Demographics & Culture

- Use the insecurity of the current environment as an opportunity to discuss financial planning with clients. They may be more amenable at this time to make changes in how and with whom their money is being invested.

- A proprietary Wealth-X economic model shows a wealth increase over a five-year period in spite of a recession, which should reinforce the value of your advice to your clients. Encourage your clients to focus on the long term, to diversify and, above all, to remain invested, if appropriate.

- Advocate faith in financial markets. Traumatic economic events provide rare opportunities to cement your relationship with clients.

After a long period of economic and stock market expansion, there is increasing anxiety around the likelihood of a recession occurring. How could a recession impact HNW clients, and what can advisors do about this? Wealth-X shares their views.

There are growing worries that a recession is around the corner.

The U.S. economy has been on a long, upward trajectory since the global financial crisis of 2008–09. Yet, amid a more protectionist trade policy and the long duration of the bull run, there is growing anxiety that the country will enter a recession over the next couple of years.

Defined as at least two consecutive quarters of declining GDP after a period of growth, the severity of recessions can vary. Each will have differing effects on the economy, employment and stock prices. Although there is “opportunity in a crisis,” as the old adage goes, for the most part recessions can see a host of asset prices suffer amid falling economic activity and uncertainty over when the period of contraction will end.

Recessions are often painful for the wealthy.

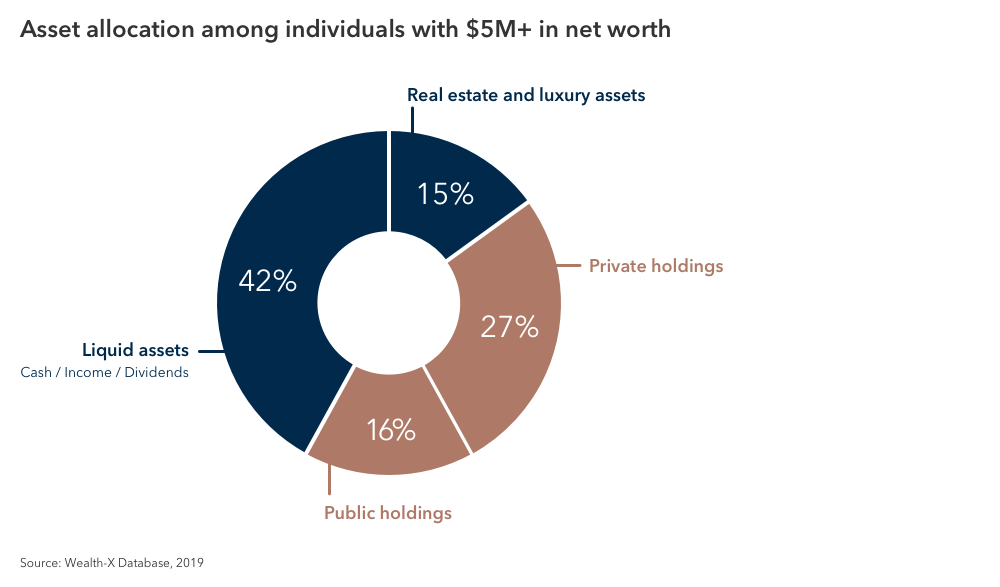

According to Wealth-X’s proprietary data, the wealthy tend to have much of their wealth tied up in two types of assets:

- Private: closely held businesses or private equity ventures

- Public: market-listed equity shares

For those with $5 million or more in net worth in the U.S., over 43% of their wealth is tied up in these two assets, greatly exposing them to the economic sensitivities of business and market holdings. This exposure contrasts starkly with the general population, who are more affected by reductions to their income than by asset fluctuations. Since the general population’s net worth is composed mostly of their primary residence and vehicles,1 their main concern during a recession will be the income needed to cover their mortgage, loans and living expenses, as well as the state of their retirement accounts.

The wealthy, however, are more susceptible to a recession’s impact on private and public assets. Such events can be stressful for them and painful to their wealth.

