Help your clients shape a college savings strategy

Offer low fees, built-in simplicity and high ratings from CollegeAmerica® 529 plans, including American Funds® target date funds.

For more information, call us at (800) 421-9900. Investors, please contact your financial professional.

About CollegeAmerica®

Launched in 2002, CollegeAmerica is the nation’s largest 529 plan,* with assets topping $107.0 billion.† It has been chosen by more than 300,000 financial professionals and more than 2.9 million‡ families nationwide.

A trusted plan

- CollegeAmerica comes with American Funds’ service, support and a long-term investment track record.

- Among Morningstar’s highly rated advisor-sold 529 college savings plan.§

- Virginia529, our long-standing state sponsor, shares our commitment to college savings.

Built-in simplicity

- CollegeAmerica features flexible and easy-to-use investment options, including target date funds.

- We’ve made it easier for financial professionals to open, offer and service accounts with a comprehensive suite of 529 resources.

- CollegeAmerica's fees are among the lowest for advisor-sold 529 college saving plans.||

- CollegeAmerica’s contribution limits allow clients to invest until the account’s value reaches $550,000.

Learn more about the features, benefits and investment options of our CollegeAmerica 529 Savings Plans.

Related literature

Unlock a world of possibilities (PDF)

Share this brochure with clients to explain the features and benefits of CollegeAmerica.

CollegeAmerica account application (PDF)

Use this application to establish a 529 CollegeAmerica savings account.

American Funds College Target Date Series®

Our college target date funds were designed to address the key challenges of saving for the rising costs of a higher education. A single investment provides diversification and a glide path matched to your clients’ investing time horizon, making saving for college easier than ever.

How the College Target Date Series works

Choose a fund

Choose the fund with the target date that corresponds roughly to the year the student is expected to enroll in college and begin taking withdrawals.

Fund is adjusted over time

Investment professionals gradually adjust the portfolio over time so that it becomes more preservation-oriented.

The allocation strategy does not guarantee that investors’ education savings goals will be met. Investors and their financial professionals should periodically evaluate their investment to determine whether it continues to meet their needs.Assets remain until withdrawn

Eventually the assets transition into the College Enrollment Fund, a preservation-oriented portfolio of high-quality, shorter term bonds. The assets remain there until they’re withdrawn

If withdrawals are used for purposes other than qualified education expenses, the earnings will be subject to a 10% federal tax penalty in addition to federal and, if applicable, state income tax. States take different approaches to the income tax treatment of withdrawals. For example, withdrawals for K–12 expenses may not be exempt from state tax in certain states.

