Practice Management

Advisors and registered investment advisor (RIA) firms across the U.S. are navigating one of the most dynamic and challenging periods the wealth management industry has seen in decades.

Macro forces — namely the expected transfer of over $80T of assets¹ to younger generations, as well as private equity-fueled RIA industry consolidation — are reshaping the competitive landscape.

Today, 77% of RIA assets are held by just 7% of firms, according to Stephen Caruso, associate director of wealth management and lead RIA analyst at Cerulli Associates. These RIAs, each managing at least $1B in assets, are increasingly dominated by a handful of “mega RIAs” with over $50B in AUM, he says. And those with $5B or more are growing faster and attracting more talent than any other segment in the industry.

However, their dominant AUM share is largely because of acquisitions and market appreciation, according to Cerulli. Antonio Bass, senior vice president and enterprise growth manager at Capital Group, believes that many of the largest firms must also confront the same chronic challenges facing all advisors in the year ahead: Stagnant organic growth and a shortage of next-generation talent willing to prospect for new clients.

“If you can’t demonstrate organic growth, your valuation will suffer in the mergers and acquisitions (M&A) market — and acquirers may not even consider you,” says Bass. “That’s a serious issue in an industry that is consolidating, where succession planning is limited, and where many firms are keeping their options open for mergers or external exits.”

To understand what’s at stake and how firms can respond, examine these four key trends facing advisors and RIAs in the year ahead, starting with the root of all business: the client.

1. A new wave of clients

The so-called “great wealth transfer” is accelerating. By 2048, Gen X, millennials and Gen Z are expected to inherit about $83.5T, according to Capgemini’s 2025 World Wealth Report. For advisors serving wealthy baby boomers and older generations, the challenge is clear: winning over the adult children to keep those assets.

That won’t be easy. About 81% of next-gen high-net-worth individuals plan to switch wealth management firms within one to two years of inheriting assets, Capgemini found. And the firms most likely to retain these clients are those that have already scaled to deliver the customization and convenience younger generations expect — think Amazon and Netflix.

“The next generation isn’t just seeking advice,” says Bass. “They’re demanding the convenience of having all their financial needs taken care of under one roof; personalized services and advisors closer to their own age. That’s what it will likely take to be a market leader going forward.”

Caruso thinks smaller firms with older clients have a unique opportunity — if they act quickly. “These advisors are well-positioned to engage the next generation before the assets transfer. But they must proactively build relationships now, while their older clients are alive and connections can be made with younger generations.”

