Marketing & Client Acquisition

Portfolio Construction

From July 1 to September 30, 2021, Capital Group’s portfolio consulting team analyzed the portfolios of 122 RIAs across the United States. This service, known as a Portfolio Analysis Review (PAR), helps advisors evaluate their portfolios and identify risks and potential enhancements. It’s a rigorous analysis built on principles of objective-based investing, global diversification and the various roles of fixed income in a portfolio.

Through our analyses, we discovered that RIAs’ portfolio construction often doesn’t align with their stated objectives. For example, while many advisors say that the primary goal of their fixed income portfolios is diversification from equity risk, we found that their fixed income portfolios often exhibit a high degree of correlation to equity index returns.

This is just one of several eye-opening findings we have gleaned from our regular reviews of RIAs’ portfolios. By recognizing these common mistakes and taking a fresh look at their portfolio construction process, RIAs can improve their ability to meet clients’ objectives.

- Fixed income: RIAs focused on equity diversification often instead create highly correlated, income-focused portfolios.

- Growth versus value: Growth continues to dominate — even for distribution-focused portfolios.

- International equities: RIAs could benefit from a more nuanced approach to achieving geographic diversification.

From July 1 to September 30, 2021, Capital Group’s portfolio consulting team analyzed the portfolios of 122 RIAs across the United States. This service, known as a Portfolio Analysis Review (PAR), helps advisors evaluate their portfolios and identify risks and potential enhancements. It’s a rigorous analysis built on principles of objective-based investing, global diversification and the various roles of fixed income in a portfolio.

Through our analyses, we discovered that RIAs’ portfolio construction often doesn’t align with their stated objectives. For example, while many advisors say that the primary goal of their fixed income portfolios is diversification from equity risk, we found that their fixed income portfolios often exhibit a high degree of correlation to equity index returns.

This is just one of several eye-opening findings we have gleaned from our regular reviews of RIAs’ portfolios. By recognizing these common mistakes and taking a fresh look at their portfolio construction process, RIAs can improve their ability to meet clients’ objectives.

Fixed income: Diversification-focused RIAs often create highly correlated, income-focused portfolios

Although the vast majority of advisors state that equity risk diversification is the top objective for their fixed income portfolios, our analyses show that the average advisor’s fixed income allocation instead tends to be more focused on generating income. Failing to recognize this bias can lead advisors to take excessive risk in fixed income, which can be particularly painful when equity markets sell off or liquidity dries up as it did in early 2020.

There are several reasons why advisors may overlook that their fixed income allocations are heavily income focused. The sustained bull-market environment has caused many advisors’ portfolios to be overweight credit and lower quality fixed income. While this strategy has been successful for several years, it can quickly face challenges when risk increases. In fact, more than one-fifth of fixed income sleeves we analyzed had a correlation with equities greater than 60%; this is clearly too high a level if diversification from equity risk is the primary objective.

One way to counteract this blind spot is to look beyond credit ratings and use correlation and scenario analysis when examining a fixed income portfolio. In addition, research into the liquidity, sectors and credit quality of a portfolio can add value. These tools, which are core parts of Capital Group’s PAR service, can help advisors build fixed income portfolios that are better equipped to deliver on their clients’ objectives.

