Demographics & Culture

- Since dementia is likely to affect some of your clients, you should be prepared for the challenge. According to the Alzheimer’s Association, more than 1 in 10 people age 65 and older in the U.S. have some form of dementia, and it’s a growing problem; the number of cases of dementia is estimated to almost triple by 2050.

- Dementia presents several challenges and complications for advisors. While you can make note of triggering events and changes in your client’s behavior, in the end there may be little you can do other than adhere to the terms of the contract establishing the client’s account. Even so, your position as an advisor is to support your client as their unbiased intermediary and advocate.

- Have your clients revisit trusts and other directive documents every three to five years, or any time there is a change in their financial status, family situation, or health care directives, or a change in probate/trust/tax laws. Be sure to check in with your clients about these issues regularly. The more you discuss them, the easier it may be for your clients to reveal a diagnosis.

As an advisor, are you ready to assist your high net worth (HNW) clients if they develop dementia? Dementia is one of the major causes of disability and dependency among older people worldwide, and while age is the strongest known risk factor for dementia, it is not a normal part of aging. In this article, we address some ways you can help clients who experience a decline in mental capacity that could affect their ability to manage their finances.

What is dementia?

Dementia is a general term for a decline in mental ability severe enough to interfere with daily life. Memory loss is an example. As stated by the World Health Organization (WHO), around 50 million people have dementia worldwide, and there are nearly 10 million new cases every year. There are many types of dementia. Alzheimer’s disease is the most common form of dementia and may contribute to approximately 60–70% of cases. About 70% of Parkinson’s patients also develop some form of dementia over the course of their disease.

Recognizing the symptoms

According to WHO, dementia affects each person in a different way, depending on the impact of the disease and the person’s personality before becoming ill. The signs and symptoms linked to dementia can be recognized in early, middle and late stages.

How you can help your clients be prepared if dementia occurs

For advisors, dementia presents several challenges and complications. Symptoms can often seem like ordinary, age-related memory loss. Clients may try to hide their symptoms, or they could be in total denial about the disease. They can also fall prey to scammers or ill-willed family members, which could lead to elder financial abuse.

Advisors should remain on the lookout for behavior such as unusual donations to charities, hiding bills and other documents, payments to telemarketing schemes, frequently wanting to change beneficiaries on wills and retirement plans, confusion or poor decision-making.

Take an active role:

- Discuss the possibility of dementia with your clients before it appears, and make a plan.

- As part of the client onboarding process, gather the names of the people you should contact (or who will be contacting you) if something were to happen to the client. Waiting to ask until your client is in their 70s could have negative consequences, as the client could become suspicious or defensive about the questions you’re asking.

- Help clients connect with an estate planning attorney to establish a trust and a health care directive, and take steps to appoint a power of attorney.

- Although most HNW clients can afford to self-insure, they should consider the possibility of long-term care insurance, as dementia can be an extremely expensive disease to manage, even for the wealthy. Ensure that the insurance covers dementia care, not just nursing care.

- Get comfortable asking your clients questions about their health. Start these conversations now with your younger clients. If you often ask, “How’s your health?” then you may be one of the first people a client will tell about a sensitive health issue.

How one RIA has dealt with dementia diagnoses

Judy Shine, president and founder of RIA firm Shine Investment Advisory Services, has her own personal experience with dementia. Her mother, age 85, was diagnosed with Alzheimer’s five years ago, and several of her clients have and are struggling with dementia as well. Looking back, the first symptom Shine noticed was when her mother was 76 and she asked her grandson to do all of the driving while he visited her, even though he wasn’t familiar with the area. When she was 77, her mother snapped at Shine’s husband at Christmas, which was extremely out of character for her. As her mother’s condition has worsened, Shine’s sister has become the major caretaker for her mother while Shine and the rest of her siblings contribute financially. Shine says, “It should be a team effort.”

However, Shine notes that many people are often lonely and do not have sufficient support networks in place in the event of a dementia diagnosis. Shine says, “I always make a point to ask my clients about their health and their support networks every time we meet face to face.” She continues, “I’ve gotten pretty good about detecting signs of dementia. If I notice something, I will say, ‘I’ve noticed a difference,’ and usually family members have the same concerns. I’ll ask my client, ‘Is there anything else you’re having trouble remembering?’ For example, my mother often asks, ‘Why doesn’t your brother come to visit as often as he used to?’ And the answer is that he lives several states away. I’ve found that trouble with geography can sometimes be a symptom of dementia.”