Key benefits

- Simplified diversification

- Actively monitored

- Time-tested American Funds investments

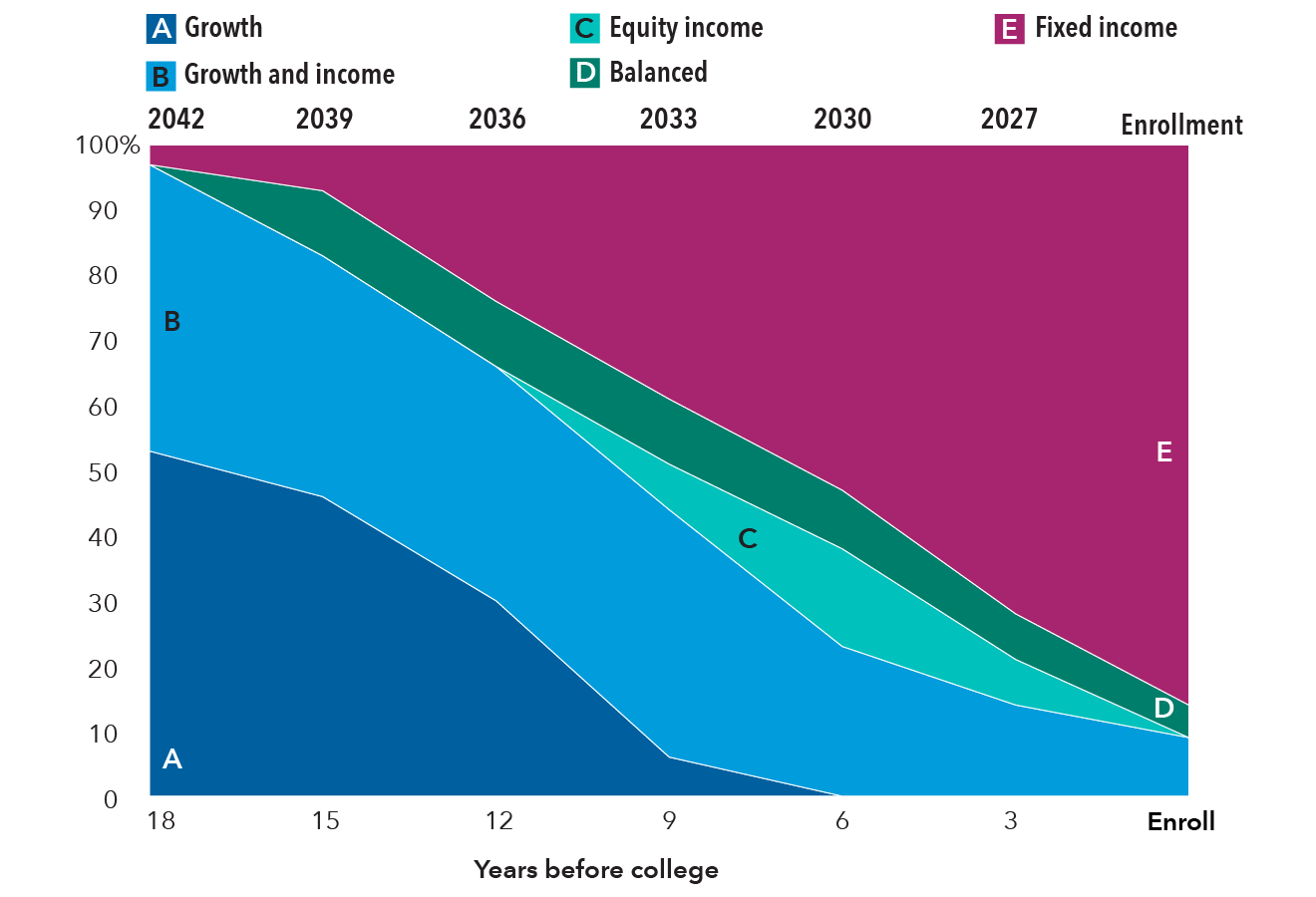

American Funds College Target Date Series glide path

The target allocations shown are as of June 18, 2025, and are subject to the oversight committee's discretion. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus. Underlying funds may be added or removed during the year. Visit capitalgroup.com for current allocations.

Other CollegeAmerica investment options

The American Funds available in CollegeAmerica can be combined for those seeking a customized and diversified portfolio.

American Funds Portfolio Series

These funds of funds were designed to pursue common investor objectives such as growth, growth and income, income and preservation.

Related resources

American Funds College Target Date Series

Learn more about the glide path, features and benefits.

American Funds College Target Date Series fund information matrix (PDF)

A financial professional reference for the College Target Date Series Funds.

Building your practice

For many financial professionals, college savings represents an untapped opportunity to meet new prospects and establish long-term relationships. Here are a few of the practice-building strategies featured in our suite of CollegeAmerica finanical professional resources.

The majority of parents would like their child to pursue college.¶

College savings and estate planning

Grandparents often contribute to college savings and may not be aware of the estate-planning benefits that a 529 college savings plan offers.

They can contribute up to $19,000 ($38,000 for married couples) a year per beneficiary without gift-tax consequences. Or they may want to take advantage of a special gift-tax election that allows them to combine five years' worth of contributions into one investment of up to $95,000 ($190,000 for married couples) per beneficiary without gift-tax consequences.

No additional gifts can be made to that beneficiary over the next four years after the year in which the one-time gift is made. If the donor of an accelerated gift dies within the five year period, a portion of the transferred amount will be included in the donor's estate for tax purposes. Consult with a tax advisor regarding your specific situation.

Connecting businesses with CollegeAmerica

For employers, 529 plans are a great, no-cost way to reward employees. For financial professionals they offer a foot in the door to build long-term relationships with businesses.

88% of investors say that they would likely open a 529 plan if one were offered at work.**

Related resources

FOR INVESTORS

CollegeAmerica — Combining estate planning and college savings (PDF)

How 529 plans can help with college and estates (Video)

FOR EMPLOYERS

CollegeAmerica — A win-win for businesses and employees (PDF)

College savings tools and resources

Our comprehensive suite of college savings resources includes practice-building ideas and how-tos to help you with every aspect of your 529 business — from prospecting to enrollment.

Planning tools

College Savings Calculator — Determine how much clients need to save to attend a specific college, and see if their plans are on track.

How-to guides

Step-by-step instructions on college planning topics such as client servicing and business development can help you service clients and grow your business.

Forms & literature

Find college savings forms, applications, client education, sales materials and more in our Forms & Literature section.

Related resources

CollegeAmerica: Unlock a world of possibilities presentation (PPT)

Educate investors about the benefits of 529 college savings plans and CollegeAmerica.

Footnotes/Important information:

* Largest by assets, according to the 529 Quarterly Data Update, Third Quarter 2025 from ISS Market Intelligence.

† As of September 30, 2025, CollegeAmerica’s assets under management (AUM) were $107.0 billion.

‡As of December 31, 2024.

§ Morningstar, "Morningstar 529 Ratings: The Best Plans of 2025," November 10, 2025. Morningstar ratings are based on the following criteria: process, people, parent and price.

|| 529 College Savings Quarterly Fee Analysis, Third Quarter 2025 from ISS Market Intelligence. CollegeAmerica’s fees were in the lowest fee tertile of the 31 national advisor-sold 529 plans and in the lowest fee quartile of the 28 national fee-based, advisor-sold 529 plans, based on the average annual asset-based fees that included CollegeAmerica's Class 529-A and 529-F-3 shares, respectively.

¶ Most Parents Prefer College Pathway for Their Child," gallup.com, August 6, 2025. Based on a web survey conducted June 2–15, 2025, by Lumina Foundation-Gallup.

** 529 Industry Analysis (2025 edition), ISS Market Intelligence.