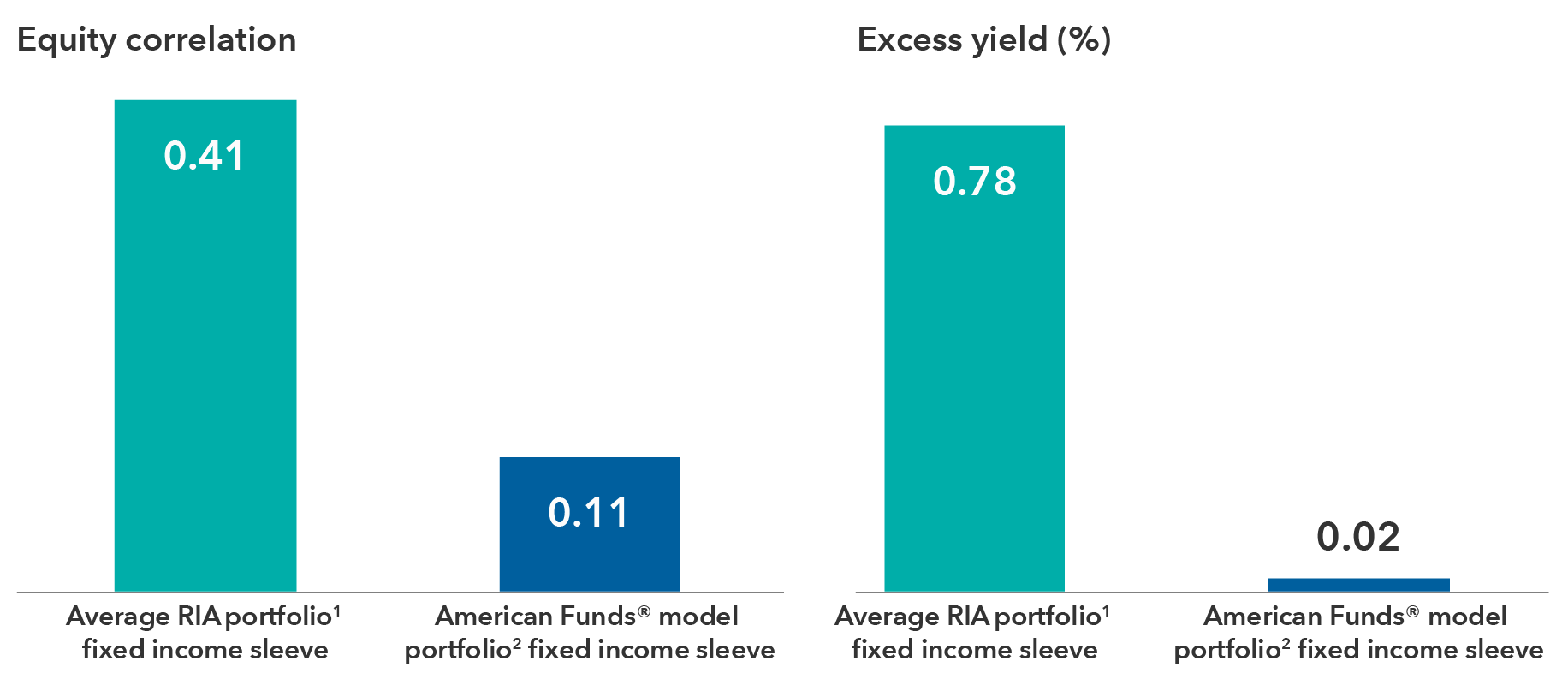

PAR analyses often show misalignment in fixed income portfolios

Our analyses of advisors’ fixed income portfolios show that portfolios with a stated goal of equity risk diversification are often highly correlated with equity index returns and/or focused on income. The charts below show the average RIA fixed income sleeve from the 122 RIA portfolios reviewed by Capital Group from July 1 to September 30, 2021.

Source: Capital Group. Data as of September 30, 2021. Equity correlation represents three-year equity correlation to the S&P 500 Index. Excess yield represents 12-month yield of the fixed income sleeve minus the 12-month yield of an ETF vehicle that tracks the Bloomberg Aggregate Index and is net of fees.

Growth versus value: Growth has dominated — even for distribution-focused portfolios

Advisors’ portfolios generally were heavily tilted toward growth stocks in 2020 and early 2021. The pendulum shifted toward value in March 2021, but by July growth had again taken the lead. Even distribution-focused portfolios have shown a growth orientation; often the only significant difference between distribution portfolios and growth-of-capital portfolios is a slightly larger fixed income sleeve in distribution portfolios. With equity markets trading near historic highs from a price-to-earnings perspective, our analyses show that a P/E contractionary event would pose significant risk to many advisors’ portfolios and could be devastating for distribution portfolios in particular.

We encourage advisors to look beyond P/E ratios and stated dividend yields when analyzing value investments. For example, beta analysis can help determine how closely correlated value exposure has been to equities more broadly. This type of analysis can help advisors focus their value portfolios on high-quality companies with sustainable dividends, which should be better positioned to sustain a potential P/E contractionary event.

