Demographics & Culture

ESG

While COVID-19 helped accelerate the ESG agenda, the tragic invasion of Ukraine is likely to further speed up its evolution.

The pandemic shone a spotlight on the “S” — or social issues — of ESG. The conflict in Ukraine has brought the “G” (the governance component) to investors’ attention. At the same time, a growing understanding of the implications and importance of climate change has meant that “E” (the environmental piece) continues to dominate investors’ ESG focus.

These insights and many more surfaced in Capital Group’s annual ESG global study published in May 2022. Collecting views from more than 1,100 institutional and wholesale investment professionals across Europe, North America and Asia-Pacific, the study showed ESG trends continue to gain traction.

ESG momentum builds

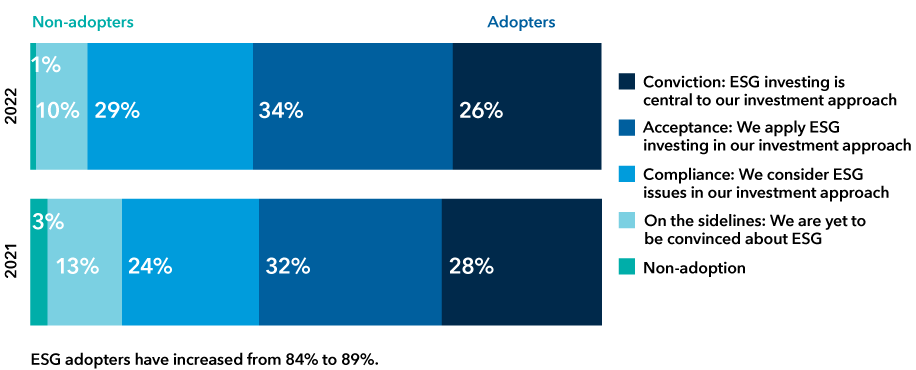

Momentum behind ESG and sustainability continues to build, fueled by investor demand and a desire to make an impact. Compared with the previous year, a higher proportion of global investors describe their ESG stance as one of conviction, acceptance or compliance. This global cohort of ESG adopters rose to almost 90%, up from 84% in 2021. Over the same period, the number who are either on the sidelines or non-adopters has fallen to 11%, down from 16% the previous year.

ESG adoption by global investors continues to grow

Source: Capital Group, ESG Global Study 2022

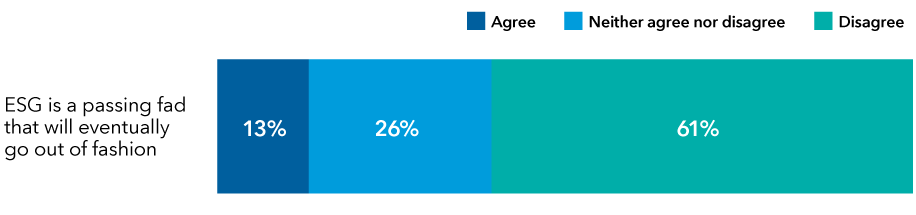

Conviction in ESG is further underscored in the finding that just 13% of global investors agree ESG is a passing fad and will go out of fashion. This demonstrates how most investors view ESG as a permanent and pre-eminent part of the investment landscape.

