Long-Term Investing

MARKET INSIGHTS

Capital Ideas™

Investment thinking from Capital Group

Asset Allocation

Have you made your New Year’s resolutions yet? Are you ready to close the books on 2020 and set your sights on a happier and healthier 2021?

In addition to setting fitness or nutrition goals, the new year is a great time to aim for healthier investment portfolios. Especially after the challenges and wild market swings of 2020, many investors may have deviated from their long-term investment plan. These investors could benefit from a portfolio makeover.

To gain insight into investing behaviors, Capital Group’s Portfolio and Analytics team reviewed more than 4,000 portfolios. Their analysis uncovered a variety of noteworthy and persistent portfolio construction trends. Below we share our thoughts on the investment implications and five potential actions financial professionals may want to consider for their clients’ portfolios.

1. Go global

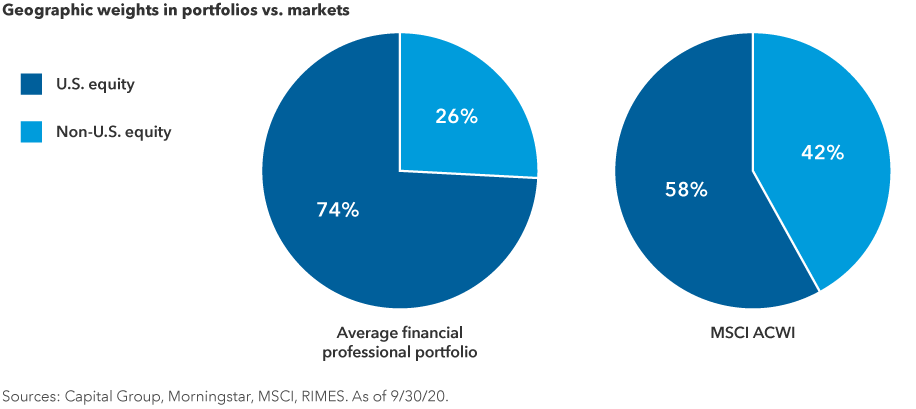

International travel may be limited in 2021, but international investing shouldn’t be. Yet our research found that the average portfolio had almost three times as much domestic equity as international. This home country bias — the tendency to invest mostly in domestic stocks — is common for U.S. investors but often hurts long-term returns.

The average portfolio is heavily weighted to U.S. equities

Many U.S. investors shy away from foreign stocks, knowing that they generally haven’t kept pace with domestic equities. But this mindset focuses too much on broad averages, instead of looking at individual companies. Many of these international businesses are dynamic, growing market leaders within their industries.

A Capital Group study that analyzed the top stocks each year over the last decade revealed that 75% of them were based outside the U.S.

Rob Lovelace, a portfolio manager on New Perspective Fund®, encourages investors to look beyond borders. “There is more innovation outside the U.S. than you might think,” Lovelace says. “So you don't want to be over-committed to the United States, but rather look for those great companies wherever they're based.”

There are many ways you can add international exposure to your portfolios. One approach is to invest in global funds that don’t have geographic restrictions. Managers in these funds can invest in their highest conviction ideas, no matter where they are located.

2. Maintain balance in your equity holdings

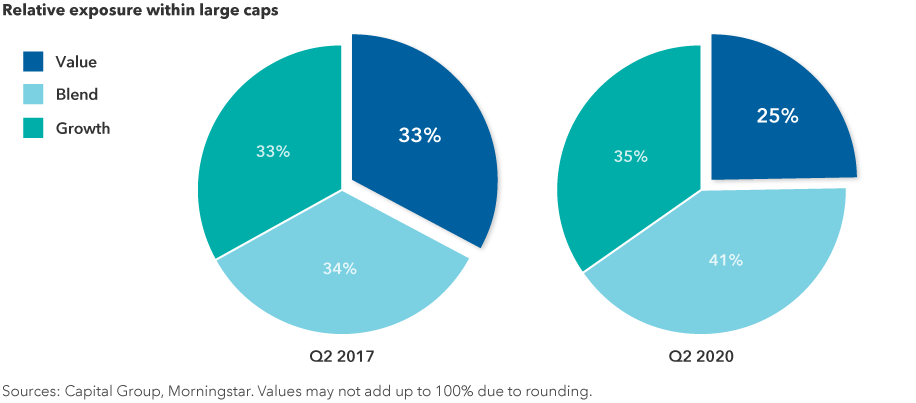

High-flying growth stocks have gotten much of the attention over the last decade, and rightfully so. Returns for consumer tech and digital companies have dwarfed those of most other industries. It’s probably no surprise then that investors have shifted their portfolios toward these recent winners.

According to our team’s analysis, investors significantly reduced allocations to value equities over the last three years. Within large caps, the average allocations to growth and blend categories were 35% and 41%, respectively, compared to value, which was 25%. In 2017, the three categories had a nearly identical split.

Investors have scaled back their exposure to value funds

As we head into 2021, financial professionals should take this opportunity to check if their clients’ equity holdings are still aligned with their long-term goals. The message isn’t to avoid growth stocks, but rather to ensure that they haven’t outgrown their intended position and role in the portfolio.

After years of being overlooked, many dividend stocks now trade at attractive valuations. But there is a fine line between stocks that present a good value and those that are just plain cheap. So it’s important to invest with managers that do the rigorous company-by-company research needed to help identify the difference. There are many funds that fit these criteria, including Washington Mutual Investors FundSM and American Mutual Fund®.

