Technology & Innovation

Interest Rates

After a stellar 2020, the bond market is coming under pressure. Massive government stimulus measures and an improving economic outlook are combining to stoke one of fixed income investors’ biggest fears: higher inflation.

The selloff has been sharp. After rising more than 7% last year, as of March 29 the Bloomberg Barclays U.S. Aggregate Index was down more than 3% on a year-to-date basis in USD. The key questions for investors: Is the selloff warranted, and are rates likely to continue rising significantly from here? Our answer to both is no.

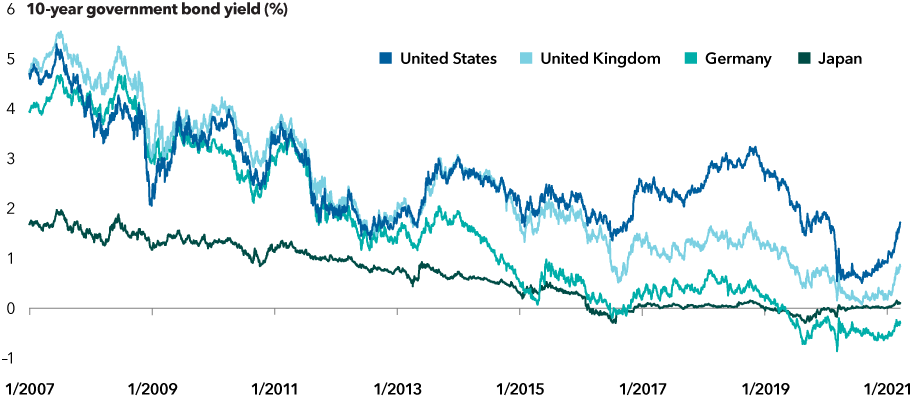

Long-term yields have risen but remain historically low

Source: Bloomberg. As of 3/19/21.

1. The market is overreacting

We believe the market is getting carried away with rate hike anxiety. Market expectations for a U.S. Federal Reserve rate hike in 2022 are earlier than we anticipate.

Our view is based on the Fed’s desire to get the U.S. back to full employment. On evaluating the labour market, the Fed has articulated a broad approach. That means no single employment measure will work as a rate hike trigger. Fed officials will consider a variety of measures of underemployment, labour participation and even employment trends within specific demographic and income groups. Some of those, such as a weak labour participation rate, suggest labour market slack and possibly some longer term scarring. This should lead to patience on the part of U.S. central bankers when considering when to tighten policy.

Additionally, the Fed has indicated that it is comfortable allowing inflation to run “hot” — above its 2% target — for a period of time if monetary policy is helping to hasten job creation amid elevated unemployment. This is evident by embracing policies such as average inflation targeting. This policy targets an average inflation rate over a period rather than having a rigid ceiling for all periods.

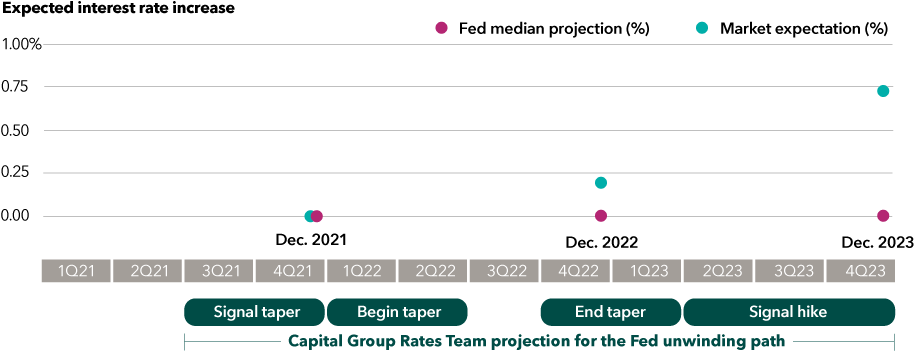

For these reasons, we believe that the Fed will remain broadly accommodative. It appears likely to encourage strengthening economic activity until late 2023 or even early 2024. Fed Chair Jerome Powell seems committed to projecting any action that could tighten policy well in advance of implementation. We believe the Fed will follow a structured unwinding path. This strategy is likely to be similar to its 2013–2015 signaling that led to its first hike after the financial crisis.