For private businesses, a recession can sometimes mean the difference in operating a profit or loss, or staying in business at all. In particular, those individuals still in the earlier stages of wealth creation whose wealth is tied up in their main business and one or two properties may be worried by constrained liquidity when asset prices decline in a recession. Meanwhile, we find that as wealth increases, so does exposure to publicly listed companies, meaning that the performance of the stock market becomes even more important to overall wealth.

What this means for RIAs:

Use the insecurity of the current environment as an opportunity to discuss your clients’ overall financial planning.

- Are their holdings diversified?

- Should they make any changes to their wealth planning?

Individuals may be more amenable at this time to make changes in how and with whom their money is being invested.

Yet, in the longer term, even a recession is unlikely to constrain growth in wealth.

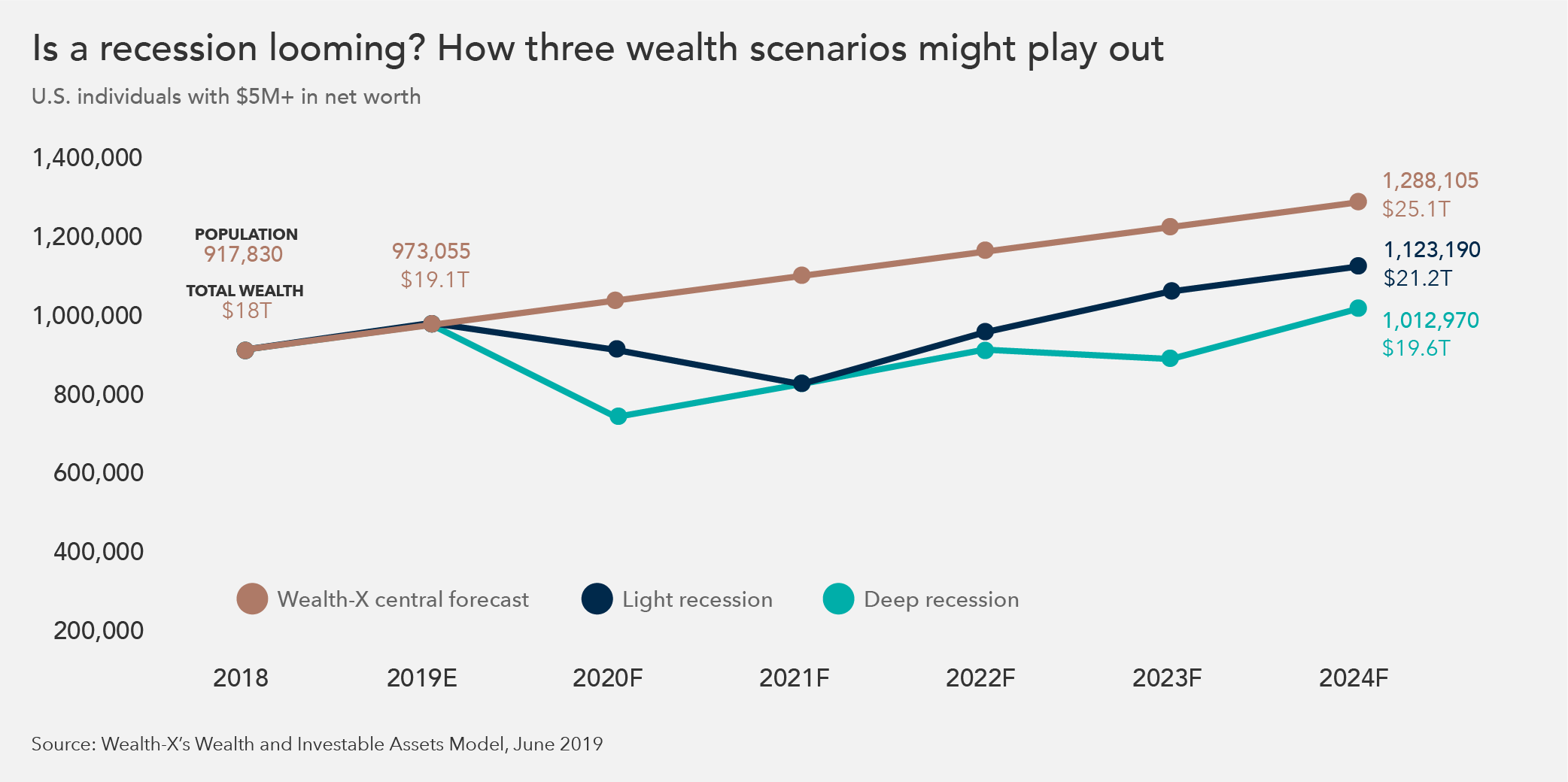

Looking at things with a longer time horizon, how is wealth affected by recession? Based on proprietary research,2 Wealth-X has forecasted U.S. wealth under a range of scenarios.

Along with our core forecast (which assumes a mild slowdown over the next couple of years), we have assumed two types of recession:

1) A light recession similar in vein to the dot-com bubble of the early 2000s, which markedly hit the stock market but whose impact on the real economy was more moderate

2) A deep recession similar to the recent global financial crisis, severely hitting both the stock market and the real economy

We take a number of macroeconomic variables that underlie such recessions and integrate them into our model, providing us with a theoretical view on how wealth is impacted. The good news is that even with a deep recession, we expect total wealth and the number of wealthy individuals to grow over a five-year period.

In a light recession scenario, wealth would be impacted negatively during the recession and the following year. But once economic recovery gets underway, businesses, the stock market and other asset prices recover, pushing both wealth and the number of wealthy individuals up.

In the deep recession scenario, recovery takes longer, and there are ups and downs to wealth along the way. By 2024, both types of recession scenarios would see wealth and the number of wealthy lower than in our core forecast; nevertheless, they would still be higher than their respective numbers in 2019.

What this means for RIAs:

Discuss the potential consequences of a recession with clients early, so that when one does materialize, there is less of a risk of them making rash and often emotionally charged decisions around wealth planning and portfolio changes.

