be an exciting part of everyone’s role when there’s little fear of failure.

5. Create a team culture with a sense of unity

If you think of a workplace engagement scale, the far-left end of the spectrum would be purely transactional: Workers perform their function with little human interaction. But many of today’s successful organizations slide further to the right on that scale, building a relational environment in which everyone believes they benefit from each other. Employees bring their hearts to work — not just their heads. Advisors can foster this environment through a variety of ways.

Celebrate key moments and achievements

Office birthdays and work anniversaries are de rigueur, but there are other creative ways to celebrate your employees and the work they do. What about recognizing professional milestones, such as achieving a series 7 or CFP designation, bringing in the most referrals, or helping a client achieve a life goal (like sending a child off to college)? Paying attention to less traditional milestones can amplify the goodwill generated in these interactions.

Foster unity with team building

Create more opportunities for employees to mingle. These activities should be a mix of work-related and just-for-fun diversions. Ask employees for ideas and involve them in planning events or lining up expert speakers they’d like to hear during a lunch-and-learn session. Get the group outside to enjoy the sunshine while volunteering in the community. You want to give your employees a chance to interact with each other outside of work routines and get to know each other as multidimensional people, not just co-workers.

Work relationships are like any other relationships in our lives. The ones that we are most invested in nourish us and provide us opportunities to reciprocate. It’s one thing to interview someone, like what you see and offer that person a job. It’s another to look back years later and tell them you’d hire them again — and tell them why, both then and now, given their accomplishments with your firm.

By showing employees you care about them, not just the job they do, you encourage agency and sense of ownership in the firm. This can set off a virtuous cycle for both the employee and the practice.

“In a challenging marketplace, your newest associate is your competition’s most credible prospect,” Grey says. “Keeping employees engaged, and managing how you do that, takes time. But it can be well worth the effort.”

1”Why diverse teams are smarter,” Harvard Business Review, Nov. 4, 2016.

2”8 Highlights From the 2022 Charles Schwab RIA Benchmarking Study,” Horsesmouth, Nov. 9, 2022.

Updated October 17, 2023

Related content

-

-

Team Management

-

Planning & Productivity

-

Standard Operating Procedures

For financial professionals only. Not for use with the public.

Eric Grey

Eric Grey