How will the first rate hike unfold?

Source: Capital Group, Federal Reserve. As of 3/22/21. Fed dots represent the median Federal Open Market Committee projections when rate increases will occur. The market dots represent investor expectations based on futures pricing. The lower timeline represents how Capital Group’s interest rates team believes the unwinding path could unfold. The Fed is likely to "taper," meaning to reduce its asset purchases, as an early step towards policy normalization prior to raising rates.

Due in part to our view on the Fed, we find shorter term U.S. Treasuries attractive at present. If the market comes around to our view on monetary policy, these yields could decline and associated bond values rise. We are neutral on longer term Treasuries.

The combination of loose monetary policy and fiscal stimulus has led inflation expectations to rise over the past few quarters. That has helped boost values of U.S. Treasury Inflation-Protected Securities (TIPS). However, the Fed’s tolerance for moderate inflation could lead expectations to rise further. This may occur if the central bank’s policy remains stimulative for longer than the market currently anticipates. If those expectations rise, so too will the value of TIPS.

What if we are wrong and higher rates are rapidly approaching? Even then, there are strong reasons to stay invested in high-quality bonds.

2. Rates are rising for a good reason — a strong recovery

Growth and inflation expectations have picked up, as markets are seeing light at the end of the pandemic tunnel. Vaccines are steadily rolling out, and infections are on the decline: These are harbingers of stronger growth. They also underscore that the improving U.S. labour market trend will likely continue as COVID-19 restrictions lift.

These positive factors have not prompted the Fed to signal rate hikes. However, their commitment to maintaining low rates amid more robust economic activity has helped boost inflation expectations. The Fed has pledged to endure moderate inflation to cut unemployment further. Yet the market believes rising inflation could mean higher rates are not that far off. An investor consensus projects an initial hike in 2022.

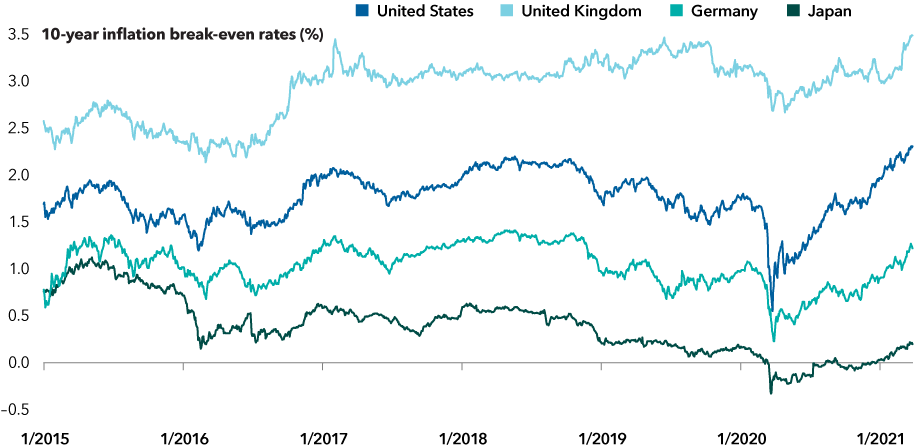

Inflation expectations are rising

Source: Bloomberg. As of 3/19/21. Break-even inflation rates convey the average inflation required over the life of an inflation-protected bond and similar nominal bond to generate the same total returns.