What should you do if your client’s family members are the ones contacting you with concerns about your client?

- While it’s a good idea to try to get to know your client’s family members prior to any issues being raised, when a problem arises be sure to listen carefully to their concerns.

- Next, inform family members that your fiduciary duty is to your client and to their well-being. Tell them that you will share what they say with your client.

- If appropriate, you can encourage family members to take your client to see a doctor that specializes in diagnosing dementia-related illnesses.

- Remember: You have no right to share financial details with family members unless your contract with your client specifically states that it is appropriate to share that information. You and your client can always revise your contract. Just be sure to maintain your fiduciary duty and abide by the terms of your contract.

Your responsibilities and limitations as an advisor

Unfortunately, your clients may not want to tackle the issue, even if they have a history of dementia in their family. In the absence of such a conversation, however, an advisor should keep an eye out for problems as they arise. Good advisors will document all client conversations to protect themselves and provide copies to their client — or to the courts, if necessary.

Under the law, we all operate under a presumption of competence. In most cases, dementia is gradual and often comes in waves with periods of lucidity. It is important to note that there is no physical test or outward determination of competence. The solution in the law is a determination of incapacity or disability or a mental health proceeding.

Ideally, your client should have established a trust, or someone already with the power of attorney to make decisions and have ensured that they have family members or friends who have the client’s best interests in mind.

The client’s trust can serve as a mechanism for determining capacity, with a detailed health care directive and a power of attorney. If your client’s trust was established many years ago, revisit it and consider listing someone in the trust who has the authority to appoint a person to serve as the client’s agent if other persons named in the trust are not available.

Capital Group’s Jeff Brooks, a HNW wealth strategist and former practicing tax and estate planning attorney, recommends revisiting trusts and other directive documents every three to five years, or any time there is a change in:

- Financial status

- Family situation

- Health care directives

- Probate/trust/tax laws

If these steps aren’t taken prior to a client losing the ability to manage their financial affairs, a judicial competency hearing may be required to decide who will make decisions about the client’s care and money. Petitioning the courts for a conservatorship or guardianship is an emotionally difficult process and can be avoided through the planning techniques. Typically, family members are the only ones with standing to initiate such court actions. Advisors can assist by documenting the specific changes in behavior that they have observed. If you’re not sure where to begin, consult with the appropriate tax and legal advisors.

Regulators are taking steps to reduce elder abuse.

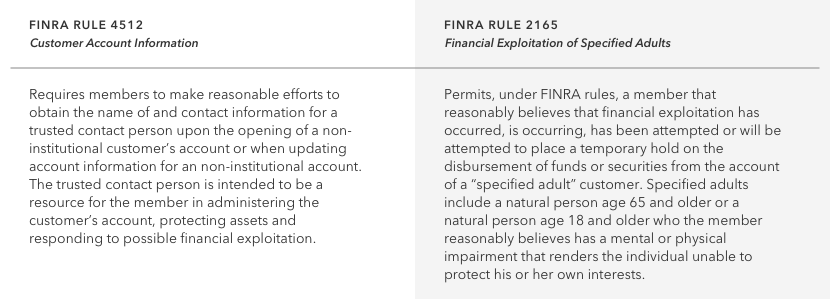

FINRA, the self-regulatory body for the brokerage industry, has moved to address the issue, and it will be important for you to remain in compliance.

Conclusion

As an advisor, you are fulfilling an important role in making sure that your client’s assets are protected in the event of a gradual decline in their mental capacity. Remember, you are your client’s advocate.

No one wants to see a long-time client suffer a debilitating disease such as dementia, but some of the greatest service you can provide as their advisor is to help be their guide and to guard their financial well-being in the best way you can.

RELATED INSIGHTS

-

-

Practice Management

-

This material does not constitute legal or tax advice. Investors should consult with their legal or tax advisors.

Use of this website is intended for U.S. residents only.