ESG poised to become a permanent part of the investment landscape

Source: Capital Group, ESG Global Study 2022

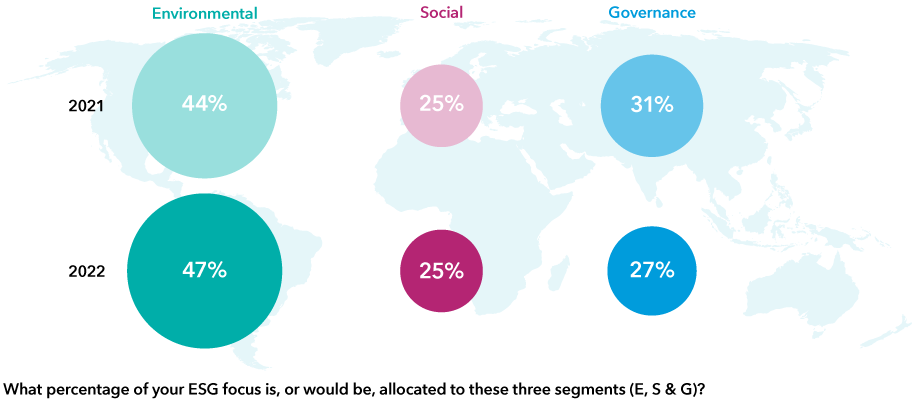

The “E” of ESG continues to dominate, but greater recognition of “S”

The structural and societal pressures arising from climate change have been key in driving environmental issues — the “E” in ESG — to the top of investors’ sustainability concerns. The study showed that the environment continued to dominate allocation decisions, with investors increasing their focus on “E,” which rose from the year before (47% vs. 44%).

The “E” in ESG still dominates

Source: Capital Group, ESG Global Study 2022

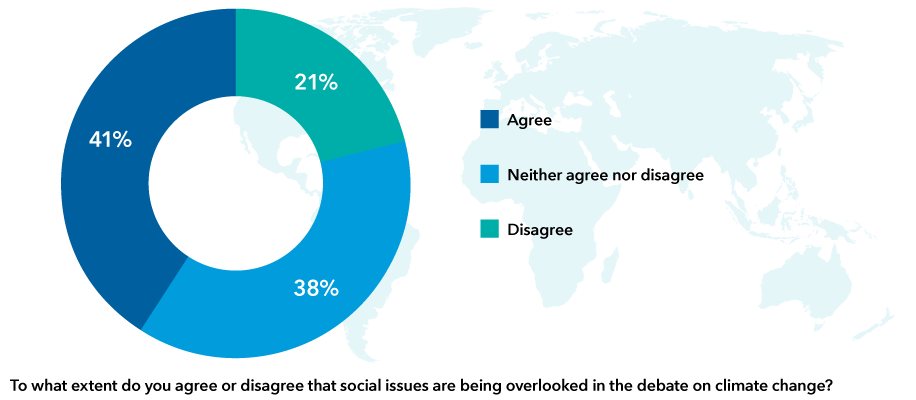

Although investors indicated an even greater focus on environmental issues in 2022, there are signs that this may change in the future as people recognize an imbalance. When asked whether social issues are being overlooked by this environmental focus, 41% of investors agreed.

Qualitative research we carried out as part of the study suggests some reasons behind these views. It is possible that the impact of the COVID-19 pandemic raised greater awareness on the importance of safe working conditions, access to health care and education.

The “S” in ESG is rising in prominence

Source: Capital Group, ESG Global Study 2022

As strict lockdowns were imposed across the world, companies operating in the retail and health care sectors came under particular pressure to ensure the safety and well-being of their workers. Many responded by providing protective equipment or extending paid sick leave to temporary staff and contractors. Other companies provided their goods and services free of charge — such as internet access, video conferences and remote learning to schools and universities — as a way of supporting their broader communities.

With an increased understanding that social issues can have material and far-reaching consequences for companies and the communities they serve, the impact of the pandemic may have prompted investors to look across a wider range of ESG issues.

“G” increases its profile

Russia’s invasion of Ukraine also brought several ESG issues into the spotlight, with concerns around governance flagged by respondents in the survey.

The global response to Russian aggression was not just political, as the corporate sector was quick to take a stance. Many companies made statements regarding their business exposure to Russia.

At Capital Group, we followed company actions closely. While much of the media focus was on actions announced publicly, we paid particular attention to companies that had not made public statements. Digging behind the public pronouncements helped us to gain a better understanding of the impacts and how companies’ licence to operate may be affected.

Sentiments on governance concerns were echoed by a number of investors surveyed.

