Municipal Bonds

Bonds

It’s the biggest shake-up in bond fund investing in years. Here’s what you need to know about Morningstar’s major category changes.

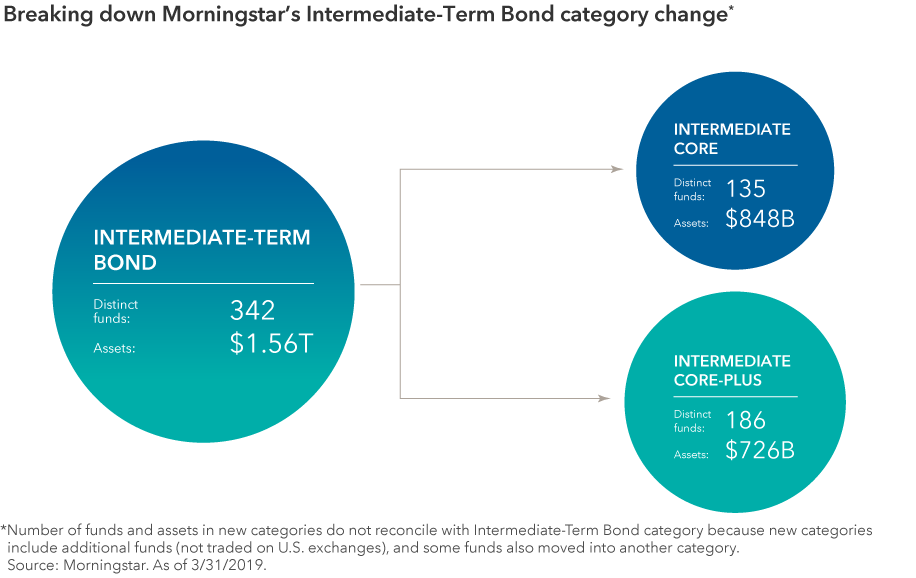

- Morningstar split the $1.6 trillion Intermediate-Term Bond category in half.

- The new categories are Intermediate Core and Intermediate Core-Plus.

- Funds with less than 5% in high yield will become part of the Intermediate Core category.

- Most other funds with more high yield exposure will move to Intermediate Core-Plus.

- We expect many investors could decide to reallocate assets from Core-Plus to Core.

The hunt for yield in a low-rate world has led to an uncomfortable truth: Many strategies regarded as core fixed income are not what they seem. It turns out we weren’t the only ones to take notice. To help investors more easily compare similar types of bond funds, Morningstar announced a major category shake-up.

We sat down with Capital Group fixed income investment director Luke Farrell to get his take on what’s happened and why it’s a big deal for advisors.

How did Morningstar change its $1.6 trillion Intermediate-Term Bond category?

Intermediate-Term Bond included more than 300 funds and was the largest bond category in terms of assets — roughly four times bigger than the next largest. This category was retired on April 30 and replaced with two new categories: Intermediate Core Bond and Intermediate Core-Plus Bond.

Before the split, almost all funds with a duration (a measure of sensitivity to prevailing interest rates) between three and seven years that held less than 35% in high-yield bonds were grouped into the huge Intermediate-Term Bond category.

However, the funds within this old category tended to fall into one of two very different camps. There were those that generally invested in U.S. investment-grade bonds and possibly held very modest exposure to high yield.

Then there were others that had strayed more into higher risk investments, and in larger concentrations, in an attempt to boost yield and total returns in a low interest rate market. These strategies offered the potential for higher returns, but had a materially different risk-return profile. Additionally, these strategies had a higher correlation with U.S. equities and had the potential for larger negative returns.

Morningstar recognized this “scope creep” or “style drift” within the category and saw the potential for investors to not recognize the inherent risk in these funds. They therefore divided the old Intermediate-Term Bond category in two.

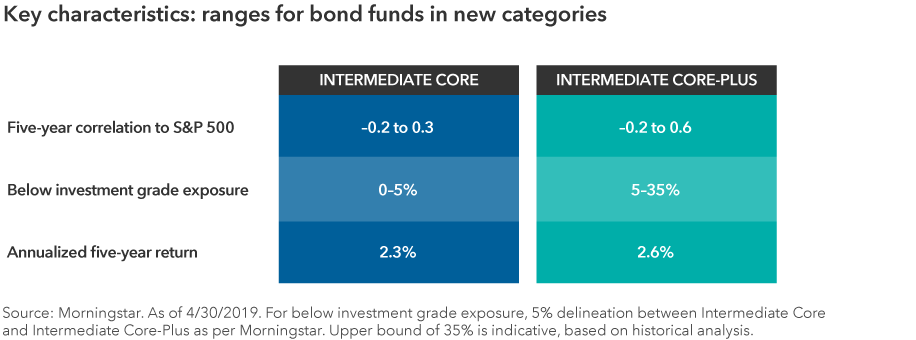

Going forward, fixed income funds averaging less than 5% of holdings rated below investment grade will be in the new Intermediate Core category. Most other funds — with between 5% and 35% of holdings rated below investment grade — now belong to the new Intermediate Core-Plus category.

This is great news for investors because now there’s a clear delineation between Core and Core-Plus, allowing for a clearer comparison of funds and their associated risks.

Why is it so important that Morningstar is splitting out core fixed income?

For the past decade, I’ve crisscrossed America meeting advisors and consultants. I’ve seen unintentional risks in fixed income portfolios become a frequent and routine problem.

