RETIREMENT PLAN SOLUTION CENTER / DC FOCUS FUNDS

Strong building blocks for retirement plan menus

DEFINED CONTRIBUTION FOCUS FUNDS

Nine American Funds options that can help enhance and simplify the core menu

-

-

QDIA: Foundational

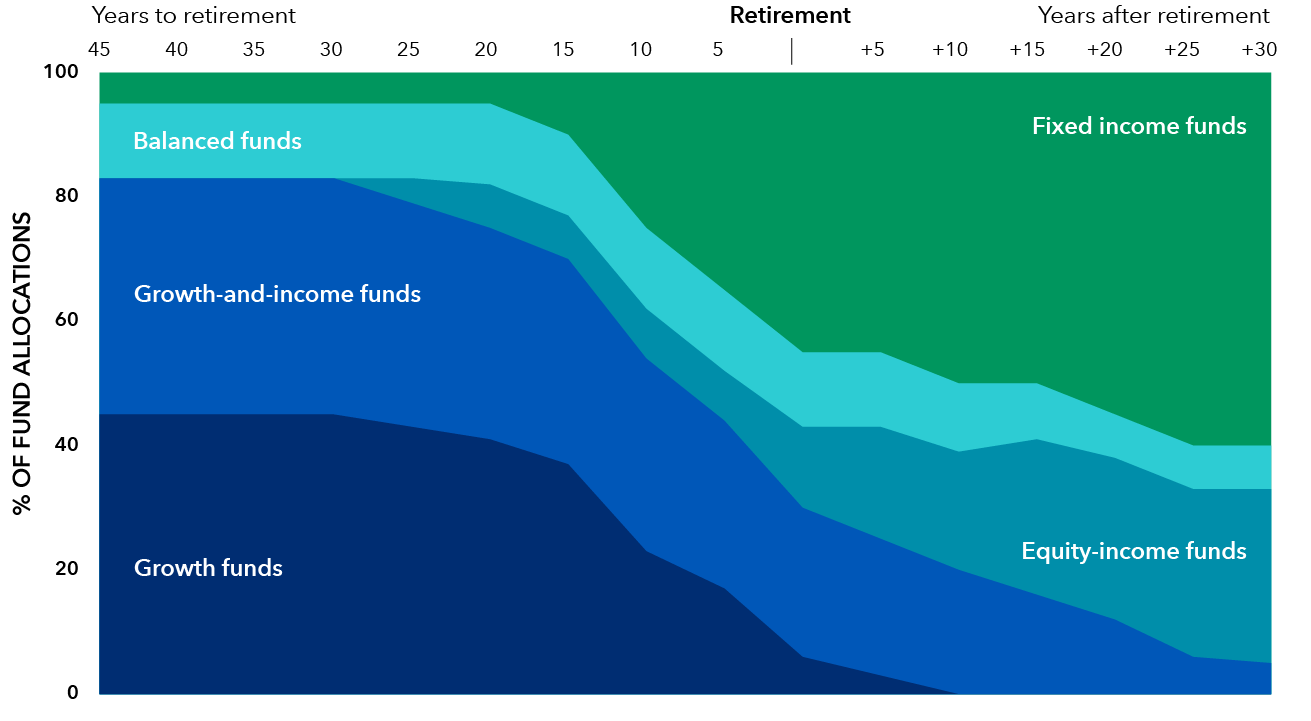

Our target date series has a distinguishing glide path

OTHER QDIA FUNDS

American Balanced Fund®

A quality balanced fund aiming for a smoother ride over the long term*

The target allocations shown are as of March 31, 2023, and are subject to the oversight committee's discretion. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus/characteristics statement. Underlying funds may be added or removed during the year. Visit capitalgroup.com for current allocations.

