Defined Contribution

Participant Engagement

Every company — and every retirement plan — is unique, but there are always lessons to be found in others. To that end, Capital Group partnered with a major employer in the health care industry to uncover ways retirement plan sponsors can effectively communicate to employees. Our focus was to help workers understand and participate in their employer’s plan.

While some findings were unique to this particular organization, several learnings broadly apply to retirement plans and employers of any plan size. These learnings may serve as a blueprint for plan sponsors to better communicate, engage and motivate their employees to save for retirement.

Company at a glance

First, a little about the company and plan:

- Industry: Health care

- Total plan assets: $2.3 billion

- Employees: 32,000

- Plan size: 27,700 eligible participants

- Plan participant rate: 83%

- Average contribution rate (for those contributing): 8.52%

Study details

In 2019, Capital Group partnered with a large health care provider to help understand employees’ retirement savings behavior. The study involved more than 20 employee interviews and data analysis. Particular attention was given to the employer’s priority demographic groups, such as lower income earners (earning less than $55,000/year), over-55-year-olds and certain job roles, such as nurses. Based on insights from that work, we segmented employees into three groups:

- Avoiders, who had little knowledge of retirement issues and had not taken any action to increase or decrease their retirement savings rate.

- Late bloomers, who were pre-retirees and needed to catch up or sought further guidance.

- Motivated millennials and Gen X, who were more informed and wanted to learn more advanced savings topics. These employees had increased their savings on the margins, but not enough to be prepared for retirement.

Next, we came up with tailored messages for each group, addressing specific barriers to retirement savings. We found that customizing messages helped ensure that employees get relevant and relatable content.

What types of savers are in your plan?

In partnership with a major health care firm, we segmented participants into three behavioral types. We used participant data and insights from interviews to target communications based on each type‘s interests and needs.

Source: Capital Group.

Of course, these personas may not apply to every employer. Plan sponsors should consider doing their own interviews and data analysis to see how to best segment their participants. However, based on our work with this company, there are three key lessons that we believe broadly apply to DC plans.

1. Meet participants where they are

Employees’ time and attention are pulled in many directions. Finding the right moment to communicate with employees can be a complex task.

At this organization, many employees were nurses, whose jobs were not tied to smartphone or computer screens. Often, they would review emails just before their shifts, at lunch and in the evening. Communication that was not directly tied to their jobs or patient care, such as information about retirement plans, was mostly deleted or ignored. In addition, many employees did not use their employer-provided email accounts. In order to be noticed, emails needed to be directed to personal accounts.

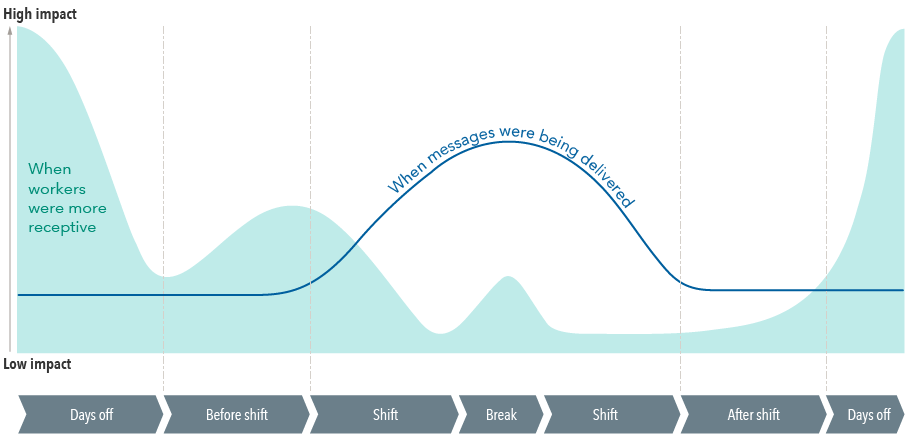

Reach employees at the right times

The health care firm discovered that its messages weren‘t being delivered at the ideal times. Most messages were being sent during working hours, even though research showed workers were more receptive during off-hours.

Source: Capital Group.

Here are some ideas on how sponsors can meet employees where they are:

- Communicate at the right times. Find out when your employees are most receptive to messaging. For some companies, this may be pre-shift. For others, it may be mid-afternoon or on the weekend. The key is to deliver messages that can be easily accessed from anywhere during times when employees are in the right mindset. Keep in mind too that your goal is to capture employees’ attention and provide consistent nudging to help them act.

- Tailor messaging. Consider employees’ specific needs and key priorities, perhaps with the help of employee interviews or data analysis. Needs may differ based on demographics or the types of jobs. For example, sponsors can customize communications according to age group, explaining the merits of investing in age-appropriate target date funds or participating in an investment re-enrollment.

- Use different channels. Targeted content can be delivered via email nudging, smartphone messages, physical and digital signage or multimedia campaigns (videos or podcasts).