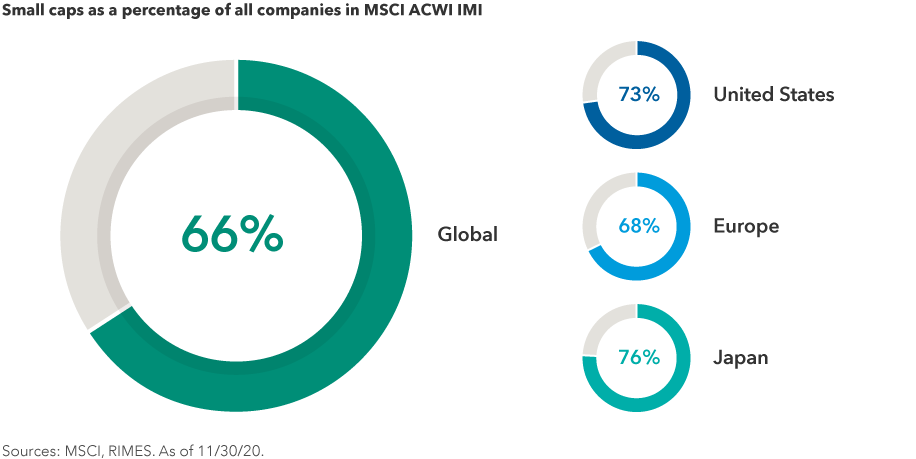

3. Think big with small caps

Another trend our team has identified is an underweight to small cap equities. This is especially true for international small caps, where the average allocation was just 1.84% in 2019, less than a third of its global market cap weight in the MSCI ACWI IMI. Among the portfolios we analyzed, 71% had no exposure at all.

It’s natural for investors to feel more comfortable with large caps, which are more likely to consist of familiar names. Even equity research firms tend to show small caps less love: Each stock is followed by an average of five analysts, compared to 19 for the average large cap. But the fact that smaller companies are often ignored is also part of the reason they may provide a great opportunity for those who use deep fundamental research as part of their investment approach.

“Many people understand the investment case for the largest companies with household names, like Amazon or Microsoft,” says Brad Freer, an equity portfolio manager with SMALLCAP World Fund®. “But small caps are often companies that most people have never heard of, which makes it that much more fun to learn about how they are special businesses.”

Two-thirds of the world’s companies are small caps

This could be an ideal time to add small caps to portfolios with little or no exposure. Small businesses were disproportionately hurt by government lockdowns this past year. As vaccines roll out and the global economy returns to some sense of normalcy, it could be small caps leading the charge. But individual company selection is particularly essential in this potentially volatile asset class. Consider funds that actively seek to determine which companies are better positioned to grow earnings in the post-COVID era and avoid those that are more likely to be left behind by the competition.

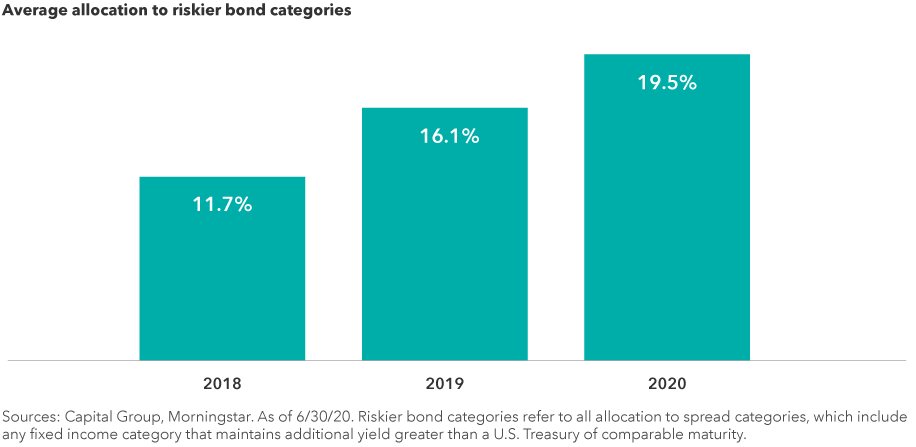

4. Avoid excess risk in your bond portfolio

Another noteworthy trend has been the shift toward riskier bonds. Over the last two years the average portfolio exposure to riskier bond categories — which include any fixed income category that maintains yield above a comparable U.S. Treasury — increased from 11.7% to 19.5%. This “hunt for yield” left many investors ill-prepared for 2020’s volatility at a time when they needed their bond portfolios to shine brightest. Investors who bucked this trend and held strong with high-quality core bond funds were rewarded when these investments did exactly what they were meant to do: preserve capital and provide diversification from equities.

Fixed income portfolios have become riskier in recent years

Equities have bounced back strongly since then, but don’t let a rosier outlook give you a false sense of security. Market recoveries are often bumpy, and the need for a core bond fund, such as The Bond Fund of America®, is as strong as ever.

“No matter the environment, a high-quality core bond fund is critical to act as ballast and fortify your portfolio for whatever the future holds,” says Mike Gitlin, head of fixed income at Capital Group. “While total returns may be more modest in the coming years, the need for diversification, capital preservation, income and inflation protection in a balanced portfolio is still vital.”

5. Run a portfolio checkup

Want a more personalized portfolio makeover, but not sure where to begin? If you’re a financial professional interested in getting a checkup on your clients’ portfolios, Capital Group can help. Request a personal consultation from one of our portfolio specialists to help you address your clients’ specific investment needs and goals, preparing them for the years ahead.

RELATED INSIGHTS

-

-

-

Market Volatility

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus.

Small company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

The market indexes are unmanaged and, therefore, have no expensed. Investors cannot invest directly in an index.

The MSCI ACWI is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes. The MSCI ACWI Investable Market Index (IMI) captures large, mid and small cap representation across more than 40 developed and emerging market country indexes.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

©2020 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Rob Lovelace

Rob Lovelace

Mike Gitlin

Mike Gitlin

Brad Freer

Brad Freer