Demographics & Culture

International

- For long-term investors, now is not the time to give up on international equities.

- The relative return gap between U.S. and non-U.S. stocks is the widest in history.

- Valuations are highly attractive amid political, trade and market turmoil.

- Expect more of the same in 2019 as a daunting calendar of events looms.

Stop us if you’ve heard this one before: Equity valuations outside the United States look incredibly attractive on a historical basis. They have looked that way for quite a while and the gap is widening. The relative outperformance of U.S. stocks compared with their non-U.S. brethren is at the highest level in history. The pivotal question for investors today is: How long can this continue?

The trend has accelerated in recent months as rising global trade tensions, slowing economic growth in Europe and a strong U.S. dollar have weighed on international equities. So far this year — a difficult time for equities overall — U.S. stocks are essentially flat, while the MSCI Europe Index has lost more than 11% in dollar terms. Japanese stocks are down about 8%.

This divergence between the U.S. and the rest of the world is indicative of a wider and longer-running storyline. For nearly a decade, international and emerging markets have lagged U.S. markets, and lagged badly. There is no sugarcoating it.

“I just don’t believe that condition is permanent,” says Capital Group portfolio manager Andrew Suzman. “It will reverse at some point. If you believe in the power of diversification, now is not the time to capitulate on international investing. Now is the time to look for opportunities in places where other investors are running away.”

Mind the gap

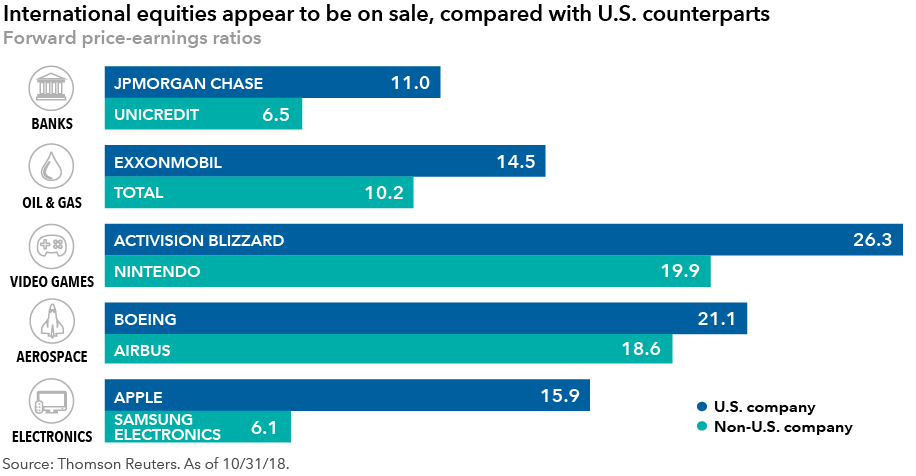

Indeed, in nearly every sector there are comparable companies outside the U.S. trading at much lower valuations. The average forward price-to-earnings ratio for U.S. stocks is 15.3, as represented by the Standard & Poor’s 500 Index. That compares with 12.5 among international stocks and 10.2 for emerging markets stocks.

Among companies, classic examples of the valuation gap include Airbus versus Boeing or Adidas versus Nike, but there are many more. Samsung trades at 6 times forward earnings, a level virtually unheard of among U.S. technology giants. These are companies with strong balance sheets, solid management and long product runways that are trading at a discount partly due to their physical address. That’s a good hunting ground for value-minded investors, says Capital Group portfolio manager Steve Watson.

“I am finding far more compelling opportunities outside the U.S. right now than I am inside the U.S.,” Watson explains. “That’s largely a function of valuations. I prefer to invest in good companies on the cheap and I find it less easy to identify those in the U.S. today. By and large, investors are finding those kinds of companies in Europe, Asia and Latin America — places where there has been political, economic and market upheaval.”

“End of the world” scenario?