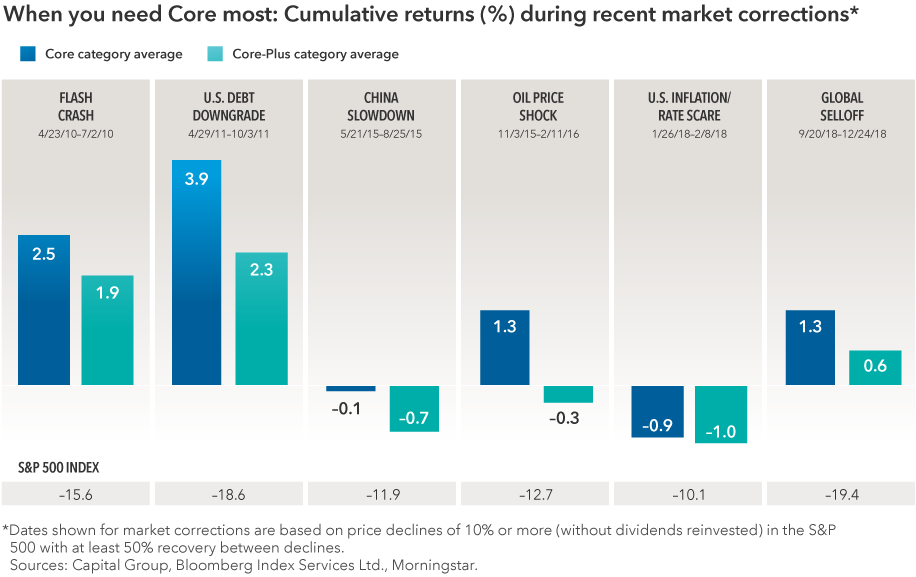

Providing stability when the stock market stumbles should be one of the key roles of fixed income. And yet, all too often, what an advisor thought was a core fixed income allocation was a fund or funds dominated by high yield, offering more volatile returns and less downside protection.

The old category had funds with major differences in holdings and approaches, which meant that funds could have dramatically different outcomes in certain market conditions. That was far from ideal for the many advisors who look to fixed income to help them create balance and stability in client portfolios.

The new categories will help advisors more easily distinguish between the risk profiles of different types of bond funds. This, in turn, should reduce confusion about the nature of bond allocations and empower advisors to make even more informed decisions.

What would you say to advisors who view this as little more than a label change?

I’d urge them to revisit why their clients own fixed income. A portfolio’s core fixed income allocation is meant to serve as ballast. Everyone knows the stock market can be volatile. Core bond funds should counterbalance that volatility and provide some stability and downside ballast.

Core-Plus has a place in portfolio construction. However, if your goal is a balanced risk portfolio, Core-Plus should never be the bulk of fixed income, but rather complement the core fixed income allocation.

Do you expect Morningstar’s decision to prompt big changes in fixed income allocations?

Newfound clarity on core could, in my view, spark a significant reallocation of fixed income assets over the next year.

Many advisors may now find themselves with a fund designated as Core-Plus by Morningstar — even though they intended it to serve as part of a core allocation focused on diversification and capital preservation. Similarly, the change could pose some tough questions for fiduciaries in the retirement space if a target date fund now has most of its fixed income exposure in Core-Plus, for instance.

Some popular high-profile funds that moved to the Core-Plus category have also seen their Morningstar rating slide. At a minimum, I think these developments alone will see many advisors weighing whether they remain comfortable with their fixed income choices over the coming months.

To begin to explore whether a fund could be a centerpiece for fixed income investments, I suggest two simple steps: determine its exposure to below investment-grade bonds and examine how tightly correlated a fund’s returns are to equity market returns.

If, for example, I encountered a portfolio where most of the fixed income allocation was to a fund with a high yield exposure of more than 5% and correlation above 0.3, that would give me pause.

Will the changes affect Capital’s approach — what about in models and fund-of-fund strategies?

No, if anything, it supports what we’ve said for years about the importance of having bond funds that behave like bond funds. The new categories align well with our view of fixed income within the broader context of multi-asset investing.

We have long believed that core fixed income should provide stability in a broader asset allocation. Our flagship core bond fund, The Bond Fund of America®, for example, is designed to meet this need.

We are also big believers in our approach to active management. Of course, any fund can lag its benchmark over certain periods. However, by design, passive strategies seek to track – not beat – their benchmarks. With The Bond Fund of America now the largest actively managed fund in Intermediate Core, I’m hopeful that more advisors will come around to our way of thinking.

Importantly, I absolutely believe that there is a role and a need for Core-Plus strategies. Analysis shows that a 75% Core/25% Core-Plus blend can be very “efficient” — offering the potential for a theoretically optimal trade-off of portfolio risk and return.

American Funds Strategic Bond FundSM should stand out in the new Intermediate Core-Plus category. This fund is a Core-Plus strategy, yet relies less on high yield and more on interest rate-driven strategies and other sectors as its source of potential returns. I think this approach, majoring in rate exposures and minoring in credit, will appeal to advisors looking for a balanced approach. Because of its design, the fund can offer investors the potential for lower correlation to equity markets and meaningful downside protection.

While Morningstar’s new categories won’t alter what we do at Capital, the change offers a timely opportunity for advisors and investors to take a step back and think about what they want from their fixed income.

Arguably, in today’s late-cycle environment, being well prepared for more unsettled markets should be front and center. That means getting your core fixed income right.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Investments in mortgage-related securities involve additional risks, such as prepayment risk, as more fully described in the prospectus. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds. American Funds Strategic Bond Fund may engage in frequent and active trading of its portfolio securities, which may involve correspondingly greater transaction costs, adversely affecting the fund's results.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Standard & Poor’s 500 Composite Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2019 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Our latest insights

-

-

Artificial Intelligence

-

Target Date

-

Technology & Innovation

-

World Markets Review

This is the headline for the Newsletter promo. Customize the message.

related insights

-

Asset Allocation

-

Global Equities

-

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Luke Farrell

Luke Farrell