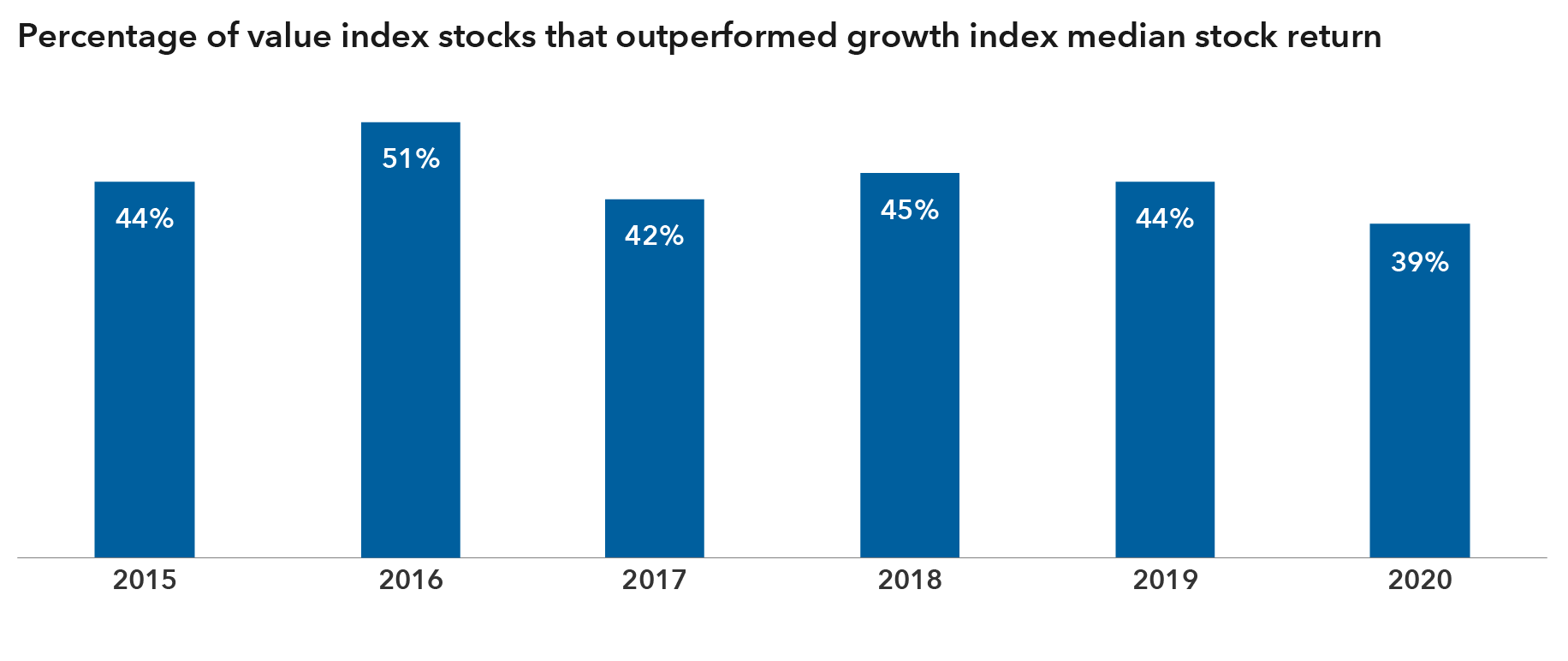

Value indexes may be “growthier” than you might expect

A value label doesn’t necessarily mean that advisors will gain the quality, non-growth exposure they seek. The chart below shows the percentage of stocks in the value index whose return exceeds the growth index median stock return for the year.

Source: MSCI World style indices. Data as of December 31, 2020.

International equities: Achieving geographic diversification requires a nuanced approach

The average equity portfolio evaluated by Capital Group allocates nearly three-quarters of portfolio capital to U.S. equities and just over one-quarter to non-U.S. equities. Advisors are particularly underweight international small- and mid-cap companies. This isn’t surprising because U.S. equities have recently outpaced international equities by a wide margin. In fact, we have recently neared all-time highs for U.S. outperformance relative to non-U.S. peers.

But there are reasons to believe that this trend may reverse in the near future. From a purely P/E perspective, international equities appear attractive relative to U.S. equities today. In addition, U.S. equities have been supported by a strong dollar environment during the past several years, and it is possible that we are moving into a devaluation period for the dollar. A weaker dollar environment would provide tailwinds for non-U.S. equities in the near term.