“I think the crisis should, and probably will, bring governance into sharper focus,” says the CIO of an independent advisory firm. “But that should have always been the case — it’s sad that we need a tragedy and war to highlight the importance of the ‘G’.”

A portfolio manager at a wealth management firm agreed: “I think the crisis has strengthened the ESG argument because it really is making people focus on what’s important — and that’s social governance, which is right up there in my view.”

The impacts of major world events have always been felt in investment markets. Building an understanding of the first-, second- and third-order effects of events and how these might impact investment decisions is not new. Viewing the consequences of these events through an ESG lens can provide a richer perspective and help frame events for investors.

However, there are still challenges to overcome, which the survey also highlighted.

Access to reliable and consistent ESG data remains a key challenge

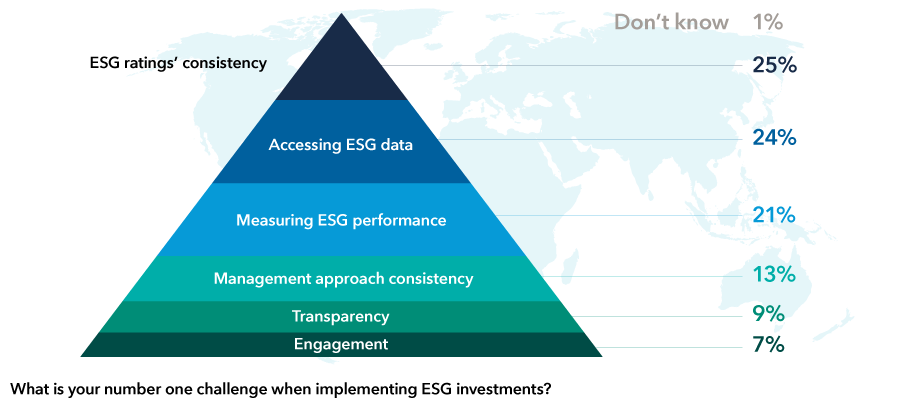

A theme that came through loud and clear in last year’s study, and was reinforced in this year’s results, is the difficulties experienced in accessing and interpreting ESG data. Specific issues raised by respondents included access to ESG data, consistency between ESG data providers and transparency of benchmark and index data.

Difficulties with the robustness of data and inconsistent scores are hampering the ability of investors to incorporate ESG considerations into their investment process.

ESG ratings and accessing data remain the largest challenges

Source: Capital Group, ESG Global Study 2022

The No. 1 challenge global investors cited in implementing ESG investments is a lack of consistency between different ESG rating providers (25%). This was closely followed by difficulties accessing ESG information and data.

Inconsistent and inaccurate ESG scores result from a multitude of factors. These include backward-looking data that fails to adequately assess the future value of companies transitioning to address sustainability issues. The companies could play an important role in driving change and may become tomorrow’s ESG leaders. The subjective nature of scoring systems also means there are varying views on the relative importance and material impact of different ESG factors in different sectors and countries.

Consistency in regulation was also raised as a significant roadblock. Investors are looking to regulators to provide common standards and definitions. When asked what the ESG regulatory framework should prioritize in their respective countries, the highest proportion of respondents cite the need to harmonize global standards, taxonomies and metrics (45%). This indicates investors are struggling to untangle an increasingly complex and disjointed web of global regulations issued by different entities.

Overcoming data challenges will help ESG to broaden its reach. Results from our global study show that momentum behind ESG and sustainability continues to build. Despite challenges around data, it appears that investors’ awareness of ESG topics is not just increasing, it is also broadening to cover a wider range of social and governance issues.

For a more detailed look at the latest findings, check out the full survey.

Our latest insights

-

-

-

Emerging Markets

-

Long-Term Investing

-

RELATED INSIGHTS

-

Long-Term Investing

-

Demographics & Culture

-

Long-Term Investing

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Jessica Ground

Jessica Ground