Webinar

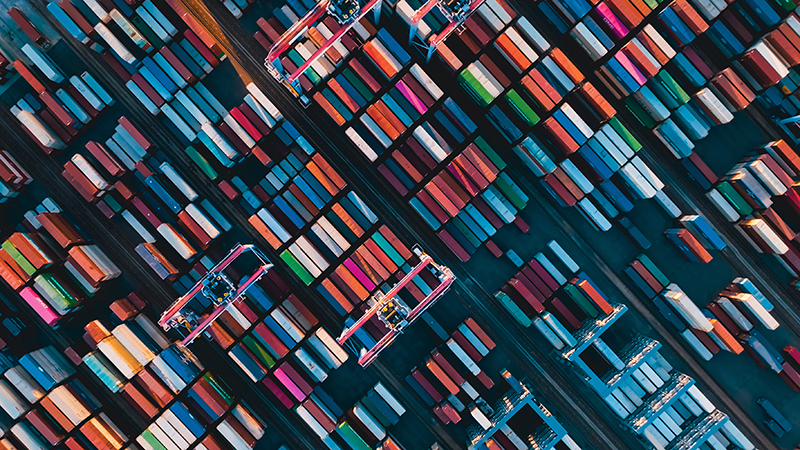

Watch our panel as they explore the challenges and opportunities of a global restructuring

and the potential implications for markets.

A restructuring of the world order is changing how we work and invest. As new technologies like AI reshape industries, and countries rethink how they trade and manage money, investors face new challenges and opportunities. Understanding these global shifts can help you make sense of today’s fast-changing economy and prepare for what’s next.

To get the highlights, read the summary here or watch our video to learn more.

Chapter 1

As labour and capital play smaller roles as economic drivers, productivity becomes the fundamental key to growth. Could AI become the next transformative force on par with railroads, PCs and the internet? What is the balance between technological advancement and AI investment in the US and globally?

Chapter 2

Trade and capital flows are inherently linked. Rebalancing the existing system will likely have multiple macro and market impacts. Shifts driven by US policies have already begun to take effect. We examine three such shifts that may provide clues to the potential impacts of current account rebalancing.

Chapter 3

Prolonged US economic strength has attracted the world’s surplus savings. The US dollar’s reserve status has further sustained these flows. As a result, a significant share of US financing has become largely insensitive to interest rate changes. But as the US budget deficit expands, what are the policy levers that could help address the debt challenge? And are there any viable alternatives to the US dollar?

Watch our panel as they explore the challenges and opportunities of a global restructuring

and the potential implications for markets.

Designed to meet a range of investment needs, whatever the market backdrop.

EQUITY

A range of equity strategies following a long-term approach to help investors achieve their goals.

Fixed income

Our distinctive approach has made us one of the world’s largest active Fixed Income managers.

Emerging Markets

Seeking investment opportunities by taking a global view and through extensive on-the-ground research.