Marketing & Client Acquisition

Portfolio Construction

From July 1 to September 30, 2023, Capital Group’s Portfolio Consulting and Analytics team analyzed 193 registered investment advisor (RIA) portfolios as part of its Portfolio Analysis Review service. The overall goal of these reviews is to help advisors gain a better understanding of how their portfolio exposure compares to their stated goals and objectives and to provide deeper insight on portfolio risk and positioning in the current environment. The team’s recent portfolio analyses highlight interesting data on dividend exposure in equity portfolios and duration in fixed income portfolios.

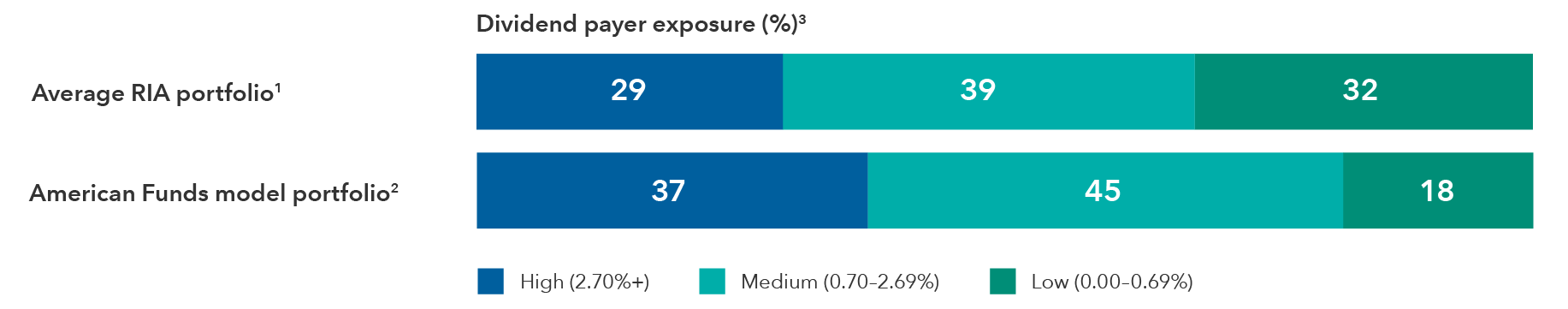

- The equity sleeve of the average RIA portfolio remains underweight dividends when compared to an American Funds model portfolio with a similar asset allocation.

- Exposure to dividends matters today, especially given current valuations and heavy equity market concentration in growth and tech stocks.

- The fixed income sleeve of the average RIA portfolio is short duration, yet the expected end of Fed rate hikes makes it a good time to consider increasing duration through core and core-plus fixed income vehicles.

- Inflation uncertainty has kept stock/bond correlations relatively high, highlighting the need for other ways of assessing how well advisors’ fixed income exposures are diversifying equity positioning.

From July 1 to September 30, 2023, Capital Group’s Portfolio Consulting and Analytics team analyzed 193 RIA portfolios as part of its Portfolio Analysis Review service. The overall goal of these reviews is to help advisors gain a better understanding of how their portfolio exposure compares to their stated goals and objectives and to provide deeper insight on portfolio risk and positioning in the current environment. The team’s recent portfolio analyses highlight interesting data on dividend exposure in equity portfolios and duration in fixed income portfolios.

During our conversations with advisors, Capital Group’s portfolio specialists often hear about the leading operational challenges to running a successful practice, including the critical, but often time-consuming, nature of the investment process. Given the uncertainties around factor timing, inflation and terminal interest rates in the current environment, we believe advisors could be well-served by considering flexible allocation portfolios that entrust more decisions to an active manager.

Dividends matter today

The average RIA has a relatively high allocation to low- or no-dividend payers — which contributes to higher overall portfolio volatility. If advisors are interested in de-risking equity exposures and seeking to improve the quality of their portfolios, more dividend exposure may help.

Exposure to dividends matters today, especially given current valuations and heavy equity market concentration. We favor higher quality dividend payers (as measured by the debt rating of that company’s bonds) over those with the highest yields. Such characteristics may provide better downside protection during equity drawdowns. Look for dividend-focused equity strategies that take a rigorous approach to company selection and support overall portfolio goals.

RIA portfolios have limited exposure to high-dividend payers

Sources: Capital Group, FactSet, and Morningstar. As of September 30, 2023.

Time to re-think duration?

Given expectations for eventual interest rate cuts after an aggressive period of monetary tightening, some investors are starting to shift out of short-maturity bonds into intermediate core and core-plus bonds. However, many advisors may not have enough core bond exposure and have been hesitant to extend duration, as shown in the table below.

Advisor portfolios are short duration

Portfolio |

BBB and below4 |

Effective duration |

|

|---|---|---|---|

Average RIA portfolio1 |

32% |

4.42 years |

|

American Funds model portfolio2 |

28% |

6.28 years |

Sources: Capital Group, FactSet, and Morningstar. Data as of September 30, 2023.

Cash and cash-like investments historically have decayed rapidly when Fed hikes end, while core, core-plus and municipal bond returns have typically outpaced cash-like investments in such periods. The rapid upward movement of yields over the last year makes it a good time to consider increasing duration through core fixed income vehicles. Core and core-plus approaches can provide flexibility through changing bond environments. These strategies are active approaches that can take advantage of longer duration opportunities while also improving credit quality.

Be mindful of fixed income diversification

Ongoing inflation uncertainty has kept stock/bond correlations high, and advisor portfolio correlations remain elevated in 2023. Higher correlations make equity risk mitigation more challenging. Stock/bond correlations are likely to come down as inflation uncertainty wanes, but in the interim advisors may want to assess how well their fixed income exposures are diversifying equity positioning.

Capital Group’s Portfolio Analysis Review service can examine rolling correlations, excess return correlations, scenario analysis and sector decomposition to gauge effective diversification of your portfolio and inform any potential changes to your fixed income exposures.

Stock/bond correlations remain high

Portfolio |

Correlation5 |

|

Average RIA portfolio1 |

0.54 |

|

American Funds model portfolio2 |

0.44 |

Sources: Capital Group, FactSet, and Morningstar. As of September 30, 2023.

Examine your clients’ portfolios to help improve efficiency and avoid common pitfalls

If you are an advisor seeking a detailed review of your clients’ portfolios, Capital Group can help. Request a personal consultation from one of our portfolio specialists to help benchmark your clients’ portfolios, address your clients’ specific investment needs and goals, and consider flexible portfolio solutions.

1 The average advisor portfolio is representative of the aggregate exposures of advisor portfolios analyzed by Capital Group’s Portfolio Consulting and Analytics team from July 1, 2023, to September 30, 2023.

2 American Funds model portfolio represents the most recent available data as of September 30, 2023. This model aligns closely to the broad asset allocation of the average RIA portfolio.

3 For American Funds, securities in the Unrated category have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with applicable investment policies.

4 Average 5-year correlation of the fixed income sleeve to the S&P 500.

To read the full article, become an RIA Insider. You'll also gain complimentary access to news, insights, tools and more.

Already an Insider?