OTHER QDIA FUNDS

American Balanced Fund®

A quality balanced fund aiming for a smoother ride over the long term*

-

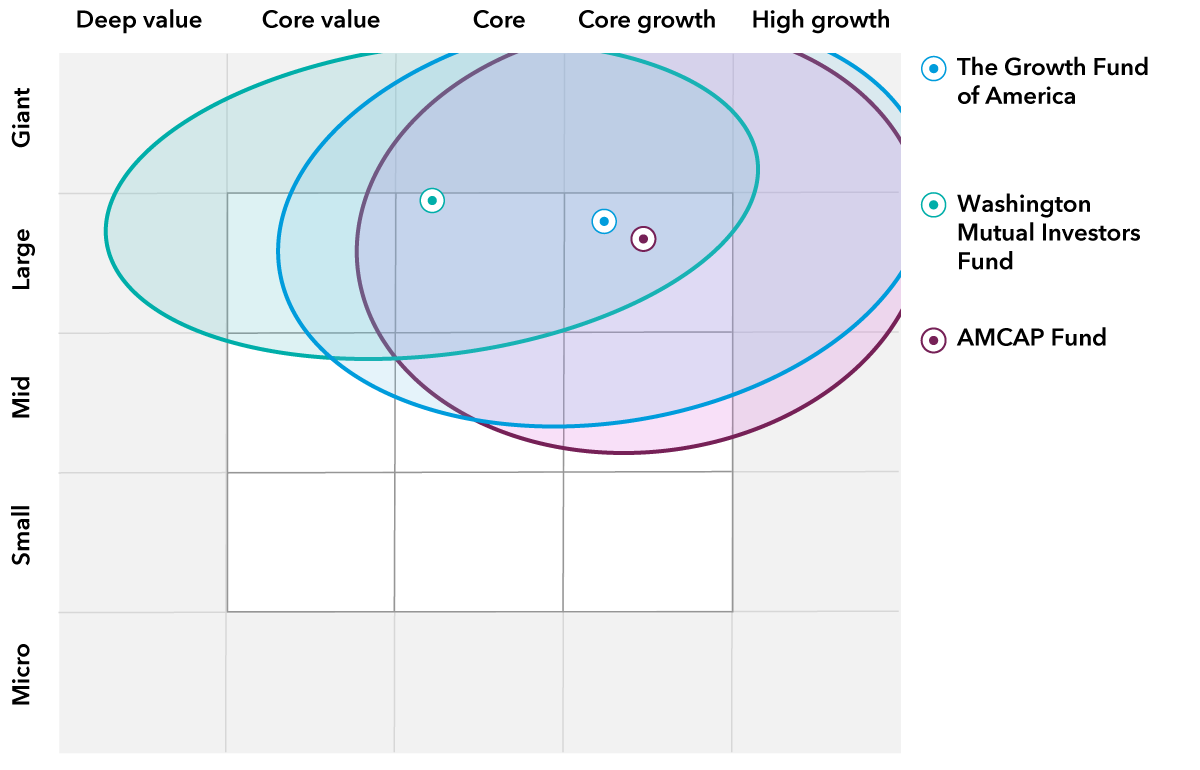

U.S. equity: Streamline

Simplify plan menus with funds that cover a wide range of styles and market cap

Source: Morningstar. As of December 31, 2022. Holdings may change.

U.S. EQUITY FUNDS

AMCAP Fund®

A disciplined approach to U.S. growth, combining market-cap flexibility with a focus on strong balance sheets.

The Growth Fund of America®

A time-tested growth strategy built for any market condition.

Washington Mutual Investors Fund

A blue-chip fund focusing on dividends for consistent results.

-

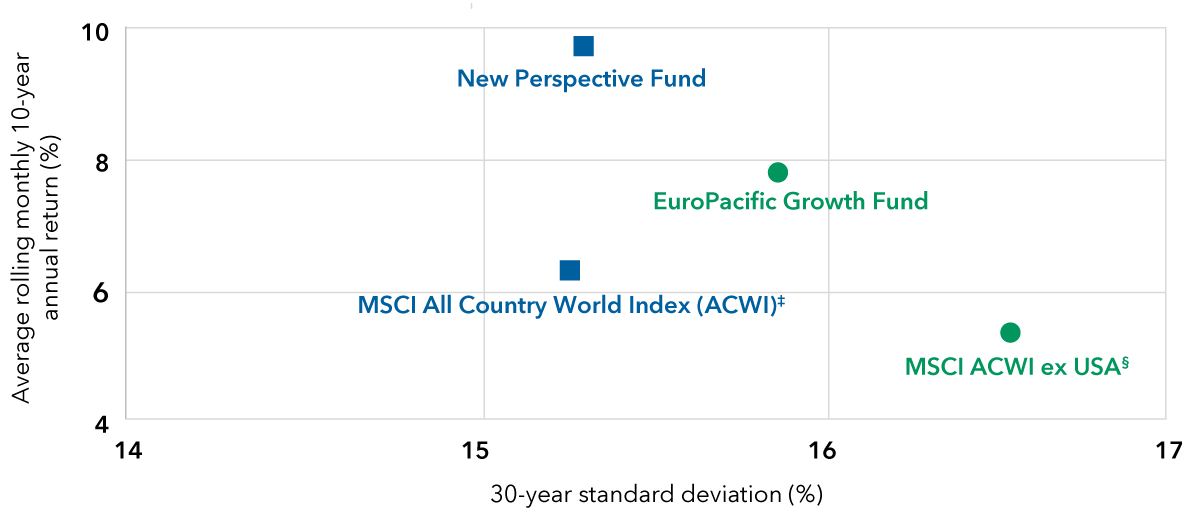

International equity: Broaden

Broaden the lineup with exposure to worldwide opportunities

Average rolling monthly 10 year R-6 annual return and standard deviation over 30 years ended December 31, 2022† 1

Sources: Capital Group, MSCI.

INTERNATIONAL EQUITY FUNDS

EuroPacific Growth Fund®

An opportunistic approach to non-U.S. markets.

New Perspective Fund®

Global flexibility to pursue above-average results and below-average volatility.

