Over 90 years of equity investment experience

Capital Group is founded in Los Angeles

Began investing outside North America

The Capital System is established

Developed what became the MSCI indices1

Launched world’s first EM equity fund

Launched pooled funds in Europe and Asia

1. MSCI indices are now maintained by MSCI, Inc

Today

We’re one of the world’s largest investment managers

INSIGHTS

Fresh perspectives from our investment team

Actionable ideas

Navigate markets with our range of equity portfolios

A core, global equity solution

An unconstrained approach to global investing focusing on high quality multinational companies

Focused on growth and innovative companies

A solution that seeks to invest in companies that are ground-breaking and forward-thinking

Capture the growth potential of developing economies

A revenue-centric approach to capturing the growth potential of developing economies

We're here with the support and solutions you need.

Risk factors you should consider before investing:

- This material is not intended to provide investment advice or be considered a personal recommendation.

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- Past results are not a guarantee of future results.

- If the currency in which you invest strengthens against the currency in which the underlying investments of the fund are made, the value of your investment will decrease. Currency hedging seeks to limit this, but there is no guarantee that hedging will be totally successful.

- Some portfolios may invest in financial derivative instruments for investment purposes, hedging and/or efficient portfolio management.

- Depending on the strategy, risks may be associated with investing in fixed income, derivatives, emerging markets and/or high-yield securities; emerging markets are volatile and may suffer from liquidity problems.

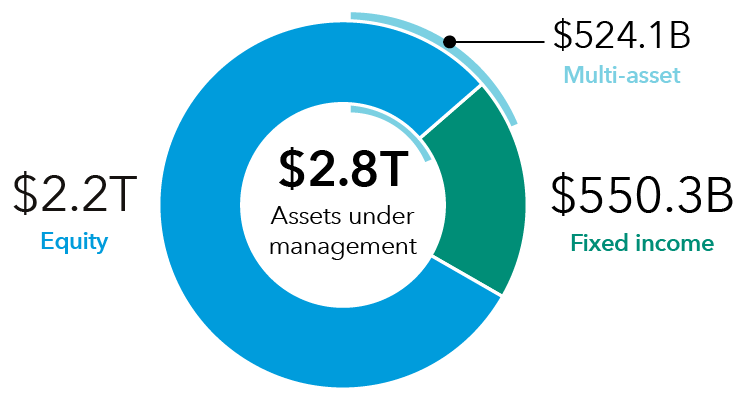

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organisation; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups. Assets under management totals may not reconcile due to rounding. Fixed income assets managed by Capital Fixed Income Investors