Capital IdeasTM

Investment insights from Capital Group

Equity

Walking the showroom floor of Germany's international auto show used to be a time to admire the latest and greatest gas-powered Mercedes-Benz, Volkswagen or even a Bentley. Not so much this year. One can sense the electric vehicle future coming. Two questions are at the forefront of people's minds: Will European consumers be interested in buying Chinese electric vehicles (EVs), and will China’s automakers slash prices to grab market share?

China has surpassed Japan as the top global automobile exporter so far this year, a feat that was unimaginable a decade ago. Several of China's leading EV makers are starting to charge into Europe's market, marking an early litmus test of demand in developed markets for Chinese EVs.

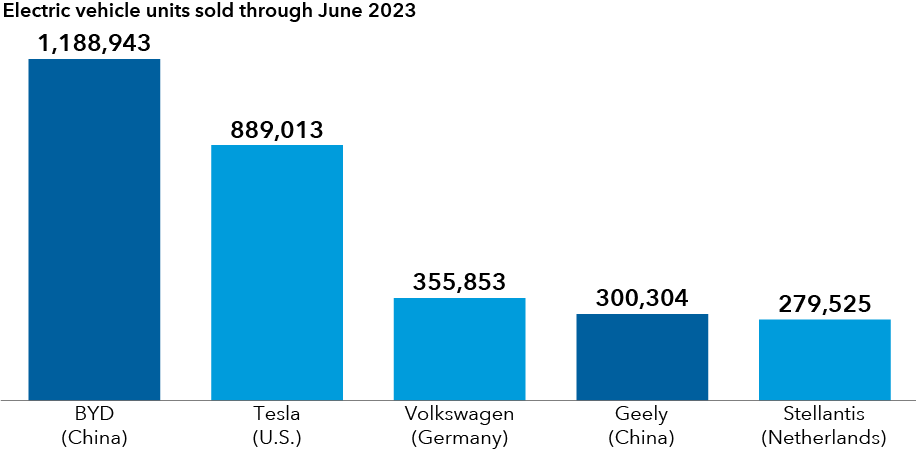

Chinese EV brands rank among the top in the world by sales

Data as at 30 June 2023. Source: Bloomberg

It's already having ripple effects in Europe, where regulators and politicians are grappling with how best to protect their traditionally strong auto industry. It's too early to know how the situation plays out, but it seems clear it will change the operating dynamic for Europe's automakers and how investors value their businesses moving forward.

Despite the initial headway China has made, many of its domestic auto manufacturers are losing money. The rush to drive down costs and prices may force lesser-capitalised EV makers out of business, and we could see a wave of consolidation.

Until then, we believe it would be a mistake to write off European automakers. Low valuations and technology advancements could provide attractive entry points for investors. They have a long and glorious legacy to build upon. They've been here before, staving off competition from Japanese car makers.

European consumers are discerning and historically chose to stay with European manufacturers even at slightly higher price points. But the global dominance of European brands, especially at the luxury end, may not last as EVs gradually replace traditional combustion engine or hybrid technology cars and other automobiles.

Our latest insights

-

-

European Equity

-

Economic Indicators

-

-

RELATED INSIGHTS

Hear from our investment team.

Sign up now to get industry-leading insights and timely articles delivered to your inbox.

Past results are not predictive of results in future periods. It is not possible to invest directly in an index, which is unmanaged. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment. This information is not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organisation; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Michael Cohen

Michael Cohen

Talha Khan

Talha Khan