Bonds

The Capital Group US Corporate Bond strategy showed tremendous resilience through the worst of the volatility experienced towards the end of the 2020 first quarter. In this paper, we take a closer look at this strategy and how it has fared year-to-date, as well as the risks and opportunities that lie ahead.

1. The strategy

Capital Group is a fundamentally driven bottom-up investor, relying on highly skilled corporate analysts working in partnership with the significant resources we have in equities and the company access those analysts have. The two portfolio managers, Scott Sykes and Karen Choi, along with our 13 US corporate analysts, as part of the research portfolio, manage this strategy. Having analysts who directly manage the portfolio ensures the value we create is predominantly driven by bottom-up issue and issuer decisions rather than top-down market timing decisions. The primary benefit of a bottom-up approach is consistency. Across the investment universe, our analysts can consistently identify value where companies are mispriced. This helps us build a portfolio from companies that are resilient through the various stages of the economic cycle.

This strategy aims to achieve excess returns of between 100-150bps with a tracking error of 100-250 basis points (bps). 90% of the value we add is driven by bottom-up factors, security and industry/sector selection. Unlike competitors the strategy is 100% invested in investment-grade bonds and downgrades to high yield must be sold within six months. We also integrate environmental, social, and governance factors (ESG) within the portfolio through our proprietary ‘screen and engage’ approach. This combines the input of industry data regarding breaches of the UN Global Compact with the power and differentiation of direct company and stakeholder interactions, aided by our large equity business.

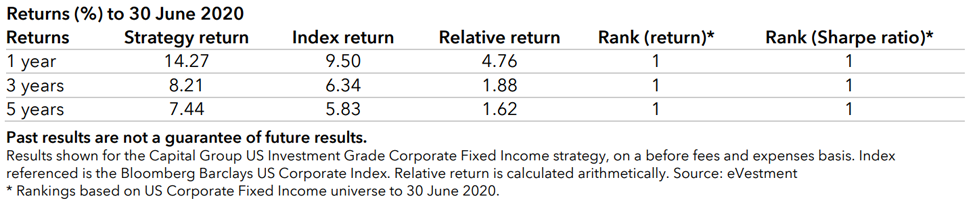

As the table below shows, our US Corporate Bond strategy has consistently added value through different market conditions, illustrating our ability to build robust portfolios that are constructed to be resilient through various market environments and to deliver the outcome our clients expect.

2. Year-to-date market review, portfolio update and long-term context

A. Market review

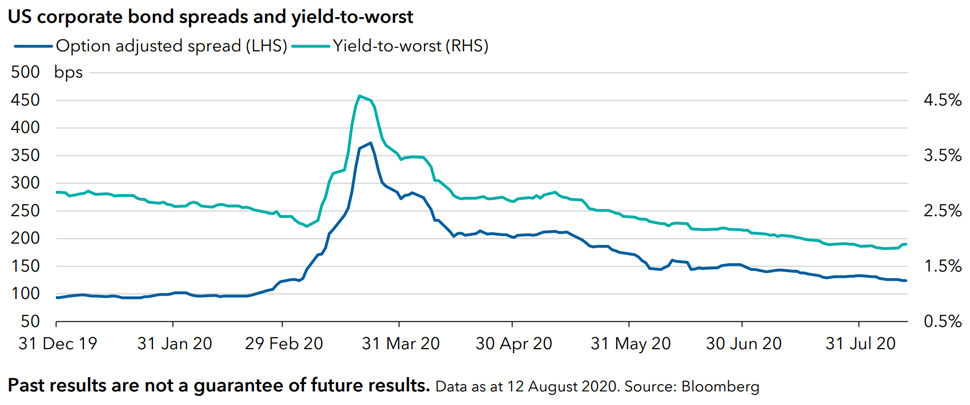

US investment-grade corporate bond markets have returned 7.97% year-to-date and 9.71% over one year (as at 12 August 2020). But what these numbers mask is the tumultuous journey it has taken to get here. Risk sentiment deteriorated sharply in March as fears surrounding the spread of COVID-19 across the globe took hold and corporate bond markets sold off sharply. US corporate bond spreads widened by 280 basis points over the period from 31 December 2019 to 23 March 2020 to reach a level of 373 bps, and the market returned -9.95% over that period.1 Uncertainty about measures to contain the virus as well as the impact from the fall in the price of oil led to a worsening in the global growth outlook. Yields also rose quickly over the worst period of volatility experienced in March before falling again to end below the level they started the year at. Liquidity became very constrained.

Risk sentiment improved as central banks and governments stepped in to help alleviate financial and market stress. Policy response to the COVID-19 outbreak by central banks globally has been swift and extensive, especially in comparison with the Global Financial Crisis. The measures, which include liquidity provision, interest rate cuts, bond buying and lending facilities have worked hand in hand with unprecedented fiscal easing measures by governments to provide near-term macroeconomic and market relief from the severe economic effects of the coronavirus outbreak and subsequent lockdowns seen in many cities and countries.

1. As measured by the Bloomberg Barclays US Corporate Index. Source: Bloomberg.

Risk factors you should consider before investing:

- This material is not intended to provide investment advice or be considered a personal recommendation.

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- Past results are not a guide to future results.

- If the currency in which you invest strengthens against the currency in which the underlying investments of the fund are made, the value of your investment will decrease.

- The Prospectus and Key Investor Information Document set out risks, which, depending on the fund, may include risks associated with investing in fixed income, emerging markets and/or high-yield securities; emerging markets are volatile and may suffer from liquidity problems.

Our latest insights

-

-

Long-Term Investing

-

-

-

Fixed Income

RELATED INSIGHTS

-

-

Portfolio Construction

-

Past results are not a guarantee of future results. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment. This information is not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.

Peter Becker

Peter Becker