Capital Group Funds (Canada)

- Summary

- Portfolio managers

- Distributions

Investment Objective

Long-term growth of capital through investments in a portfolio comprised primarily of securities of large-capitalization issuers located outside North America.

Fund Description

A diverse mix of growth companies outside North America

Invests in stocks from a broad range of countries, including emerging markets.

Invests in stocks from a broad range of countries, including emerging markets.

Returns

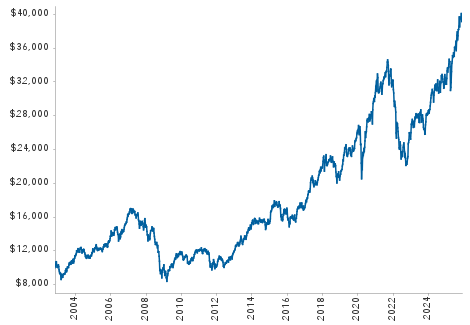

Growth of $10,000 since inception (Series F)

Returns include reinvestment of all distributions and do not reflect the effect of a sales charge. Past returns are not predictive of future returns.

| Returns (%) | Series F | |

| 1 month | 2.71 | |

| YTD | 8.10 | |

| 1 year* | 11.00 | |

| 3 years* | 0.02 | |

| 5 years* | 5.52 | |

| 10 years* | 7.04 | |

| 15 years* | 8.34 | |

| 20 years* | 4.89 | |

| Lifetime* | 5.45 | |

| Lifetime (cumulative) | 211.44 | |

| 2023 | 13.19 | |

| 2022 | -21.60 | |

| 2021 | 4.76 | |

| 2020 | 18.34 | |

| 2019 | 24.02 |

*Annualized compound returns.

Portfolio information

| Fund assets ($mil) combined series | $685.5 | |

| Dividend yield1 | 1.89% | |

| Companies / issuers | 151 | |

| Income distributions paid | December | |

| Capital gains paid | December | |

| Portfolio turnover (2023) | 24% | |

| Trading expense ratio2 | 0.06% | |

| Weighted average market cap ($bil): | ||

| Portfolio | $137.0 | |

| Benchmark3 | $101.3 | |

| Top 10 holdings as a % of: | ||

| Portfolio | 27.5% | |

| Benchmark3 | 8.8% | |

Sector diversification

| Information technology | 21.3% |

| Industrials | 18.4% |

| Health care | 13.9% |

| Consumer discretionary | 11.8% |

| Financials | 11.1% |

| Consumer staples | 7.5% |

| Materials | 4.4% |

| Energy | 3.4% |

| Communication services | 2.6% |

| Utilities | 1.6% |

| Real estate | 0.5% |

| Cash and cash equivalents & other assets less liabilities |

3.5% |

| Total portfolio | 100.0% |

Portfolio characteristics

| Series F | |

| FundSERV | CIF 826 |

| MER4 | 0.86% |

| Fund inception | Nov 1, 2002 |

| Minimum initial investment | $500 |

Portfolio managers

| Years with Capital / Years in profession | |

| Eu-Gene Cheah | 26 / 26 |

| Michael Cohen | 24 / 33 |

| Akira Horiguchi | 23 / 30 |

| Gerald Du Manoir | 33 / 34 |

| Philip Winston | 26 / 38 |

Top 10 holdings

| Novo Nordisk | 3.8% |

| TSMC | 3.7% |

| Safran | 3.4% |

| ASML | 2.8% |

| Keyence | 2.7% |

| AstraZeneca | 2.5% |

| SAP | 2.4% |

| TotalEnergies | 2.2% |

| Airbus | 2.1% |

| London Stock Exchange Group | 1.9% |

| Total top 10 holdings | 27.5% |

Quarterly holdings (PDF)