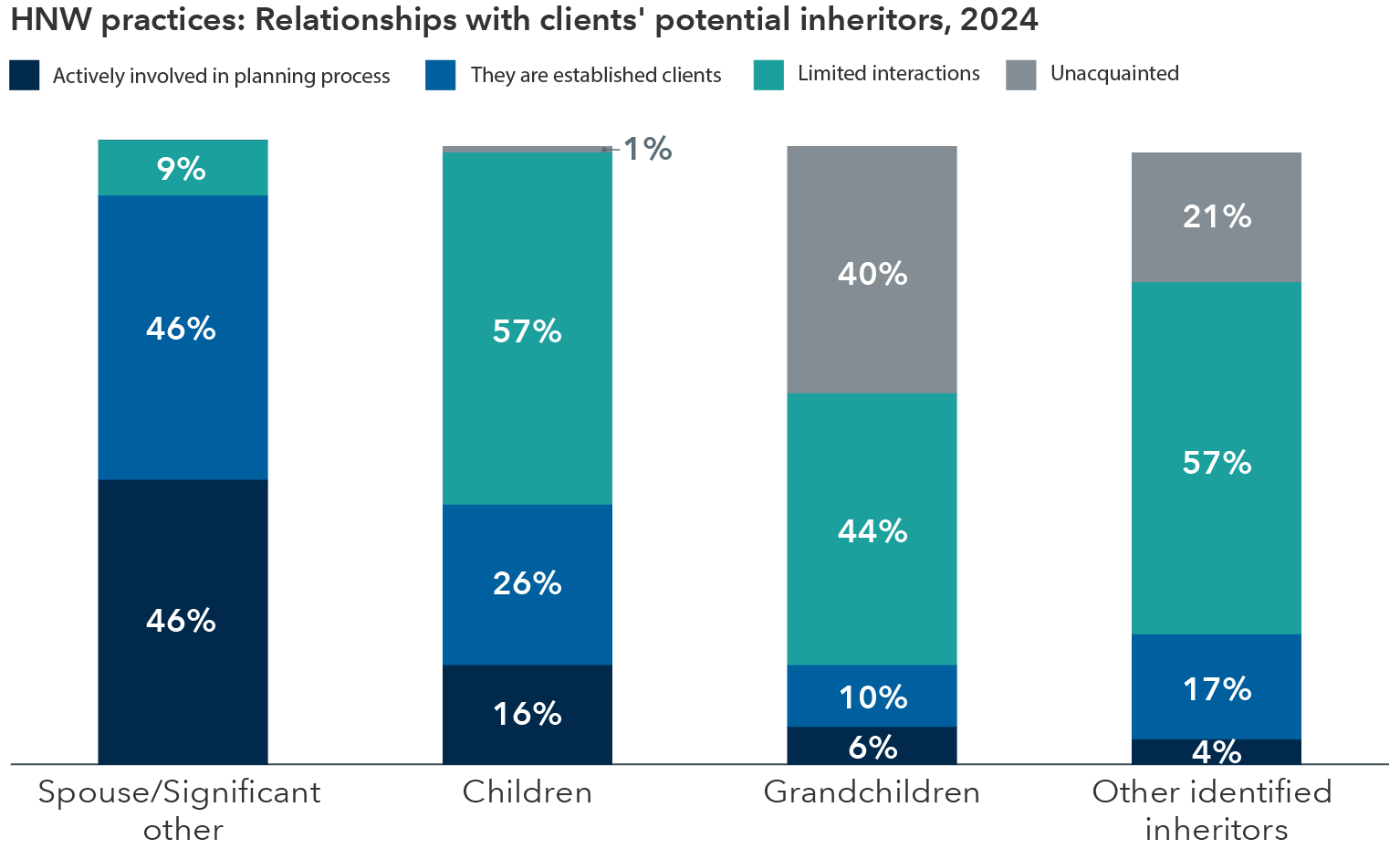

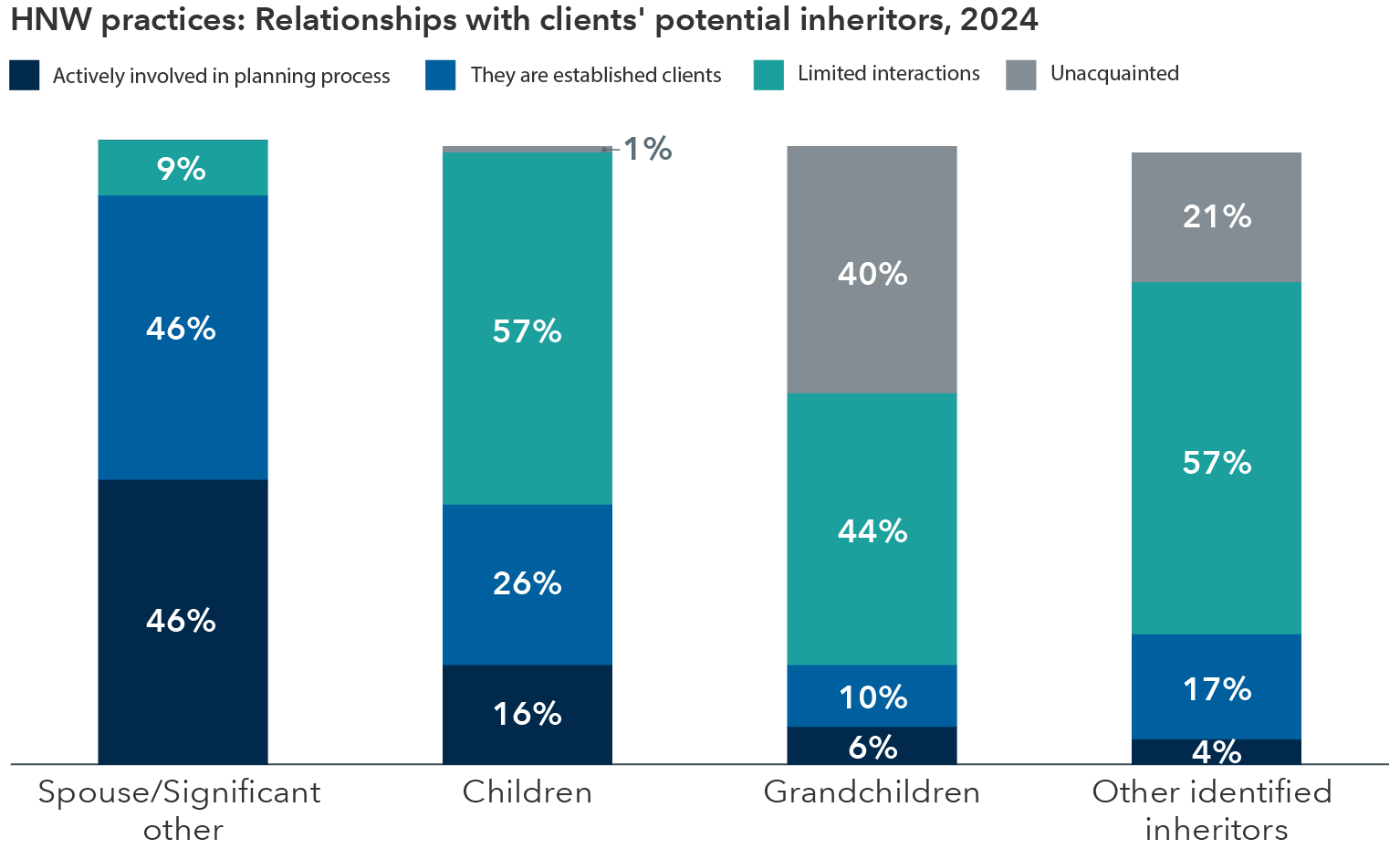

Cerulli data suggest there’s significant room for improvement.

To capture “Great Wealth Transfer,” establish relationships with heirs

Source: Cerulli Associates, "High-Net-Worth and Ultra-High-Net-Worth Markets 2024.”

Note: Cerulli defines high-net-worth as a client whose investable assets are between $5M-$20M.

Tackle the trend:

- Assess whether your service model can profitably support younger, less lucrative family members without compromising overall client experience or profitability.

- Host family meetings to discuss wealth transfer strategies and best practices.

- Identify new or existing services that can be tailored for younger clients — and pair them with advisors who can build long-term relationships.

2. Organic growth is the new battleground

For the first time in several years, the majority of advisory firms see organic growth rather than mergers and acquisitions as their top priority going forward, according to Cerulli.

Their primary focus isn’t just because of the growth in younger generation wealth. It’s also to maintain valuations in an M&A market where buyers are paying a premium for firms with robust client acquisition systems.²

“Without strong new client acquisition, RIAs will likely experience weaker valuations,” says Caruso. “In an ever-consolidating market, the need for positive net asset flows cannot be overstated.”

The numbers tell the story. While RIA assets have grown by 10%-11% over the past five years — and 16.4% from 2023 to 2024 — about 7.5% of that has come from market appreciation.³

Cerulli estimates average organic growth for the RIA channel is around 3–4%, but that includes assets gained from mergers and acquisitions. Bass believes that minus acquisitions, as well as assets gained by adding new advisors and receiving referrals from custodians, growth across the board is probably closer to zero to 1.5%.