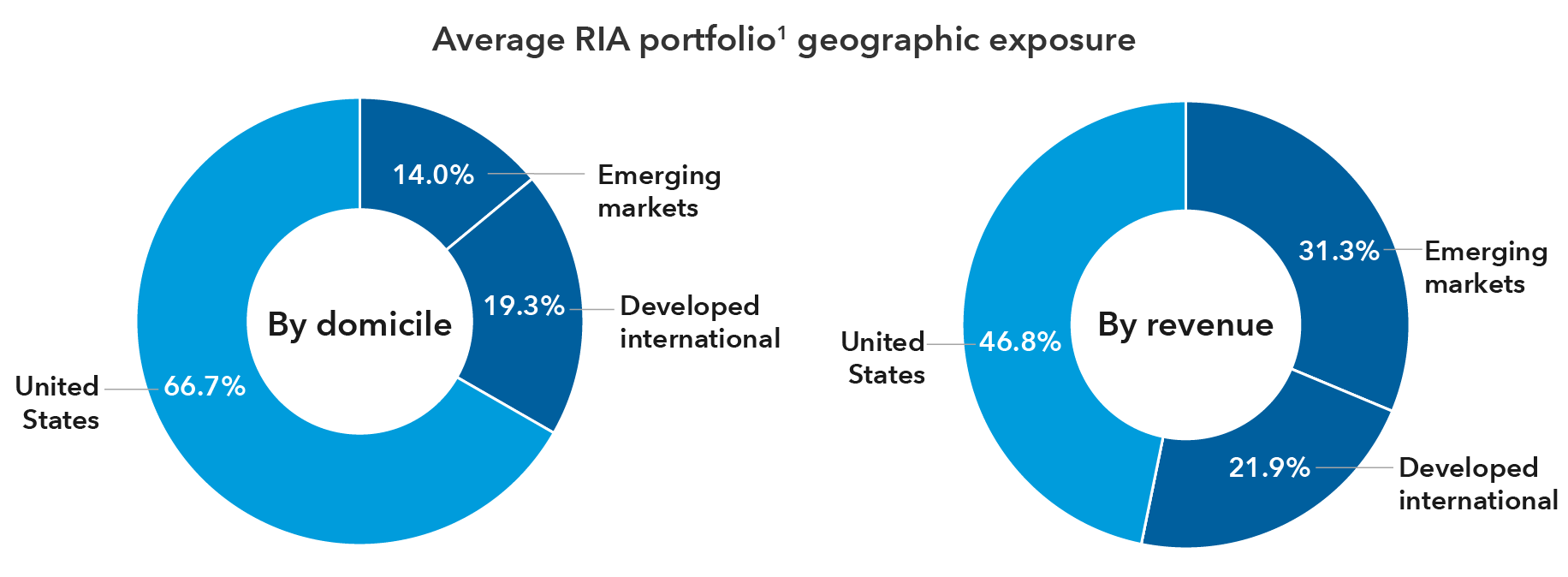

Before advisors increase exposure to international equities, it can be valuable to start with a more nuanced view of their current geographic diversification. Looking just at a company’s domicile can make it difficult to build the geographic diversification advisors seek with an appropriate level of precision. Analyzing the portfolio’s revenue generation by country, however, is a much more telling measure of how a portfolio’s exposure to business risk is spread across borders and provides a better foundation for making changes.

International exposure by company domicile versus company revenue

When analyzing international exposure through Capital Group’s PAR service, advisors are often surprised to discover that diversification by revenue is often widely different than diversification by domicile. Taking a more nuanced view of geographic diversification can enable advisors to more precisely achieve the diversification they seek. The charts below represent the average exposure among the 122 RIA portfolios reviewed by Capital Group from July 1 to September 30, 2021.

Source: Capital Group. Data as of September 30, 2021.

Examine your portfolios to avoid common pitfalls

Let us help you evaluate whether your portfolios are exhibiting the kinds of misalignment we frequently see, and find out how your portfolios stack up relative to those of other advisors.

If you are a financial professional interested in getting a portfolio checkup, Capital Group can help. Request a personal consultation with one of our portfolio specialists to help you address specific investment needs and goals surrounding your client portfolios.

Allocations may not achieve investment objectives. The portfolios' risks are directly related to the risks of the underlying funds.

MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results of developed markets. The index consists of more than 20 developed market country indexes, including the United States.

Bloomberg Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

To read the full article, become an RIA Insider. You'll also gain complimentary access to news, insights, tools and more.

Already an Insider?

Casey Dregits

Casey Dregits

Royce Woodley

Royce Woodley