RESOURCES / PARTICIPANT EDUCATION

Use Health Savings Accounts (HSAs) to help enhance retirement security

8-minute read

THE TAKEAWAY

Position HSAs as a complement to a DC plan

Overview

Ryan Tiernan

Senior National Accounts Manager

More than a health benefit, Health Savings Accounts (HSAs) can help improve retirement outcomes

Although HSAs were originally introduced as a cost-saving measure, many employers are realizing that these accounts can work effectively with a defined contribution (DC) plan to promote better retirement outcomes. Ideas from DC menu planning can apply to HSA menu arrangements. Similarly, factors that influence HSA investment decisions – such as career stage and risk tolerance – follow well-established patterns used in DC planning. With support and guidance from plan sponsors and financial professionals, savers can learn to view HSAs as not simply a health care benefit, but a critical pillar of retirement security.

The problem

Rising health care costs threaten retirement readiness

A potential solution

HSAs offer triple-tax free status, penalty-free withdrawals for qualified expenses. Moreover, assets can be invested to help build savings for health care expenses

Impact

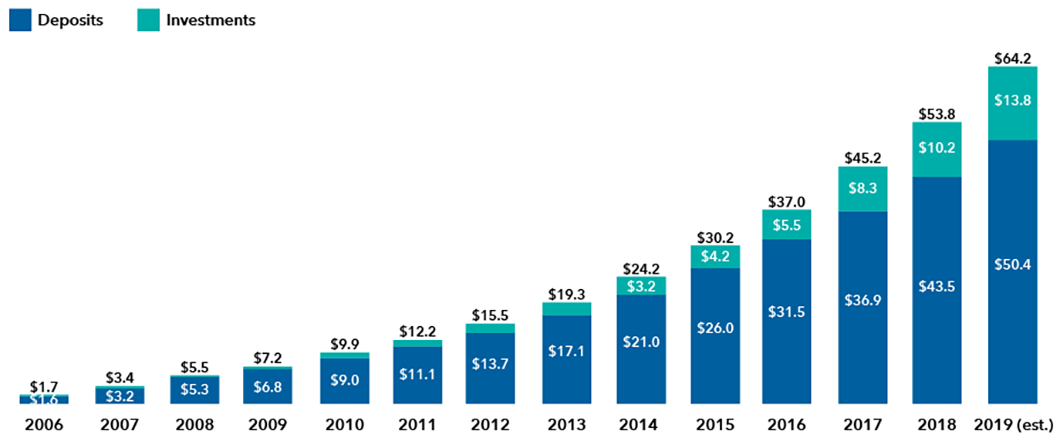

HSA assets are growing

As of August 2019, there were 26 million HSAs holding $61.7 billion in assets, a year-over-year increase of 12% for accounts and 20% for assets. Over one million of those accounts are investing a portion of their assets.

Source: Devenir Research, August 2019.

Tips for success

Create an HSA investment menu

Consider target date series or mirroring the options offered in the 401(k) menu. Offer a mix of options to address varied financial situations and risk.

Consider an age-based framework

Factors from DC menu planning such as career stage, goals, financial situation and risk tolerance also influence HSA decisions.

Encourage a holistic approach to saving

Help savers understand and access the full range of benefits and investment solutions.

Differentiate

Distinguish HSAs from “use it or lose it” flexible spending accounts. Explain tax differences between HSAs and DC plans.

Highlight costs

Help savers understand the costs of medical care in retirement and how HSAs can be used to address them.

Help optimize

Outline ways participants can distribute contributions among HSAs, DC plans and other benefits to best meet their needs.

Participant education is key to success

Adapt our educational materials to create custom communications for your participants.

Explore more participant education resources

-

Participant Education

Balancing risk and reward

-

Participant Education

Help for participants nearing retirement

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only.

American Funds Distributors, Inc.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.