Advisory firms facing the greatest sustainable threat are the so-called “lifestyle” firms, according to Bass, where many founders close to retirement age have eased up on chasing new clients. “The market appreciation of AUM has enabled them to make a comfortable living simply serving their existing clients,” he says.

More than a third of RIAs are expected to retire within the next 10 years, according to Cerulli, 34% of whom are uncertain about their succession plans, and 33% who expect to sell externally.

According to Bass, those without strong client acquisition systems could struggle to not only find a next-gen advisor willing to go into debt for a business that isn’t growing, but also to get the valuations they want in an external sale.

David DeVoe, a member of Capital Group’s RIA Advisory Board and head of investment bank DeVoe & Company, believes that many RIAs without succession plans may be forced into the M&A market in coming years.

In the search for organic growth, referrals reign supreme

Source: Source: Cerulli Associates, "U.S. RIA Marketplace," 2025.

Tackle the trend:

- Build formal reciprocal referral relationships with centers of influence (COIs).

- Invest in digital marketing infrastructure.

- Create specialized teams and business development departments focused on new client acquisition.

3. Talent is the linchpin

A shortage of talent and the lack of organic growth are two sides of the same coin. The number of upper-high net worth households has increased nine-fold since 2010,⁴ and the transfer of older client wealth among family members will boost the number of wealthy people going forward.

At the same time, advisory numbers are dwindling. McKinsey & Company estimates there could be a shortage of about 100,000 advisors in the wealth industry by 2034.

According to Cerulli, RIAs find advisor time constraints to be the largest challenge when implementing new organic growth strategies.

There also appears to be more new recruits who prefer service work (farmers) to drumming up prospects (hunters). “What firms are finding is that two-thirds of new hires are farmers, not hunters,” says Bass.