For true value investors, European banks represent perhaps the ultimate expression of economic and market sentiment in the region. As a group, European bank stocks have been hammered by a long list of troubles: weak economic growth, negative interest rates, political upheaval in Italy, recurring debt crises in Italy and Greece, and global trade tensions that threaten to cripple Europe’s trade-dependent economy.

However, unless you are preparing for an “end of the world” scenario, says Capital Group portfolio manager Lisa Thompson, “There are solid banks in Europe suffering from very negative sentiment that may have gone too far, in my opinion.” Some of those banks include the U.K.’s Barclays and HSBC, France’s BNP Paribas and Société Générale, Switzerland’s Credit Suisse, Spain’s Banco Santander and Italy’s UniCredit.

Rate hike on the horizon

- “Everyone is worried about rising interest rates in the United States, but in Europe the policy rate is negative right now,” Thompson notes. “That has created a very difficult lending environment and severely limited the profitability of banks. All it would take is a moderate increase in interest rates to produce an immediate improvement in the outlook for European banks.”

European Central Bank officials have indicated that they may begin raising rates in mid- to late-2019. That’s assuming eurozone economic and inflation trends remain within the ECB’s target forecasts. The ECB already has announced plans to end its bond-buying stimulus program this month, which would be the first step before an eventual rate increase.

Daunting calendar of events

The 2019 outlook for international equities is clouded by a series of upcoming events in Europe that should be considered daunting, to say the least. They include:

- Brexit showdown – The U.K. is expected to extricate itself officially from the European Union in March. EU leaders recently approved a “divorce” plan drafted by U.K. Prime Minister Theresa May. However, the plan already has come under intense criticism from within May’s own Conservative party and the opposition Labour party. It remains unclear whether the British Parliament will approve it. An initial vote is expected this month, and some political observers say May’s future as prime minister hangs in the balance.

- Merkel uncertainty – German Chancellor Angela Merkel’s administration was severely weakened during recent regional elections in which her Christian Democratic party lost significant ground. Europe’s longest-serving leader has said she will not run for reelection in 2021, but a rising chorus of voices is calling for her to resign well before then. Therefore, it is possible that Europe could lose two of its most important political leaders — Merkel and May — in the span of just a few months.

- ECB transition – ECB President Mario Draghi’s term ends in October and, before that, a new president must be selected. The normally low-key process could be highly contentious this time around if more fiscally conservative candidates vie for the position. The political maneuvering will happen at the same time that the ECB is adapting to life without stimulus measures and, perhaps, attempting to raise interest rates as well.

- European Parliament elections – This is another normally under-the-radar event that could produce further political turmoil. The European Parliament elections, scheduled for May 23–26, may be more controversial this time, given the rise of populist and euroskeptic politicians in Germany, France, Italy and elsewhere.

- Italian budget dispute – Italy’s new coalition government has unveiled a budget proposal that is expected to dramatically increase deficit spending, despite strenuous objections from EU leaders. In response, Moody’s has slashed the country’s debt rating. A showdown is looming with the EU and it is possible that new elections will be called in 2019 if the current coalition government can’t get its fiscal house in order.

Given what could be a potentially ugly news cycle in 2019, the question remains: When will international equities finally turn a corner?

“I don’t know, and the truth is, no one knows the answer to that question,” says Capital Group portfolio manager Carl Kawaja. “International equities are out of favor for myriad reasons. That will continue to be the case — until it’s not. Eventually, market sentiment will shift. In the meantime, it is my strong belief that investing in solid companies at reasonable prices will prove to be a rewarding strategy.

“Maintaining international diversification is important, even if it may not seem so at any one point in time,” Kawaja adds. “Diversification, by definition, means that some areas of a portfolio are down while others are doing well. Achieving that balance is crucial to successful long-term investing.”

Use of this website is intended for U.S. residents only.

Andrew Suzman

Andrew Suzman

Steve Watson

Steve Watson

Lisa Thompson

Lisa Thompson