Geographic diversification

| Europe ex-UK | 44.9% | |

| Japan | 17.6% | |

| Emerging Markets | 17.1% | |

| United Kingdom | 10.2% | |

| Canada | 2.6% | |

| Pacific Basin ex-Japan | 2.3% | |

| United States | 1.7% | |

| Other | 0.1% | |

| Cash and cash equivalents & other assets less liabilities |

3.5% | |

| Total portfolio | 100.0% | |

| 1 | Income generated by portfolio securities, before expenses; does not reflect unitholder distributions. |

| 2 | As of December 31, 2023. |

| 3 | MSCI All Country World ex USA Index. |

| 4 |

Capital Group, at its discretion, currently waives some of its management fees or absorbs some expenses of certain Capital Group funds. Such waivers and absorptions may be terminated at any time, but can be expected to continue for certain portfolios until such time as such funds are of sufficient size to reasonably absorb all management fees and expenses incurred in their operations.

The management expense ratios for the portfolios are based on audited total expenses for the 12-month period ended December 31, 2023, and are expressed as an annualized percentage of daily average net assets during the period. Actual MERs may vary. The following lists the management expense ratios for Capital Group International Equity Fund (Canada) before waivers or absorptions for the 12-month period ended December 31, 2023: Series A, 1.96%; Series D, 1.21%; Series F, 0.86%; Series I, 0.10%.

|

| Updated on a monthly basis. | |

| Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their value changes frequently and past performance may not be repeated. | |

Eu-Gene Cheah

Years at Capital: 26

Years in profession: 26

Based in Singapore

Eu-Gene Cheah is an equity portfolio manager at Capital Group. Earlier in his career at Capital, he was an equity investment analyst covering pharmaceutical and biotechnology companies globally. He was also a country analyst for Singapore. Before joining Capital, Eu-Gene was a doctor in the U.K., where he was a Member of the Royal College of Physicians and a Fellow of the Royal College of Ophthalmologists. He holds an MBA with distinction from INSEAD, France, as well as a degree in clinical medicine from Oxford University, where he was a Rhodes scholar.

Michael Cohen

Years at Capital: 24

Years in profession: 33

Based in London

Michael Cohen is an equity portfolio manager at Capital Group. Earlier in his career, as an equity investment analyst at Capital, Michael covered European utilities companies, as well as companies domiciled in Israel. Before joining Capital, he was a research analyst with both Schroders and Salomon Brothers in London. He holds a master's degree from the London Business School and a bachelor's degree in accounting and economics from Tel Aviv University.

Akira Horiguchi

Years at Capital: 23

Years in profession: 30

Based in Geneva

Akira Horiguchi is an equity portfolio manager at Capital Group. Earlier in his career at Capital, Akira was an equity investment analyst and covered Japan as a small- and mid-cap generalist. Prior to this, Akira was an investment manager of Japanese equities with Gartmore Investment Management Japan Ltd. Before that, he worked with MeesPierson Capital Management Japan Ltd. He holds a bachelor’s degree in economics from Tokyo University. He is also a chartered member of the Security Analysts Association of Japan.

Gerald Du Manoir

Years at Capital: 33

Years in profession: 34

Based in London

Gerald Du Manoir is an equity portfolio manager at Capital Group. Earlier in his career at Capital, as an equity investment analyst, Gerald covered European construction building materials and European consumer goods companies. Gerald began his career at Capital as a participant in The Associates Program, a two-year series of work assignments in various areas of the organization. Prior to joining Capital, he spent six months with Donaldson, Lufkin & Jenrette/Autranet in New York. He holds a degree in international finance from the Institut Supérieur de Gestion in Paris graduating with honours.

Philip Winston

Years at Capital: 26

Years in profession: 38

Based in London

Philip Winston is an equity portfolio manager at Capital Group. Earlier in his career, in addition to being a portfolio manager, Philip was an equity investment analyst at Capital covering U.K. property and paper & packaging companies, as well as European property and media companies. Before joining Capital, he was a director and U.K. equity fund manager at BZW Investment Management in London. Prior to that, he worked at Orion Royal Bank in London and New York. He holds a PhD and a master's degree in history from Cambridge University.

| Capital Group funds and Capital International Asset Management (Canada), Inc., are part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed-income investment professionals provide fixed-income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups. |

| Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. |

Distributions

|

Historical Prices & Distributions

Select Dates

From:

To:

| Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. |