Larger firms have an advantage, he argues. They can split roles and develop different compensation models for acquisition and service teams, rather than having all new advisors pound the pavement. This approach can help firms find the right personalities for the right roles and incentivize the development of prospect pipelines.

Some larger firms are solving both talent and growth challenges simultaneously. According to Capital Group’s RIA Advisory Board, Modern Wealth Management is an example of an emerging RIA aggregator that has built up prospecting staff supported by state-of-the-art digital marketing systems. They pull prospects from the top of the marketing funnel and swiftly route them through an internal prospect pipeline which feeds new advisors.

“We knew we had to build an organic growth hub to attract advisors by feeding them a steady stream of warm leads,” says Jason Gordo, president and co-founder of Modern Wealth Management, who also sits on Capital Group’s RIA Advisory Board.

Modern Wealth placed tax preparation and planning at the core of its growth strategy, sensing that many in its $1M to $10M client segment have not optimized tax savings. The firm has grown to $11 billion in AUM in just 32 months, according to Gordo. Its expansion has primarily come from strategic acquisitions, complemented by a strong track record of delivering organic growth.

Tackle the trend:

- Redesign advisor roles and compensation models to separate client service and business development functions.

- Offer equity-sharing, flexible work arrangements and specialized training tracks for Gen Z.

- Create mentorship and career development programs to attract and retain next-generation advisors.

4. Technology: scale, efficiency and the AI edge

The largest RIAs have the resources to not only integrate marketing technology and AI to drive lead-generation, but also to develop systems that accelerate the prospect-to-client conversion rate.

“A lot of mega firms are getting lead-generation digital marketing technology to provide strong leads for their advisors, but to be really effective they also have to build an ecosystem within the firm to execute on digital leads as fast as possible,” says Bass. “If you don’t, the lead could end up going to a competitor they are also researching.”

Technology and AI integration are also essential for those firms hitting up against advisor capacity limits as they seek to scale, according to Wassan Kasey, a senior practice management consultant at Capital Group.

“AI is crucial,” says Kasey. “In an industry where the number of wealthy clients are climbing and advisor numbers are flat, firms have to free up as much time for their advisors as possible.” Kasey believes advisors should spend 25% of their time or less on investment management, 53% or more on client services and interactions, and the remainder on operations.

RIAs are still at the relatively early stages of executing on AI use cases, but the adoption rate is growing fast. About 70% of $1B-plus RIAs use AI for note-taking or call documentation, 50% for client onboarding and 25% to track client engagement, according to Cerulli.

The next frontier is data. 61% of $1B-plus RIAs have launched large-scale data initiatives to unify client information and build predictive AI models.⁵

Despite the progress, RIAs are still facing integration hurdles, with almost a third of $1B RIAs surveyed by Cerulli reporting major challenges optimizing technology stacks.

Tackle the trend:

- Implement the low hanging fruit: AI for note-taking, meeting scheduling and client onboarding.

- What you can’t build, find someone who’s already built it. Partner with fintech providers, or consider merging with a larger firm offering centralized tech systems.

- Launch data integration projects to amalgamate client data and enable predictive analytics.

What’s next? Expect more consolidation

M&A in the RIA industry was set to hit record levels in 2025, and DeVoe & Company. expects 2026 to be another strong year, as firms continue to seek economies of scale in anticipation of a new wave of clients.

“It’s been another banner year for M&A, and there’s no stopping in sight,” McKinsey partner Jimmy Zhao told Capital Group’s RIA Advisory Board. He expects there will be $1T RIAs by 2030.

DeVoe expects the number of large RIAs ($1B-$5B) on the market to set a new record by the end of 2025, as they joined forces or merged with RIA aggregators to gain economies of scale. These firms are seen as “safe bets” by acquirors, says DeVoe, because they’ve already proven their managerial and operational strengths — and their ability to attract talent.

RIAs in this size range will focus on building their organic growth, according to Bass, in a bid to maintain high valuations and to keep M&A options open.

“In today’s M&A market, if you have a younger client base, organic growth and a team of young advisors, you’ve hit the trifecta,” he says. Without these three things 2026 and beyond could be a challenge.

Footnotes:

¹Capgemini Research Institute, “World Wealth Management Report 2025”

²Cerulli Associates, "U.S. RIA Marketplace," 2025

³Ibid

⁴Cerulli Associates, October 2025

⁵Cerulli Associates, "U.S. RIA Marketplace," 2025

Past results are not predictive of results in future periods.

Private market data may be less standardized and less frequently updated than public market data.

Antonio Bass

Antonio Bass

Wassan Kasey

Wassan Kasey