Although their wealth is likely to fall in the short term, encourage your clients to focus on the long term and, above all, to remain invested, if appropriate. Timing the market is notoriously difficult. Work with your clients to review their asset allocations and bond holdings to ensure that their portfolio is diversified and as well-prepared for a downturn as possible.

Encourage your clients to have faith in financial markets. Traumatic economic events provide those infrequent opportunities to lead clients through the disarray of short-term declines into the inevitable future of long-term growth. The time you spend with clients exercising your vision and faith in their long-term outcome cements your relationship like no other activity. Although there’s no escaping the investment and wider wealth fallout that a recession brings, your clients may well be thanking you a few years down the line.

1 Source: Federal Reserve Bulletin, September 2017

2 The Wealth-X proprietary Wealth and Investable Assets Model produces statistically significant estimates on total private wealth and population by wealth segment for the top 76 world economies, which account for 98% of global GDP.

Using a two-step process, we estimate total private wealth using econometric techniques that incorporate a large number of national variables such as stock market values, GDP, tax rates, income levels and savings from sources such as the World Bank, IMF, OECD and national statistics authorities.

We then estimate wealth distribution and allocate wealth across each country’s population. Due to a lack of wealth distribution data, most models estimate wealth patterns using income distribution data. However, our exclusive database of HNW and UHNW individuals across the globe with hundreds of thousands of records allows us to construct wealth patterns using real — rather than implied — wealth distributions. We use the resulting Lorenz curves to distribute the net wealth in a country across its population.

As part of our methodology, we use the most current data available to us, perform fact checks on core inputs, and adjust for any known limitations.

With regards to the forecasts and scenario forecasts above, our model focuses on those US individuals with $5 million and more in net worth.

RELATED INSIGHTS

-

-

-

Demographics & Culture

Forecasts and scenario forecasts are those of Wealth-X, are subject to change at any time due to changes in market or economic conditions and may not actually come to pass. Data shown has been obtained from sources generally believed to be reliable, however, no representation is made by Capital Group as to its accuracy.

Use of this website is intended for U.S. residents only.