3. Core bonds have shown resilience amid U.S. rate hikes

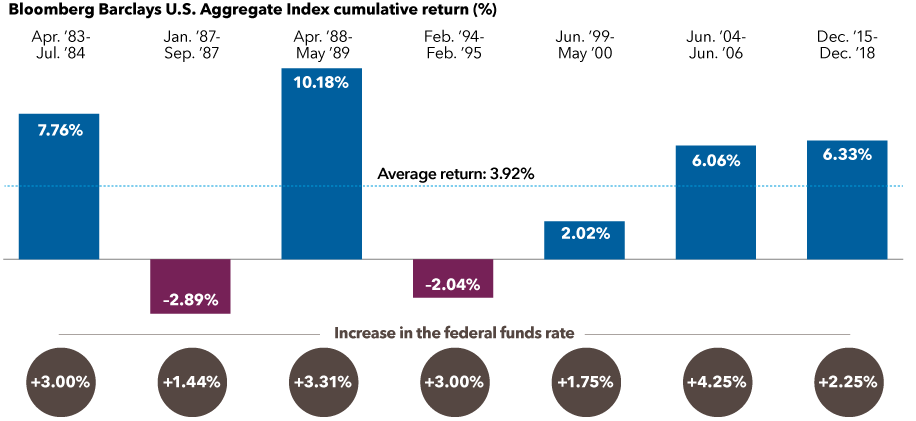

Bond values decline when rates rise. But history suggests that this isn’t the whole story. When rates rise, they historically haven’t done so quickly and sharply enough to cause significant losses over a hiking cycle for core bond investors.

The yield bonds offer investors and other factors that push up bond values can help provide a positive total return. The chart below shows rate hiking periods over the past several decades. In all those periods, only two have seen negative total returns for the core bond benchmark. Despite rising rates, the average return for these periods was nearly 4% in USD.

Rising rates don’t always mean negative bond returns

Sources: Bloomberg Index Services Ltd., Federal Reserve. Data through 3/17/2021 in USD. Periods represented above include: 4/1/83-7/31/84, 1/1/87-9/30/87, 4/1/88-5/31/89, 2/4/94-2/1/95, 6/30/99-5/16/00, 6/30/04-6/29/06, 12/16/15-12/20/18. Note: Daily results for the index are not available prior to 1994. For those earlier periods, returns were calculated from the closest month-end to the day of the first hike through the closest month-end to the day of the final hike.

Recent history is probably more relevant to what we can expect from the Fed as well. When central bankers began raising rates in 2015, they did so gradually. They began with a 25-basis point hike in December 2015. The Fed then waited a full year for another. Over the next year it raised rates three more times, again by just 25-basis points per hike.

History alone may seem a compelling enough reason not to abandon your core bond allocation when rates begin to rise. However, we would argue a core bond allocation is something a balanced portfolio needs in any market environment. Having a strong core bond allocation can help to provide a measure of stability when unexpected shocks hit. Indeed, today’s market makes an even stronger case for maintaining a solid core.

With riskier asset prices soaring, we believe investors should prioritize diversification from equities and capital preservation in fixed income. Markets are reflecting the likelihood of a post-pandemic economic upswing, but there could be bumps along the way. As the market crash in early 2020 illustrated, high-quality core fixed income can serve as ballast in portfolios during periods of equity stress.

What kind of core or core-plus funds should you consider? Those that do not take excessive credit risk. Their correlation to equities — how closely tied their returns are to those of stocks — should be relatively low. In Canada, Capital Group offers two bond mandates: Capital Group Canadian Core Plus Fixed Income FundTM (Canada) and Capital Group World Bond FundTM (Canada). Both portfolios have historically had low correlation to equities, which can help smooth the ride when equities hit a rough patch.

Our latest insights

-

-

Demographics & Culture

-

-

Emerging Markets

-

Long-Term Investing

RELATED INSIGHTS

-

-

Global Equities

-

Long-Term Investing

Bloomberg Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Margaret Steinbach

Margaret Steinbach

Ritchie Tuazon

Ritchie Tuazon