-

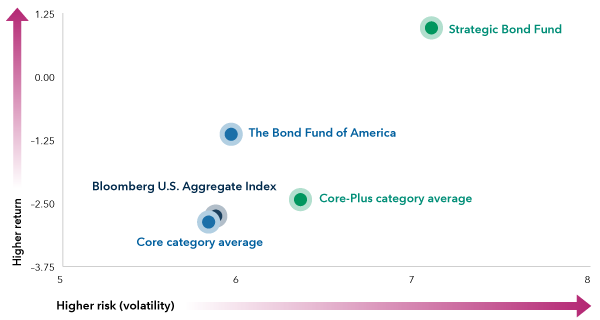

Fixed income: Anchor

The Bond Fund of America® and American Funds® Strategic Bond Fund

A history of strong results with moderate volatility versus peers.

3-year R-6 annualized return and standard deviation (%)†1

Sources: Capital Group, Morningstar, as of December 31, 2022. Return measure is average annual return. Volatility measure is standard deviation.

-

INSIGHTS & RESOURCES

Find a new perspective

Stay on top of retirement plan trends, investment options and regulatory changes.

* Plan sponsors should consult a financial professional before selecting an investment option other than a target date series as a qualified default investment alternative (QDIA).

†Rolling monthly 10-year periods and standard deviation over the 30 years ended December 31, 2022. Annualized standard deviation (based on monthly returns) is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility.

‡From March 13, 1973, through December 31, 1987, the MSCI World Index was used as New Perspective Fund’s index because the MSCI ACWI did not exist. MSCI ACWI is a free float-adjusted market capitalization-weighted index that is designed to measure results of more than 40 developed and emerging equity markets. MSCI World Index is a free float-adjusted market capitalization-weighted index that is designed to measure results of more than 20 developed equity markets. MSCI World Index results reflect dividends net of withholding taxes, and MSCI ACWI results reflect dividends gross of withholding taxes through December 31, 2021, and dividends net of withholding taxes thereafter.

§From April 16, 1984, through December 31, 1987, the MSCI EAFE (Europe, Australasia, Far East) Index was used as EuroPacific Growth Fund's index because the MSCI ACWI (All Country World Index) ex USA did not yet exist. Since January 1, 1988, the MSCI ACWI ex USA has been used. The MSCI ACWI ex USA is a free float-adjusted market capitalization-weighted index that is designed to measure results of more than 40 developed and emerging equity markets, excluding the United States. The MSCI EAFE Index is a free float-adjusted market capitalization-weighted index that is designed to measure developed equity market results, excluding the United States and Canada. The MSCI EAFE Index reflects dividends net of withholding taxes. The MSCI ACWI ex USA reflects dividends gross of withholding taxes through December 31, 2021, and dividends net of withholding taxes thereafter.

Unless otherwise indicated, data is as of December 31, 2022, and fund data is for Class R-6 shares.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. This index was not in existence when the fund’s Class A shares were first sold; therefore, lifetime results are not shown.

Intermediate-term core bond portfolios invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, and hold less than 5% in below-investment-grade exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

Intermediate-term core-plus bond portfolios invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, but generally have greater flexibility than core offerings to hold non-core sectors such as corporate high yield, bank loan, emerging-markets debt, and non-U.S. currency exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

Figures shown are past results and are not predictive of results in future periods. Current and future results may be lower or higher than those shown. Investing for short periods makes losses more likely. Prices and returns will vary, so investors may lose money. View mutual fund expense ratios and returns.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional securities, such as stocks and bonds.

Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

Although the target date portfolios are managed for investors on a projected retirement date time frame, the allocation strategy does not guarantee that investors' retirement goals will be met. Investment professionals manage the portfolio, moving it from a more growth-oriented strategy to a more income-oriented focus as the target date gets closer. The target date is the year that corresponds roughly to the year in which an investor is assumed to retire and begin taking withdrawals. Investment professionals continue to manage each portfolio for approximately 30 years after it reaches its target date.

American Funds Strategic Bond Fund may engage in frequent and active trading of its portfolio securities, which may involve correspondingly greater transaction costs, adversely affecting the fund's results.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries.

Capital Group offers a range of share classes designed to meet the needs of retirement plan sponsors and participants. The different share classes incorporate varying levels of financial professional compensation and service provider payments. Because Class R-6 shares do not include any recordkeeping payments, expenses are lower and results are higher. Other share classes that include recordkeeping costs have higher expenses and lower results than Class R-6.

There may have been periods when the results lagged the index(es) and/or average(s). The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg's licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses.

When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower and net expenses higher. Please refer to capitalgroup.com for more information. Read details about how waivers and/or reimbursements affect the results for each fund. View results and yields without fee waiver and/or expense reimbursement.

Certain share classes were offered after the inception dates of some funds. Results for these shares prior to the dates of first sale are hypothetical based on the original share class results without a sales charge, adjusted for typical estimated expenses.

- Class R-6 shares were first offered on 5/1/2009.

- Calculated by Morningstar. Due to differing calculation methods, the figures shown here may differ from those calculated by Capital Group.

Use of this website is intended for U.S. residents only. Use of this website and materials is also subject to approval by your home office.

American Funds Distributors, Inc.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.

© 2024 Morningstar, Inc. All Rights Reserved. Some of the information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar, its content providers nor Capital Group are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Information is calculated by Morningstar. Due to differing calculation methods, the figures shown here may differ from those calculated by Capital Group.