- Reduce complexity. Make it seamless for employees and bring all the information together in one place. As much as possible, make messages short and action items easy to complete in a few minutes, as the employees’ attention may be limited. It may be helpful for plan sponsors to provide one online destination point to access retirement information. Content should be simply and concisely worded. It should also provide convenient links to other resources such as wellness providers, educational resources and other employee benefits. Avoid requiring passwords when appropriate/possible to help ensure employees are not overwhelmed by a complex landscape of logins and portals.

2. Cut through barriers

We found that resistance to retirement planning often had less to do with logistics and more to do with emotions. For example, many people expressed shame around their lack of knowledge or savings, or feared that they’re too far behind in savings to catch up. They also felt overwhelmed by competing needs, which included everyday expenses, debt and family demands.

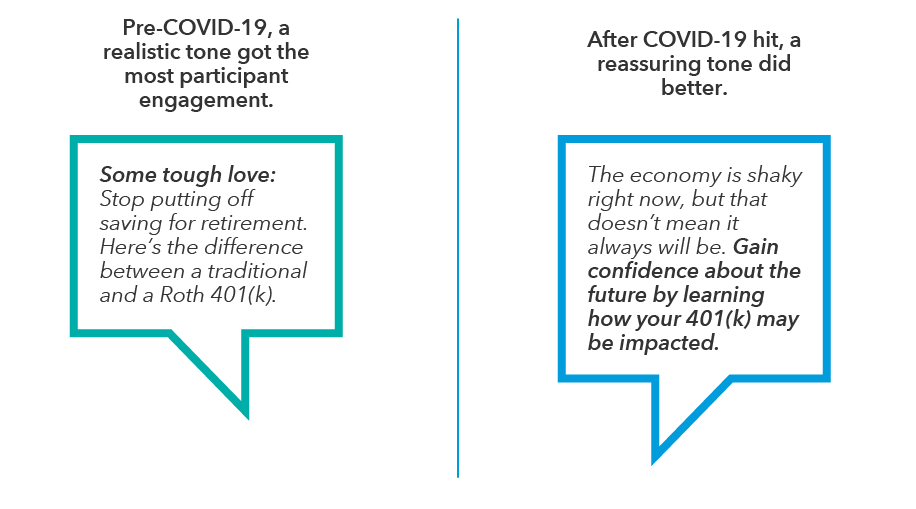

Communication that ignored these factors alienated employees. We had much better luck with messaging that sought to speak to emotional realities, taking care not to exacerbate shame or fear. This included plain language — what we call “kitchen-table English” — and a reassuring, helpful tone. That said, we believe messaging tone is key to illustrate empathy. To prove this point, we tested participant messages using different tones to match employees’ moods. Specifically, we tested different tones of messages before and after the COVID-19 pandemic hit and found very different results.

Match the tone to the employee mood

Source: Capital Group, based on studies conducted in February 2020 and April 2020.

Here are some recommendations on how sponsors can cut through barriers:

- Address emotional obstacles. Understand your employees’ emotional roadblocks so you can help the employee move past them.

- Speak plainly and empathetically. Use friendly, welcoming language that is easy to understand and would resonate well with employees.

- Lay out options. Content that details specific options available and the pros/cons of each performed well at this organization. This can help employees quickly evaluate tradeoffs in a clear format.

3. Establish trust

Unfortunately, many employees’ trust in financial services and even in their employer is low. This is a trend recorded across industries and institutions, with trust waning as a sense of inequity and unfairness rises. As the voice of an institution, it can be challenging to convince these individuals you’re on their side. This is a significant hurdle to overcome in helping employees seek better retirement outcomes.

To increase trust, you might want to look to sources employees do trust. You’ll also be more likely to earn trust with authentic communication that tonally matches the subject matter than with overly formal or disingenuous messaging.

Here are some recommendations on how sponsors can establish trust:

- Enlist allies. Employees have strong connections with colleagues who are part of their “circle of trust.” We found that people place a great deal of weight on advice from trusted peers, including on financial matters. It may be good to seek the help of influencers who speak the employees’ language to reach them on an emotional level. Consider recruiting these influencers as ambassadors to help other employees understand the retirement plan and how small decisions now can make significant long-term impact.

- Match the mood. Adjust the tone of the communications in response to internal and external events. For example, a sunny tone may be appropriate for discussing the employer match, but it may be more appropriate to take a somber and reassuring approach to addressing market volatility.

Above all – listen

Our biggest learning from this study was that employees all differ in needs, preferences and priorities. A plan sponsor should listen to employees to find out what matters to them. We believe messages that aren’t accessible and relevant to an individual in the moment they receive it will not be effective – even if the content is helpful or important to their long-term goals. As stewards of retirement savings, plan sponsors can empower individuals. They can do this by meeting employees where they are, cutting through barriers and showing trustworthiness.

Our latest insights

-

-

Investment Menu

-

-

-

Retirement Income

RELATED INSIGHTS

-

Liability-Driven Investing

-

Defined Benefit

-

Regulation & Legislation

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Vidhi Sanders

Vidhi Sanders