Long-Term Investing

Goals-Based Investing

- Targeting four measures of investment returns — lower risk, higher alpha, lower down-capture and higher long-horizon return – may result in better client outcomes than optimizing for volatility alone

- Risk and volatility are not the same thing, although the two concepts are often used interchangeably

- Asset allocation plans should go beyond simply tracking benchmarks, taking into consideration investment objectives such as appreciation, income or preservation that align to client goals

At some point during most initial meetings between a client and an advisor, a risk-tolerance questionnaire often comes out of the desk drawer. A typical document poses dozens of questions about how clients might react in various situations, all with the goal of trying to figure out how much market risk one can stomach.

The questionnaire’s appeal is understandable since it’s so functional and seemingly precise. By looking over a client’s answers, you can get a good general idea of when distributions will be needed and also how much volatility the client might be able to handle before making irrational decisions that could impact the overall asset allocation. Matching these answers with an algorithm helps inform the advisor how much risk, or standard deviation, the client can handle. With this information in hand, you can craft a portfolio that aims to maximize return based on the risk your client is willing to tolerate.

There’s just one problem. This approach ignores one of the most important factors of a successful portfolio outcome over time: the client’s actual goals. Standard deviation measures the volatility of the stock market, but that’s not what clients are really concerned with. Clients have real-life goals – such as paying for college or saving for retirement. Clients don’t necessarily mind which path they take to reach their goals, but they do care about meeting them. “Risk” really is then defined as being able to meet his or her goals.

And that’s where the current thinking on portfolio construction and design might be lacking. Our research suggests an alternative way for building portfolios that focuses on meeting a client’s individual goals, as opposed to just matching portfolios based on statistical measures of volatility. This work was outlined in the article, “Which Fund Attributes Matter for Goals-Based Investors,” published in the January/February issue of Investments & Wealth Monitor from Investment Management Consultants Assocation (IMCA).

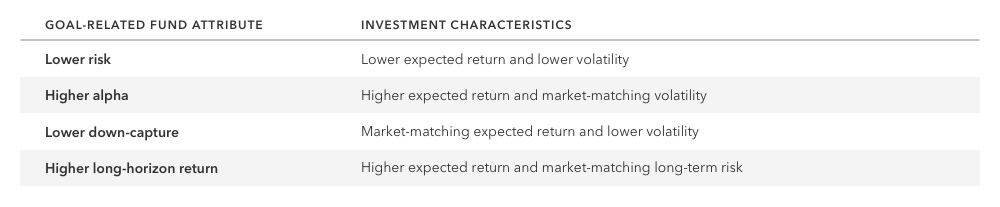

Specifically, our research examines the need for advisors to choose investments with attributes that address specific client goals, with resulting predictable outcomes:

We benchmarked hypothetical portfolios targeting each of these goal-related fund attributes against a base case of a market-capitalization weighted, passive equity index.

Specifically, the:

- “Lower risk” goal looked at a conservative investment approach with 20% lower exposure to equity in favor of cash.

- “Higher alpha” objective modeled an approach where skilled portfolio managers successfully selected companies with a 1% higher expected return compared with the passive fund returns.

- “Lower down-capture” goal simulated managers who limited downside to 20% of market declines while capturing 85% of the upside.

- “Higher long-horizon return” objective simulated the performance of managers able to select companies with strong growth in earnings and revenues. This portfolio was 20% more sensitive to market moves and had 20% higher short-term volatility, but long-term volatility was only modestly higher than the market and the return is 1 percent higher.

In each case we measured outcomes for three very different types of investors: A young worker saving for retirement, an older worker with a shorter time horizon, and a retiree seeking consistent withdrawals.

The analysis found all four goals-based attributes resulted in less downside wealth over the base case, while three of the four goals-based attributes, namely “higher long-horizon,” “higher alpha” and “lower down-capture,” resulted in greater expected wealth. Importantly, the attributes that mattered most depended on the specific investor goal. The “higher long-horizon returns” portfolio produced the greatest benefit for the young worker, while the retiree benefited most from “lower down-capture” portfolio.

These findings have profound implications for advisors, as they suggest that clients may benefit more from investments that target goals, as opposed to strictly adhering to asset class benchmarks.

To see our full research on how risk is not the same as volatility, download the entire paper here.

Which Fund Attributes Matter for Goals-Based Investors.

RELATED INSIGHTS

-

-

Market Volatility

-

Artificial Intelligence

Use of this website is intended for U.S. residents only.

Sunder Ramkumar

Sunder Ramkumar